Written and published in partnership with the World Government Summit.

Overview and history of FDI in the GCC

The economies of GCC member states have undergone an unprecedented economic and social transformation since the 1970s, resulting in upgraded infrastructure, job creation, and improved social indicators. The countries have also coordinated their efforts to boost economic growth and employment.

The main reason for the change was the discovery of oil, which led to economies dominated by a single commodity. Now, however, the GCC countries are trying to overcome this dependence through major initiatives, including KSA Vision 2030, the Abu Dhabi 2030 economic strategy, and the introduction of VAT in KSA, Bahrain, and UAE.

Greater foreign direct investment (FDI) – in the form of greenfield investment, cross-border M&A, or project finance – can play a major role in diversifying the GCC economies. FDI opens new commercial opportunities, generates further wealth, promotes competition and trade, and supports the development of human capital.

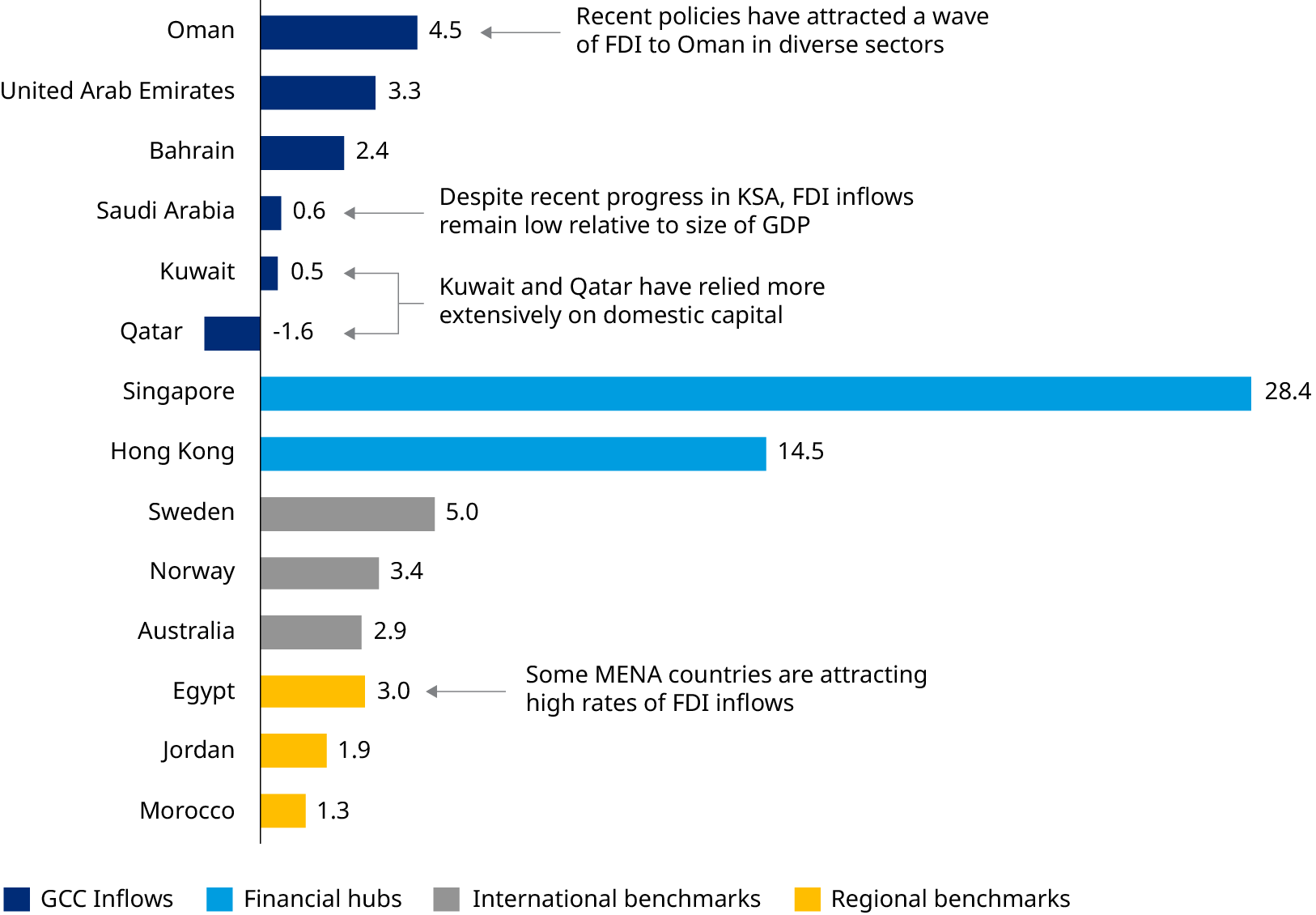

Historically, FDI to the GCC has failed to materialize as a consistent driver of economic opportunity in non-oil sectors and has exhibited significant volatility. An abundance of domestic capital has made FDI less of a priority for the GCC than for many other economies. Foreign investors have shown limited interest due to regulatory and political risk and gaps in economic fundamentals such as infrastructure and human capital. Since 2017, the trend of declining FDI inflows has been reversed, and they have steadily increased to most GCC countries. While this is encouraging, the region is still underperforming at attracting FDI relative to its ambition and to benchmark economies.

Promoting a successful FDI policy in the GCC

We argue that, to attract additional FDI, GCC countries need to prioritize regulations and policies that de-risk the investment landscape.

FDI attraction policies can generally be categorized into five archetypes:

Dedicated policies to attract FDI are often more successful at increasing inflows in the short-to-medium term than general economic reforms. Nevertheless, governments can also increase their appeal to foreign investors through strategies that increase the appeal of a market to international firms, even without being exclusively focused on attracting FDI. These include:

If GCC countries are able to craft and implement innovative sector-specific regulations in an agile manner, they can provide the investor certainty that other jurisdictions are unable to deliverProf. Henisz, Deloitte & Touche Professor of Management, and Director of the Wharton Political Risk Lab at The Wharton School, University of Pennsylvania

If GCC countries are able to craft and implement innovative sector-specific regulations in an agile manner, they can provide the investor certainty that other jurisdictions are unable to deliverProf. Henisz, Deloitte & Touche Professor of Management, and Director of the Wharton Political Risk Lab at The Wharton School, University of Pennsylvania

Considerations for FDI Policy Implementation & Examples of Successful Targeted FDI Policies

FDI attraction policies carry several risks and considerations:

Ineffectiveness

Inefficiency

Precedent

Domestic Competition

International Competition

Domestic Political Risk

Despite these risks, most threats can be mitigated by ensuring that FDI schemes remain focused so that they target specific gaps in the economy. Several FDI-stimulating initiatives that adhere to these principles have been launched with great success in the GCC, including Dubai International Financial Centre, Khalifa Industrial Zone Abu Dhabi, and the Royal Commission for Al-Jubail and Yanbu.

Although global FDI fell 42 percent in 2020 due to the COVID pandemic, the impact on GCC countries is not yet clear. However, it is expected to be less severe in the region than in many other parts of the world, because of the GCC’s relatively low dependence on FDI and positive trends before the pandemic.

When attracting FDI, GCC countries need to find a balance that considers associated risks of negative impacts on the local market and workforce. They should prioritize emerging sectors in which value chains are still under development. Investment in education and infrastructure, as well as ongoing economic reforms, could all make a substantial contribution to altering investor perception, which typically changes only slowly.

The report can be also found on the World Government Summit website.