One of the challenges with solar power has been the reality that the sun only shines for so many hours a day and on some days not at all. Wind faces the same intermittency problem. While this disadvantage has been a headache over the past decade for solar and wind power, renewable energy never accounted for enough of the power supply to make it a real problem for the industry. Today, the tectonic shift in the power generation mix away from fossil fuels and toward renewables is elevating the issue into a risk that may eventually threaten the proliferation of wind and solar, if not tackled soon.

Wind and solar intermittency cause a lack of predictability in both supply and pricing that can catch utilities by surprise. As renewable energy reaches critical scale in regional power systems as it has in the United Kingdom — where it now represents 35% of the generation mix — it is becoming the so-called market price setter. That may mean higher rates for customers or lower profits for utilities because of the intermittency problem.

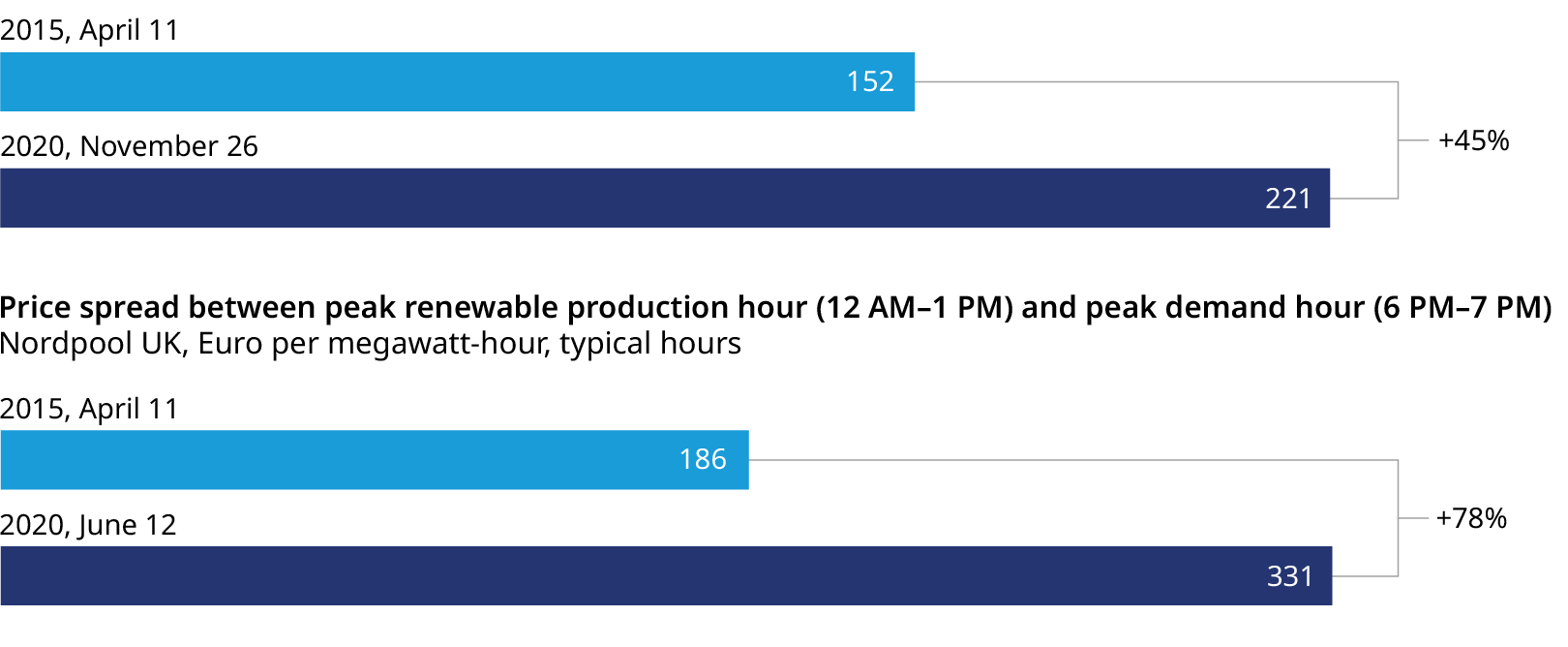

For instance, in 2020 in NordPool UK, the maximum hourly price change was +221 euros per megawatt-hour (€/MWh), which is 45 percent more than the comparable spread in 2015. Similarly, over the same five years, the spread between the average daily peak in renewables’ production — between 12pm and 1pm — and the peak in demand between 6pm and 7pm—has widened 78%.

Overall, the impact of an expanding renewable component in the generation mix has been positive. Not only is the marginal cost of solar and wind generation virtually zero, the Levelized Cost of Energy (LCOE) has also come down significantly — wind by 20 percent and solar, including storage, by almost 70 percent over the last five years. Oliver Wyman projects that the LCOE for battery storage will fall by five percent annually through 2050, eventually reaching less than $80 per megawatt-hour. Already, solar in combination with storage can compete with flexible gas-fired peaking generation in some jurisdictions.

As a result of an increasing share of near-zero variable cost renewable supplies during several hours of the day, energy prices have been falling — in the case of NordPool UK, dropping on average at 7% annually over the last five years. This is partly also because some of the wholesale cost of renewable energy has been subsidized through separate consumption levies.

But while renewables drove down price levels at times, they paradoxically also incorporated more risk and volatility because of the intermittency.

Today, market participants face both higher price spikes during peak demand and negative prices when excesses of renewables go beyond what the grid can easily absorb because their “fuel” is so dependent on the weather and time of day. As a result, renewable energy producers become systemically disadvantaged, finding themselves producing when prices are low — on sunny or windy weekends, for instance — and missing out when prices are high — in the early evenings as people return from work.

