Exploring coinsurance in the korean market

In 2020, the Korean insurance regulator (Financial Services Commission, or FSC) introduced a coinsurance structure allowing for full risk transfer, including investment risk, interest rate risk, insurance risk and policyholder lapse risk, as a permitted practice. Expanding use of coinsurance in the Korean insurance market brings a suite of potential benefits to Korean insurance companies including increased financial flexibility, options to improve policyholder protection and shareholder value through optimization of business strategies. As such, FSC’s initiative and intention to introduce coinsurance opportunities to the market is commendable.

In this paper, we evaluated potential amendments to the Korean coinsurance structure via introduction of coinsurance with funds withheld structure, which is commonly used in the U.S. We believe these amendments would align the Korean coinsurance structure more closely with global practices and would attract more onshore and offshore capital, to the benefit of the overall Korean insurance industry.

Key highlights:

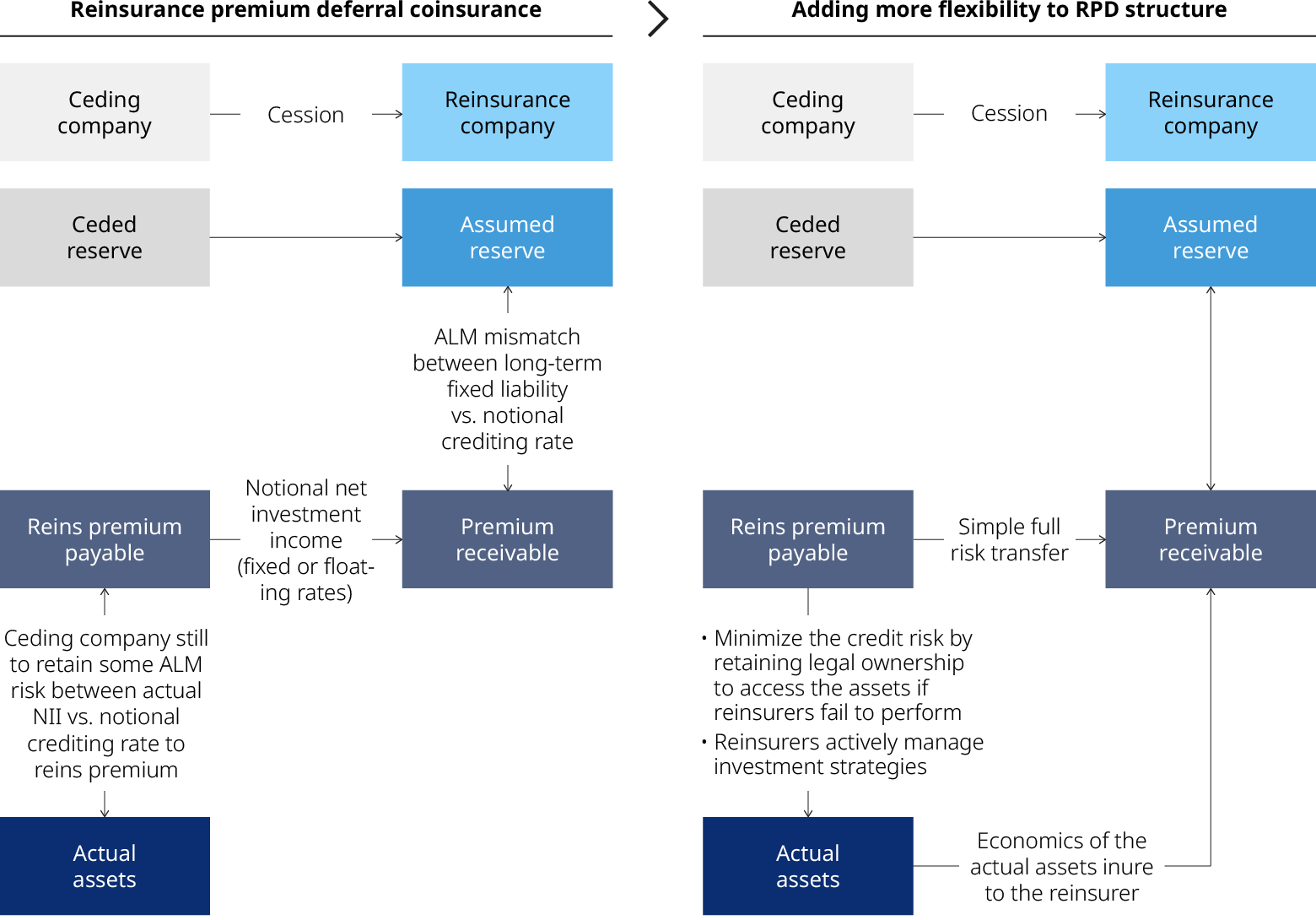

Economic risk transfer under coinsurance structure with reinsurance premium deferral (RPD)

The current RPD structure in Korea prevents full transfer of interest rate and investment risk to the reinsurer and instead exposes both ceding company and reinsurer to significant interest rate and investment risk.

Benefits of coinsurance with funds withheld structure

The U.S. sees high volume of reserves coinsured under a funds withheld structure which suggests that the implementation of global coinsurance practices in the Korean life insurance industry would serve to expand domestic reinsurance capacity. This structure has the following benefits:

Potential Amendments to current RPD structure

The report highlights the following potential amendments to the current RPD structure which would support full risk transfer: