Introduction

Since the middle of the 20th century, natural gas has played a crucial and expanding role in the world’s energy mix — first, as a cheaper alternative and then as a cleaner replacement for more carbon-intensive fuels, such as coal. Primarily made up of methane, the abundant supply of natural gas can produce high degrees of heat, invaluable in the production of power and other industrial applications.

Unlike many energy sources being considered as alternatives to fossil fuels, natural gas is easy to store and transport as both a gas and liquid. The world’s supplies of gas are moved via pipelines to major demand centers in Europe, the Americas, and Asia or transported there via truck, ship, or rail in the form of liquefied natural gas (LNG). Most nations — whether they have natural gas reserves or not — depend on natural gas, which accounts for almost a quarter of primary energy consumption worldwide. Despite its attractiveness, natural gas has a major Achilles heel in that methane is a highly potent greenhouse gas.

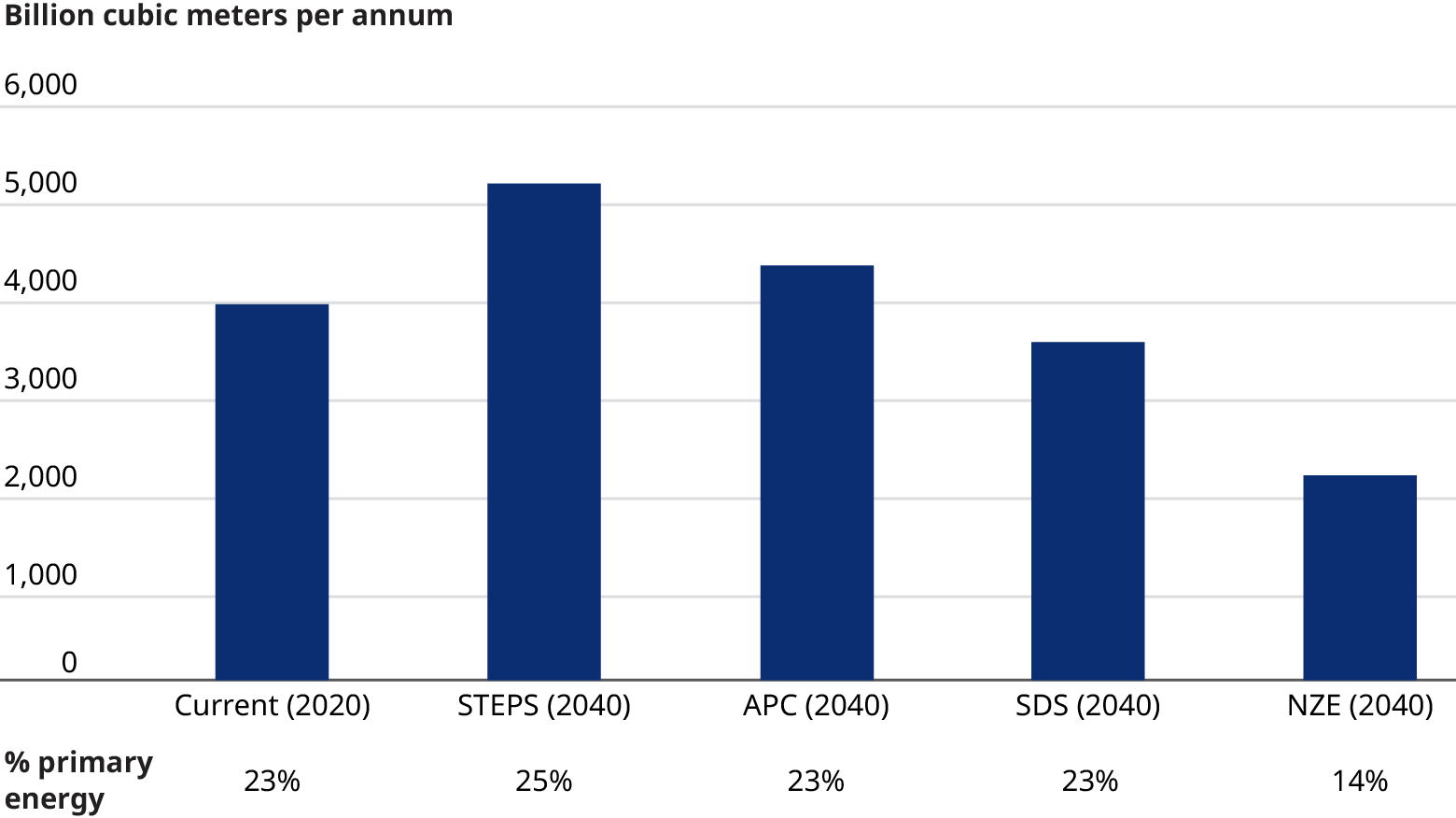

In 2018, the International Energy Agency (IEA) published its annual World Energy Outlook and called for a 10% decline to 3,444 billion cubic meters per annum (bcma) in the use of natural gas by 2040. At the time, projections based on stated energy policies forecast a 32% increase in the use of gas to 5,068 bcma over the same 12 years. (See Figure 1).

The IEA’s 2018 sustainable development scenario — the first time the agency projected a decline — rattled the industry. But that reduction was necessary, the IEA calculated, if the increase in Earth’s temperature was to be restricted to less than 1.8 degrees Celsius.

Unfortunately, for natural gas and LNG, the 2018 IEA report may have been a best-case scenario. By May 2021 in a new Net Zero 2050 forecast, the IEA had concluded that there was no need for further investment in new fossil fuel supply beyond projects already committed as of 2021. In this scenario, gas consumption in 2040 would need to shrink to just 2,100 bcma — a massive drop of 45% — to address accelerating climate change. (See Figure 1)

Gt of CO2

Natural gas consumption by scenario

In response, the industry has spent much of the past three years trying to push back the tide by promoting the ‘relative virtues’ of gas and LNG versus more carbon-intensive hydrocarbons, such as coal. And despite a slight drop in 2020 because of COVID-19, consumption of natural gas has rebounded strongly and is expected to return to close to its pre-crisis level by the end of 2021.

