Retailing is a difficult business even in ordinary times, but the past 15 months have been unusually unpredictable. In the first half of 2022, inflation skyrocketed to an annualized rate of 9.1%, propelled by supply chain disruptions, a tight labor market, and aggressive fiscal stimulus during the pandemic. Gross domestic product (GDP) declined for two consecutive quarters, raising fears of recession. Then in the second half, conditions reversed: Year-over-year inflation has gradually decreased every month since June, while GDP grew in both the third and fourth quarters.

The outlook for the rest of this year remains highly uncertain, particularly given the recent turbulence in the banking sector, and with first-quarter GDP estimates varying widely. On the positive side, supply chain pressures have eased and commodity costs have dropped. But retail demand is waning. February and March retail sales declined as depleted savings and higher prices left consumers wary.

What market volatility means to the retail industry

It is never easy to predict whether a recession is looming. But whether or not the economy meets the technical definition, continued market volatility and softer consumer demand appear inevitable, even as their depth, scope, and duration remain unclear. While experts anticipate inflation returning to more normal levels within 12–18 months, this could come at the cost of further reduced demand and increased unemployment, given the monetary tightening that has already taken place and any further actions this year.

The upshot: any slowdown from here is likely to impact industries and consumer sectors unevenly, so retailers must prepare for a multitude of scenarios.

Strategies for retailers to pass savings to customers

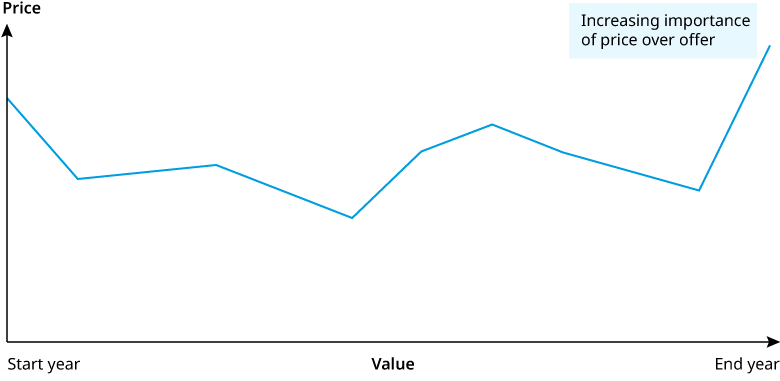

During economic downturns, the flight to value is relentless, and retailers that persistently offer strong value propositions to consumers often thrive. Our latest annual Customer Perception Map survey in the United States reveals that the relative importance of price versus offer (including choice, quality, and service) has reached its highest level in more than a decade. Out of more than 30 drivers of overall customer satisfaction, "overall value for money" rose to second place from ninth in our most recent research.

Retailers can lower their costs, and pass those savings on to customers, through four strategies.

Negotiate smarter. After two years of supplier dominance amid supply chain shortages, retailers now have the opportunity to take the offensive. They should target pre-2021 levels since the costs of many underlying commodities are rapidly decreasing.

Retailers can use technology in three ways to proactively negotiate with suppliers. First, they can track the evolution of underlying commodity costs for the products they sell to identify and prioritize opportunities and determine the “ask.” For example, the ingredients that drive the cost of a frozen pizza are wheat, tomatoes, cheese, corrugate, freight, marketing, manufacturing, and overhead costs. The 50% decline in the price of wheat from its peak in mid-2022, along with changes in other inputs, should be reflected in a cost decrease of at least 10% for frozen pizza. Second, retailers can examine the broader vendor relationship and determine the right tactics to employ “in the room” — how incremental is this brand to my assortment / how loyal are customers to those products? What would happen to the category and vendor X's business if we were to give vendor X more space, or took it all away? What is that worth? Third, retailers can organize a company-wide negotiation campaign to go after the value and set up the right process to track and win opportunities.

Personalize and deliver targeted value. Retailers can take advantage of digital technologies to deliver value to the customers who need it most, using localization and personalization. Investments in these technologies will yield dividends throughout a recession and beyond. For example, store zoning and dynamic pricing, which had been threatened by more omnichannel solutions, are becoming more viable with geo-based updates of online prices. Likewise, personalized digital offers can save a lot of promotional spending by not giving certain offers to customers who would buy those items anyway, and encouraging trial or trade-up by targeting the right customers with the right products at the right time. And dynamic displays and location-based promos for shoppers can improve the in-store experience.

Automate to the right-size. Now is the time for retailers to assess their organization's size and structure, identifying redundancies that can be eliminated to reduce costs. Digital solutions will enable retailers to do more with fewer resources or reassign talent to higher value-added activities. For example, they can provide better visibility across the supply chain to unlock new sources of value, and automate time-consuming, repetitive tasks in the head office, manufacturing plants, distribution centers, and stores. And digital solutions can augment decision-making by bringing new insights powered by sophisticated machine learning and AI.

Evaluate and enhance financial services offerings. Retailers should consider how they can reduce payment costs and improve value propositions for economically strained consumers. Opportunities for optimizing relationships with payment partners are abundant, including reducing the cost of accepting payments, encouraging incremental sales via new methods such as buy now, pay later, and streamlining customer shopping experiences both in-store and online.

The bottom line for retailers: Deliver outsized value to win customers

Consumers and their wallets are already weary from prolonged high inflation — and there’s more uncertainty ahead about macroeconomic trends in the coming months and the Fed’s response. As this uncertainty unfolds, for however long it lasts, we can learn from past downturns and periods of turbulence: customers will vote with their wallets for the retailers who offer the best value for their money. Retailers should prioritize initiatives that drive better value for their customers.

Kathleen Snider also contributed to this article.