Financial institutions are launching strategies to capitalize on the opportunities stemming from the low carbon economy transition. However, they still must navigate between the key barriers financial institutions face with the enormous potential of the climate and transition finance market. Oliver Wyman and IACPM conducted interviews with 25 leading financial institutions alongside market research to assess current market progress. In this context, our study has identified four concrete dimensions where financial institutions have developed innovative ways to deliver against their commercial strategy and climate goals:

Focusing on products and services by pioneering decarbonization solutions in finance

Most business and risk teams are leveraging their existing capabilities, client base, and expertise. Meanwhile, early innovators are developing new products and services, ranging from performance guarantees offered by insurance providers to transition bonds and funds from banks and asset managers, all aimed at supporting decarbonization initiatives within high-emitting sectors.

Enabling deal-level capabilities for climate finance deal success

There are currently limited deal opportunities in the climate and transition finance market that work with financial institutions’ risk appetite and investment profiles, and those that do fit the criteria are often highly competed. To navigate these challenges, business and risk teams have established deal-level capabilities and enablers through action-oriented partnerships as well as fostering team innovation. This has included engaging with potential clients earlier in the investment lifecycle to enable increased deal origination and integrating transition plans and emission projections into the underwriting process.

Aligning risk management and portfolio steering in climate finance

Risk measurement tools and techniques hold a pivotal role in the strategies of financial institutions, and climate strategy is no exception. Financial institutions are establishing risk sharing partnerships to better align risks with their risk appetite. Furthermore, they are re-developing financial management practices to match their climate commercial objectives, such as preferential fund pricing for environmentally friendly investments.

Evolving the organization for climate commercialization

Business teams are recognizing that positioning themselves for climate- and transition-related opportunities requires a reevaluation of how their organization delivers services and how it interacts internally. For example, financial institutions are starting to establish substantial low-carbon go-to market teams, ranging in size from a few dozen to hundreds of employees. They are also developing internal centers of excellence to offer specialized expertise and actively hiring non-traditional skillsets such as engineers, for technical advisory roles.

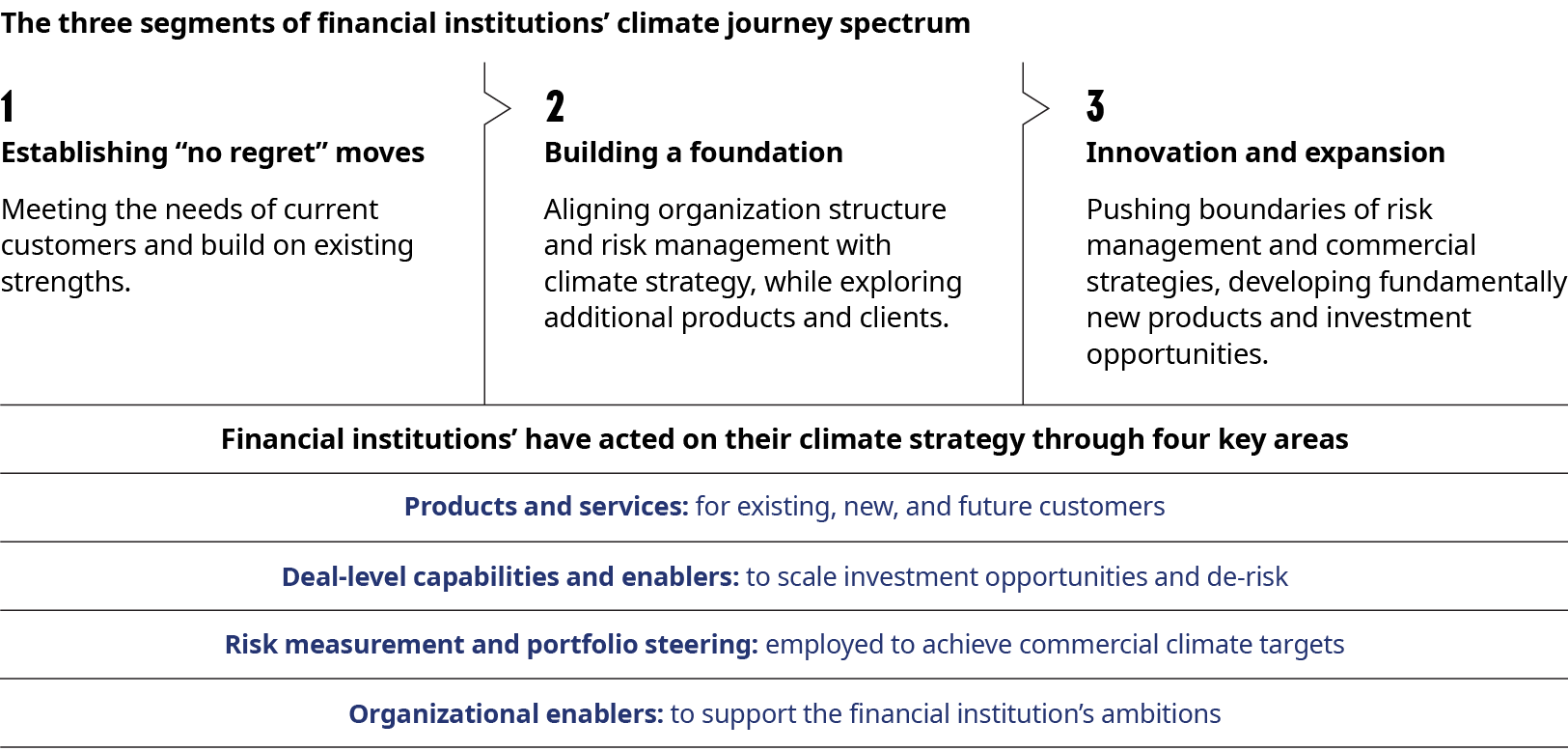

These commercialization efforts take up time and resources. As companies move forward in their climate commercialization journey, business and risk teams can consider certain strategies, depending on their ambition and the amount of effort they’re willing to invest.

Under this framework, our study sought to understand how financial institutions are pursuing commercial opportunities in climate-and transition-related financing, despite the hurdles within the market. The study’s objective was to provide a primer for business and risk teams at financial institutions on how to navigate current obstacles and support commercial objectives and strategy.

This report was written in collaboration with the IACPM.