The IEA’s dire conclusion should have served as a wake-up call for gas industry executives who have hitherto responded and adapted far too slowly to the changing world around them. Having previously been one of them, I can appreciate and understand the massive powers of inertia that have led to this outcome. Now free from the challenge of executive office, I offer former industry colleagues the following words of advice on how to reduce gas-related emissions efficiently and progressively:

Leadership Imperative #1:

Make the easy changes immediately by stopping flaring, preventing methane leaks, and mandating quality carbon offsets on LNG trade

According to Capterio, huge volumes of gas — around 150 billion cubic meters (bcm) — are routinely flared, resulting in additional CO2 emissions as well as methane emissions. The methane — a greenhouse gas that is about 82 times more harmful than CO2, when measuring its climate impact over a 20-year period — is the result of incomplete combustion. Primarily associated with oil production, the common practice of gas flaring creates some 1,100 million tonnes of CO2 equivalent emissions annually, including the methane release. Yet, it generates no power.

Largely as a result of poor maintenance, another 56 bcm of natural gas — essentially methane — are released into the atmosphere either through operational venting or leakage from pipelines and valves. Venting and leakage together add another 5,500 million tonnes of CO2 equivalent per annum to the atmosphere.

Discontinuing venting and flaring won’t reverse climate change or prevent decline in natural gas consumption, but they are actions that industry leaders should take soon if natural gas is to play any credible role as a transition fuel. While representing a relatively small proportion of overall gas-related emissions, successfully addressing these two sources would reduce the industry’s CO2 equivalent emissions by more than four times the total emissions of the entire aviation sector.

Boards, investors, and finance providers must hold executives accountable for delivering upon the World Bank’s zero routine-flaring goal by 2030. Thus far, flaring has only been reduced by 14% since 1996, according to the Oil and Gas Climate Initiative’s website. That’s less than a paltry one bcm per annum, when flaring must be reduced by around 15 bcm per annum, between now and 2030, if the World Bank’s goal is to be achieved.