In a low or no-subsidy environment, it becomes essential for renewable energy producers and traders to manage this risk, pushing operating costs higher as players hedge intermittency with entirely inappropriate instruments. Sophisticated market participants like power traders require compensation to manage it in day-ahead and intraday markets that often lack liquidity in relevant hourly tranches, with risk premiums paid today often exceeding two euros per megawatt-hour.

Market participants are usually forced to revert to base and peak load contracts to manage risk in the forward horizon. “Consumers are being charged significant risk premiums that could be avoided [with] new market products and asset classes to hedge risk and intraday volatility,” Steven Meersman, founder and director at Zenobe Energy Limited, concludes.

To reduce risk premiums and cover the growing and much more sporadic risk, a wider array of physically and financially settled derivatives need to come to market. Given that most traditional electricity market participants structure derivatives around the needs of longer-term wholesale markets, these new instruments would have to hedge against the small windows of time when producers and investors face extreme volatility.

This would require specialist asset traders to create a mixture of short-term call or put options that better reflect the irregular and transitory pattern of risk of solar and wind power. This can involve a period as short as 30 minutes in a day and thus may necessitate half-hour granularity to ensure short-term fluctuations in power portfolios are hedged.

Without them, these market risks and the lack of proper risk management tools are likely to become eventually a hurdle to further decarbonization of the energy system because they will reduce return on investment and discourage new money. It underscores how important it is for market liquidity and the available set of risk management instruments to keep up with the growth in installed solar and wind capacity.

Batteries that store renewable energy and neutralize the intermittency problem can also play a key role in protecting return on investment. These physical assets have the short-term responsiveness necessary to manage volatile grid load and, when coupled with appropriate derivatives, could help reduce the volatility. “Battery storage deployment and associated hedging products will help balance the system’s price fluctuations,” says Aaron Lally, managing partner at Vest Energy. “It will also make available de-risking flexibility as an investment and allow suppliers and generators to provide power at a reasonable price.”

Key considerations in these markets will be how to structure these deals, collateral requirements for banks/trading houses engaging in the products, credit of each counterparty, and an understanding of the optionality embedded in battery storage assets. This fits the expertise of technology-augmented trading operations that understand both the financial electricity market and asset capabilities. These intermediaries will likely sit in between asset owners and those that require this optionality in the same way that banks and trading houses have been intermediaries on commodities risk for decades.

Flexible products, capable of providing an effective solution for integrating intermittent supply, became available recently in power markets in the United States and Australia. These products give the optionality to buy and sell at defined hours of the day at pre-agreed strike prices, thus fostering the continued investability of the renewable power sector. Such products, designed to mitigate transfer risks potentially years in advance, will further accelerate the investment into flexible assets, thereby increasing grid stability. But their limited availability must be addressed if they are to really represent a risk management solution for the industry as a whole.

In addition, where renewable generation is installed on-site ‘behind the meter,’ such as rooftop solar, battery storage can also play a role in avoiding the delays and costs associated with grid upgrades. Solar developers on larger behind-the-meter sites increasingly find that the need to upgrade network to allow for export is significantly impacting timescales for development and adding large costs.

Sizing the market for Europe and the UK, we estimate that more sophisticated flexibility markets backed by energy storage solutions, such as those that are backed by battery storage, could well exceed €10 billion by 2030. This rapid growth is a direct consequence of the low predictability of wind and solar supply: There is a 30% mean absolute percentage error between forecast and realized volume.

The lack of predictability and potential dramatic swings in supply underscore why the associated costs with balancing these intermittent sources are so substantial. But it also suggests why the opportunity for market participants could be equally significant.

In the United Kingdom, the capacity share of renewable sources has grown from 22 percent to 35 percent since 2015. It’s expected to reach 69 percent of total available capacity by 2030 and more than 80 percent by 2050. Even in the United States, where the share of renewable power has grown more slowly — from 13 percent to 18 percent between 2015 and today — the portion of power from solar, wind, and other renewable energy is still expected to mirror the UK’s mix by 2050. Most European countries are on very similar — if not, more ambitious — trajectories.

As indications of the existing needs and potential market growth, the Federal Energy Regulatory Commission (FERC) in the US has issued two significant orders that facilitated the participation of storage and ancillary services solutions.

- In 2018, FERC issued Order 841 that enabled local storage resources to participate in the capacity, energy, and ancillary services markets alongside traditional generation resources.

- In 2020 FERC then expanded the effort by issuing Order 2222, which allowed aggregated Distributed Energy Resources (DERs) to enjoy similar rights. This order forced tariff revisions to enable DERs to compete in the market, incentivizing new market participants with the hope that an influx of storage capacity would serve to increase reliability and lower overall costs of service over time.

As the US makes a strong pivot to eliminate greenhouse gas emissions from electric generation by 2035, a significantly bigger base of storage and ancillary services across the different independent service operator regions will be critical.

A derivatives market adapted to the needs of a changing power generation mix will help producers and investors manage risks in advance. This will reduce the need to balance costs for the end customers and unleash the full potential of a more efficient industrial system. Traders will be able to bring to bear weather and climate intelligence and help adequately price associated risks. With the frequency of extreme weather events like the February 2021 Texas cold spell likely to increase, market instruments able to reflect and better cope with a rising proliferation of renewable generation are of systemic importance.

Emanuele Raffaele, Engagement Manager, also contributed to this article.