What We Do

Market Conditions

During today’s challenging environment of shrinking capacity and escalating insurance and reinsurance premiums, our clients are looking to retain ever increasing amounts of risk and rely less on commercial markets, whether through an increase in SIR, expanded use of a captive, or increase in reinsurance retention.

However, the tradeoff between the cost of commercial market coverage and the risk being retained is often not well understood.

Quantifying Risk

Quantifying the potential magnitude and probability around adverse loss events for individual retained risks, as well as in the aggregate across all risks, is essential for any risk management professional.

Each entity’s risk tolerance is unique. However, the need to measure and manage risk is universal.

The Oliver Wyman Approach

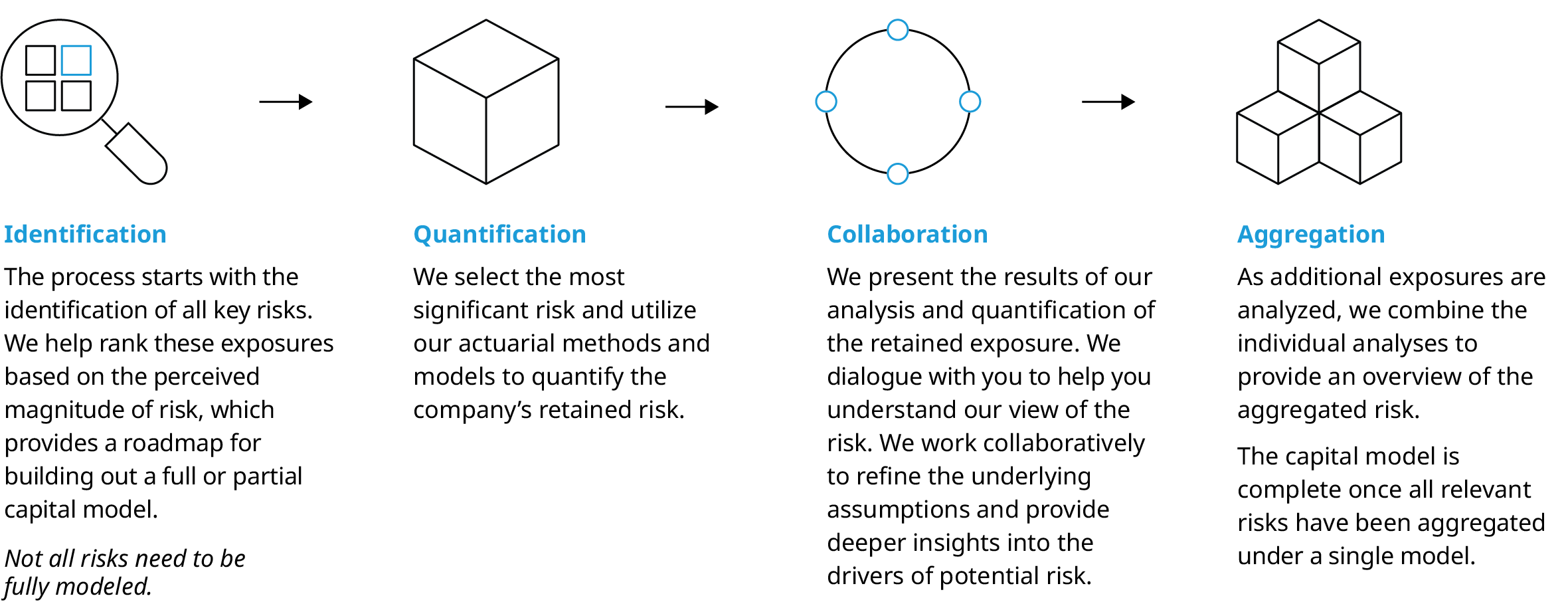

We recognize the effort required to build a full-fledged capital model can seem daunting given the multitude of risks that an organization may face. We recommend our clients view the process as a journey and utilize our building block approach to risk quantification and capital modeling.

Use cases for capital model