So too must business leadership be held to account for the maintenance of their gas infrastructure and methane containment. Given methane’s heightened potency, the world can no longer afford to live with leaky systems. Spending on maintenance must be significantly increased to repair systems that may otherwise face calls to be decommissioned. Gas regulators should also intervene and set a much higher bar, requiring operators to demonstrate containment or risk the revocation of licenses to operate.

An immediate patch repair is also required to offset the emissions footprint associated with global LNG trade that links global supplies to demand. While it is encouraging to see the world’s first ‘carbon-offset’ LNG shipments beginning to be made, the reality is that these remain a drop in the ocean. To date around 20 LNG cargoes have been delivered out of an annual total of about 5,000 cargoes. And, even for this handful of cargoes, it’s unclear whether the full lifecycle of emissions — spanning production, distribution, liquefaction, shipping, regassification, and delivery to point of use — have been accounted for.

Collectively, the ‘carbon neutral’ LNG deals signed to date account for just 0.5 million tonnes of LNG supply, or around 0.1% of the 360 million tonnes of global annual LNG supply. Resolving to offset LNG cargoes associated with supply agreements is in theory straightforward — providing that buyers mandate offsets as a procurement precondition. In such cases, suppliers would factor into price negotiations the associated offset costs.

Currently, the cost to offset the full greenhouse gas footprint of a 175,000 m3 LNG vessel delivered to the UK, using quality carbon credits, is estimated at $250,000. This based on a ‘cradle to gate’ calculation, which tracks a shipment from extraction to point of delivery. The cost figure was provided by Climate Neutral Commodity, a startup that has developed a new independent certification standard for validating whether the emissions footprint of a commodity transaction has been accurately calculated and mitigated.

There is also a role here for the bankers and financiers of global LNG trade to make a prerequisite of commodity financing that all future LNG supplies — whether spot or term — be fully offset with recognized, quality carbon credits, covering emissions from wellhead to the point of consumption.

Leadership Imperative #2:

Anticipate the inevitable decline in natural gas consumption by rationalizing gas portfolios, challenging LNG investment decisions, and decommissioning outdated LNG vessels

Acting now to abate and/or offset emissions associated with existing gas portfolios will buy the industry some time and likely prolong the use of gas as a transition fuel, especially for displacing coal. But it’s simply a bandage that will inevitably have to be ripped off.

