Striking strategic partnerships and boosting profitability

Governments and telecom operators will spend more than €100 billion by 2030 to rollout fiber to European homes and businesses. Both, network service providers and telecom operators, can best benefit from this expanding market by operating in a turnkey model. For network service providers this model can boost profitability to 1.6 times the level achieved by a traditional model.

Over €100 billion To Deploy Fiber To 110 Million European Homes

Fast broadband networks are critical enablers of an ever more digital society and economy, and European economies plan to meet the demand through fiber-to-the-home networks. Fiber penetration to homes remains low in many countries, including Germany, the United Kingdom, and Belgium, which have rates of less than 20 percent of homes with access to fiber. To accelerate network build in Europe, governments and operators will invest more than €100 billion between 2021 and 2030, according to our estimates.

Network service providers – which design, deploy, connect, and maintain fixed and mobile networks for telecommunication operators, infrastructure companies, and tower companies – are essential to deliver these accelerated fiber network build plans. In markets where fiber rollout is in the early stages, such as Germany and many Eastern European countries, the landscape of network service providers tends to be more fragmented. In markets like the UK, France, Spain, and Portugal, where the fiber build is mature, there are fewer – but larger – champions, and the market is more consolidated and tiered: Tier 1 network service providers maintain large, typically turnkey, contracts with operators, and they subcontract work to tier 2 and 3 players.

Turnkey Contracts Help Drive Market Consolidation And Profitability

Within these markets, profitability varies significantly. Laggards achieve margins of between 1 and 5 percent of EBITDA, while leaders can reach 20 percent and more. Working with our clients, we have found that the operating model is making the difference. Those fiber builders that are able to manage the higher risk profile of turnkey contracts generate substantially higher profitability compared to traditional rollout models that work on command-and-control activity pricing. Moreover, turnkey programs also accelerate rollout delivery: They are between two and three times faster than traditional models.

While turnkey models hand over significant construction risks to a network service provider, in return the provider has greater freedom to manage the fiber buildout. This leads to higher crew utilization, a reduction in stop-and-go activity, and more-efficient network design. Another benefit is a dramatic decrease in overheads for reporting, quality control, and progress monitoring. The best network service providers can manage the additional risk and turn the efficiencies into structural profitability growth.

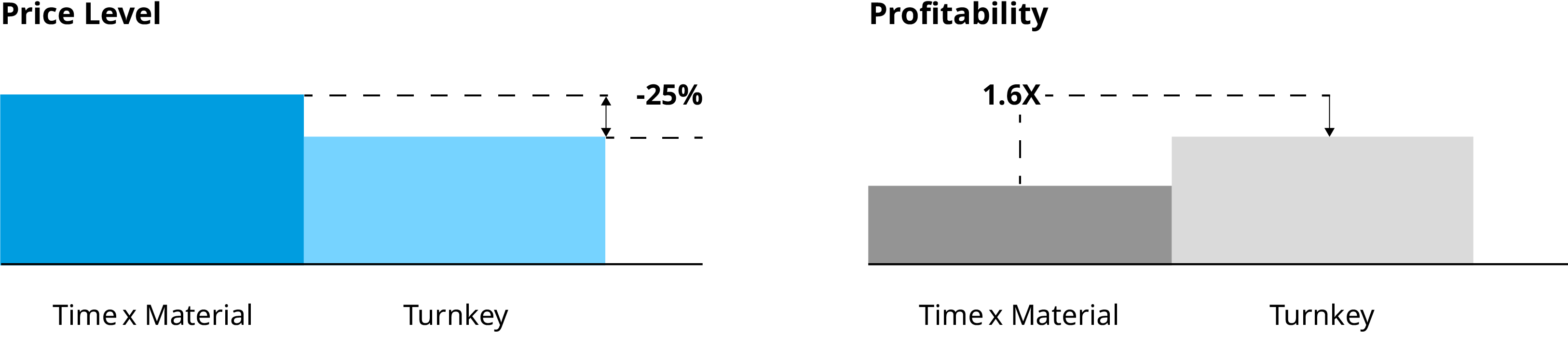

If service providers boost their profitability like this, they can enter a virtuous circle. They can lower the prices they charge to telco operators and thus gain market share and increase their volumes – which will then let them share the benefits of further efficiency by lowering prices more. We have seen turnkey price reductions to operators of 25 percent over a standard time and material contract, at the same time as increasing profitability for the fiber builder.

Growing Recurring Revenue And Becoming A Strategic Partner

The rapid professionalization of fiber builders has other positive effects. It is becoming more and more common for operators to not only outsource the build but also maintenance and repair. This offers fiber builders a way to create a larger base of recurrent revenues and escape the feast/famine dynamics of fiber build programs. And it permits operators to start to more seriously consider ways to structurally re-engineer their very costly maintenance and repair models.

The following exhibit shows the ingredients for network service providers to achieve structural profitability growth, expand their recurring revenue base, and become a strategic network services partner. The most important are:

- Contracts: Widely adopt turnkey deployment contracts. They should be longer term (lasting between four and five years), so as to provide long-term demand visibility.

- Processes: Develop standardized, industrialized rollout processes. These should continuously incorporate innovations and simplifications that reduce variability and complexity.

- Organization: Adopt a modern operating model, with flat organizations, significant empowerment of local build crews and project management, and large spans of control.

- Development of powerful information systems, with automatic network planners, standardized digital workflows and supply chain triggers, and transparent interfaces that inform on build progress to the customer. The systems should also enable the professional management of permits, quality issues, rework, and penalties.

- Extension: Extend the turnkey build service offering to include installation, maintenance, and repair services. The extension is a low risk move leveraging existing build capacities and deep understanding of the new network topology.

Valuations Rise For A New Class Of Strategic Network Services Partner

A turnkey build services company that also provides maintenance, repair and installation services is no longer a simple manpower supplier. It becomes a long term, strategic partner to operators, improving and extending the life of the network.

We are witnessing a new industry in the making with the development of a new class of services businesses in telecom infrastructure. These businesses are starting to attract significant private capital. In May, Circet, a large European fiber specialist, was acquired by Intermediate Capital Group (ICG) for €3.3 billion, more than nine times EBITDA. Given the significant opportunities for value creation in this industry, we expect the interest of private capital to accelerate significantly.