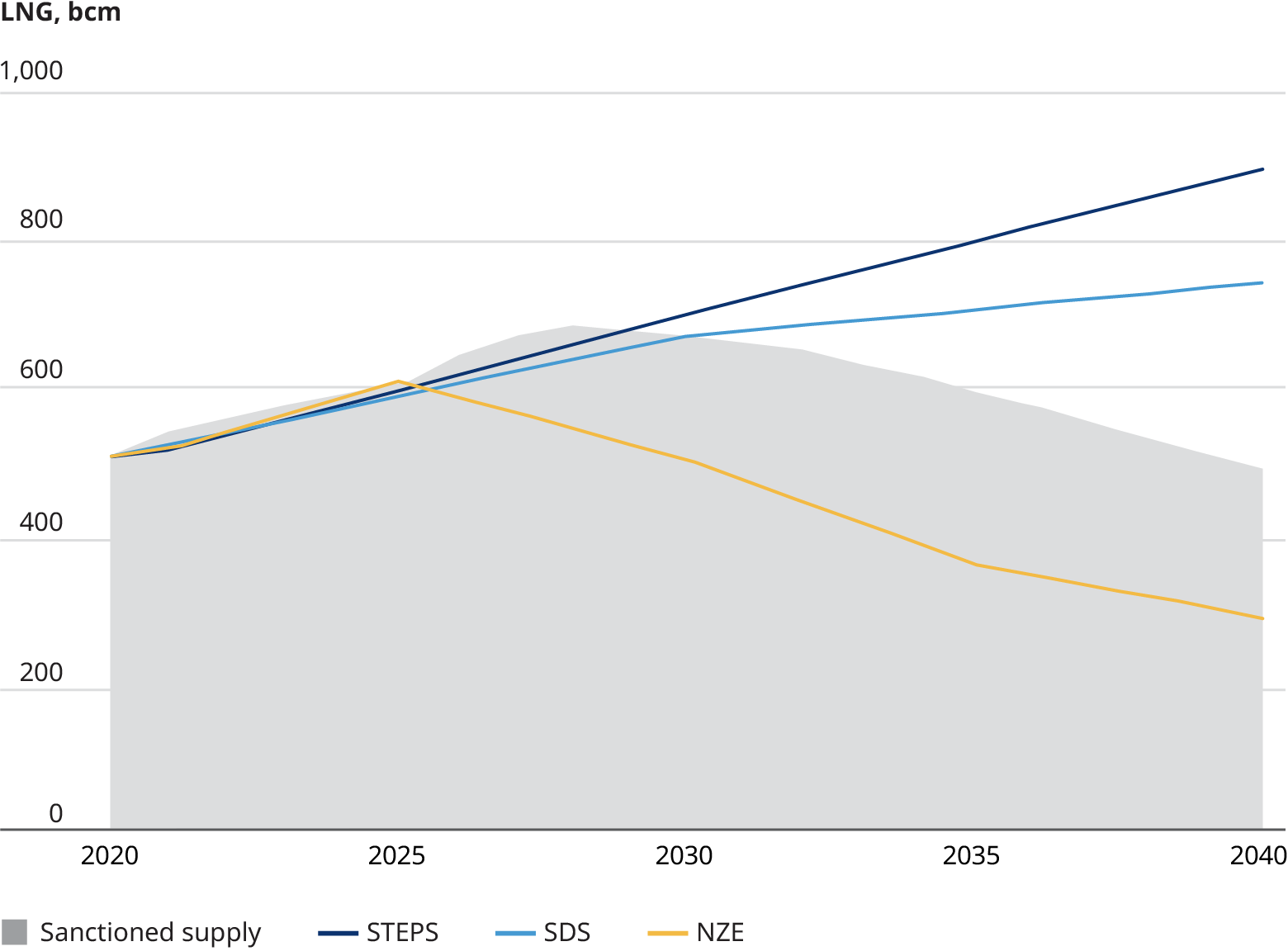

If the world is to achieve net zero, gas industry executives need to accept the fact that the share of natural gas in the primary energy mix is going to decline significantly and faster than they expect, even if it continues to grow over the short term. In fact, many gas industry executives are still projecting an increase in gas and LNG volume. According to Carbon Tracker’s Adapt to Survive report, based on the IEA scenario, global LNG demand will fall to less than 300 bcma by 2040. That’s around a third of the volume currently forecast by most gas industry executives in that timeframe. (see Figure 2)

Maybe the pace of change is debatable, but the fundamental, long-term direction is surely beyond dispute. In response, industry CEOs and chief financial officers need to develop timetables for their gas assets that are aligned with net-zero targets. First, they must be honest and transparent with themselves, and then, more importantly, with investors and financiers about the implications for current balance sheets and future investments.

Smart gas and LNG industry leaders will take the initiative in these conversations and strategic pivots, rather than be forced to overhaul portfolios by bankers, insurers, and activist investors. Winning strategies will be those that adopt not only the cheapest production, but the most climate-friendly technologies like the use of renewable power for electric drives to decarbonize any future liquefaction plant investments. Those that fail to do so risk wasting scarce financial resources chasing after portfolio investment dreams that will never become reality.

Forward-thinking gas executives will also try to get ahead of the issue by overhauling their portfolios. While advantaged players — those with the lowest costs of production and lowest emissions — will be able to hang in and harvest their assets for another decade or more, others —with high-costs and emissions — risk progressive write-downs and the destruction of shareholder value unless they act soon to either renew or rationalize their asset bases.

One area ripe for this kind of new investment and restructuring is the transport of LNG. The seas today are littered with too many shipping fleets of all shapes and sizes. Around a third of all LNG ships are over 15 years old; 10%, over 25 years old. Most of these ships are powered by either steam turbine or diesel-generation technologies. Less than 5% are of the largest, most efficient M-type, electronically controlled gas injection (MEGI) class. While MARPOL legislation has improved local air quality by mandating a shift to lower sulphur diesel, it has not fundamentally altered the carbon footprint of these ships. To address that, shipping industry executives, together with those who commission and operate these vessels, need to begin decommissioning older vessels and replace at least some of them with more efficient and environmentally friendly alternatives. With lower LNG consumption, fewer ships will ultimately be needed.

Here again, financiers and insurers can play a key role in enforcing fleet renewal by tightening the criteria for lending and underwriting. Of course, the bigger challenge is judging when to pivot away from LNG entirely: How soon will it no longer make sense to invest in any new liquefaction, shipping, or regasification facilities?

Leadership Imperative #3:

Total gas industry reinvention by pivoting to alternative hydrogen technologies for hard-to-abate industrial applications

Over the coming several decades, huge increases in renewable power generation are forecast to be installed. Under the IEA net-zero 2050 scenario, renewable energy will rise from three terawatts (TW), or 38%, of the global generation mix to 27 TW, or 88%, by 2050. This proliferation of renewable power has profound implications for the gas industry.

First, renewables will provide a direct substitute for gas in low-heat applications, such as electric heat pump alternatives for residential home heating. The UK, for instance, has already announced plans to compel this substitution. Second, it will give birth to a new, truly decarbonized ‘gas’ industry of the future — in this case, the gas will be hydrogen, not methane. For this future to materialize, a lot needs to happen, representing both opportunities and risks for gas industry participants.

There needs to be an expansion of cheap renewable energy, as well as a steep decline in hydrogen electrolyser costs. This would enable the production of green H2 at $1 to $2 per kilogram versus today’s range of $3 to $7. Given the challenges to achieve this, we expect users in the meantime to rely instead on blue hydrogen — created from natural gas using carbon capture and storage technology to decarbonize the process.

An even bigger challenge is finding the more than $10 trillion needed for new infrastructure to enable hydrogen to be transported from production hubs to demand centers. None of this infrastructure exists today, except for a handful of pilot projects. Choices also need to be made and bets placed on the best means of transporting hydrogen — either in the form of liquid hydrogen, with the associated energy density limitations and small molecule containment challenges, or as ammonia, with its inherent toxicity risks.

Given the major investments and associated risks, we expect this new hydrogen industry to follow the path that LNG took when it was developed decades ago — the major facilities will need to be supported by long-term offtake contracts with high-quality buyers, such as utilities or the steel industry. To complete the value chain, dedicated ships will be commissioned to shuttle between supply and demand nodes, tailored to handle either liquid H2 or NH3 accordingly.

For gas industry executives, everything will come down to timing. The challenge leaning into the future is assessing when and how to pivot away from natural gas and LNG and shift resources to integrated blue and green hydrogen investments. Move too quickly and risk locking in long-term mediocre economics on early technologies that lose out to fast-following enhancements. Move too slowly and risk being stuck with obsolete gas and LNG portfolios and missing out on the most advantageous hydrogen production opportunities.

Conclusion

History shows us that executive teams often resist accepting such inevitabilities about their businesses and cling onto outdated strategies for far too long, ultimately making the end more painful. Clarion calls from other sectors include brick-and-mortar retail’s reluctance to recognize the impact of the internet on their businesses, the demise of the DVD and video rental companies in the face of streaming, and the smartphone’s bloody conquest of the mobile market. But the consequences of those failures pale to the cost of ignoring climate change.

Gas and LNG executives have hitherto failed to clean up their industry, seeking comfort in predictions of how long it will take and how expensive it will be for hydrogen to develop as a viable alternative. Or they have focused on the intermittency and lack of storage for wind and solar. But, just as we saw with the urgency in the development of COVID-19 vaccines and with an accelerating pace of technology adoption, the timetable for energy innovation is rapidly being condensed. The day of reckoning is now fast approaching when gas industry leaders must act decisively in addressing climate challenges or face an almost inevitable slide into obscurity.