This report is co-authored with the World Economic Forum.

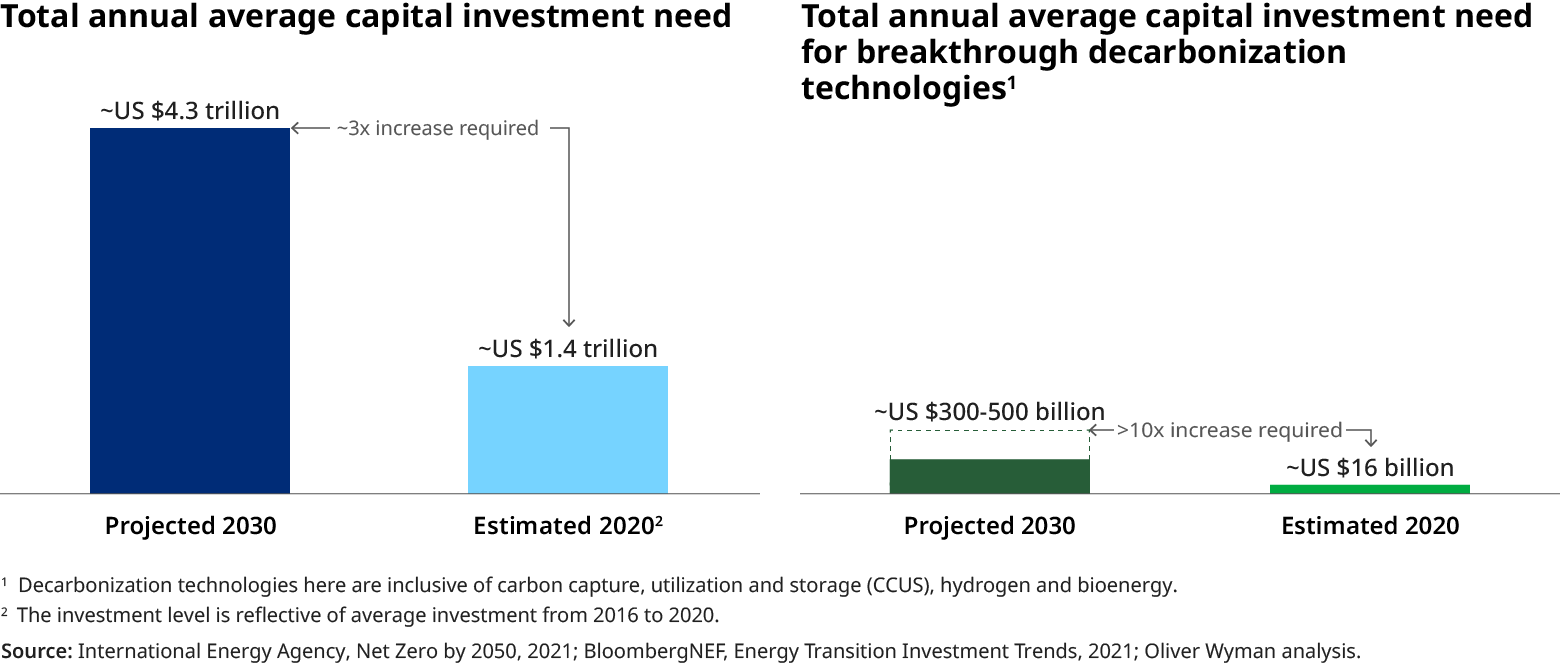

Approximately $50 trillion in incremental investments is required by 2050 to transition the global economy to net-zero emissions and avert a climate catastrophe. Much of the emissions abatement pre-2030 will be driven by existing technologies (e.g. solar), but post-2030 abatement relies on breakthrough technologies, such as energy efficiency solutions, hydrogen-based fuels, bioenergy and carbon capture/utilization/storage solutions, among others. A prerequisite to the successful expansion and deployment in the 2030s is validation of these breakthrough technologies at commercial scale in the 2020s. Significant capital needs to be steered for the timely industrial decarbonization of hard to abate sectors and a global energy transition.

Several technologies are not yet competitive with their greenhouse-gas-emitting alternatives and are in the early stages of development. They typically experience a market failure called “valley of death”, characterized as “an inability of businesses to secure financing for the initial commercial-scale deployment” of projects and assets. Furthermore, investments in these technologies can be capital intensive and high risk, which will result in a global financing shortfall, as things stand.

This report discusses three fundamental findings that help overcome key challenges by solving for increased bankability through replicable blueprints and collective action.

- The innovative blending of capital supported by an enabling ecosystem is needed, where different sources of public and private capital are brought together in technology-specific financing blueprints. To do this effectively, mechanisms that activate collaboration among multiple stakeholders are necessary.

- Transformative business models are essential, where industry participants and capital providers work together to establish new contracts and ways of doing business to increase the probability of commercial success. Transformation can be achieved through measures to stimulate demand and establish reliable, scalable supply.

- Targeted public intervention is critical, focused on the design of incentive schemes rewarding early movers adopting innovative technological solutions and de-risking schemes to mitigate investment risks unique to these innovative solutions.

The innovative blending of capital

Sophisticated capital structures, which blend different sources of public and private capital, are necessary to close the investment gap for the deployment of breakthrough technologies. These will allow financing to be offered, consistent with stakeholder investment frameworks and risk appetite. Overall, a far more strategic approach to risk allocation is necessary for innovative solutions than for conventional projects. A prerequisite to this collaborative financing approach is activation of involvement from various stakeholders in the transition finance ecosystem. Such collective action can be achieved through coordination by anchor investors. Multilateral development banks are best positioned to play this role but will need to work with the private sector to establish specific solutions and structure bankable opportunities.

Transformative business models

Mechanisms to allow businesses to establish bankable projects are the need of the hour. Businesses should look to identify key performance drivers, sometimes in partnership with capital providers to better commercialize operations based on breakthrough technologies, and reduce the costs of innovation, and as a result unlock greater flows of capital.

This involves identifying the greatest innovation and investment risks and subsequently new ways of doing business to improve underlying cash flows. Companies will be required to introduce demand- and supply-side contracts (e.g. offtake agreements, tolling structures, availability-based payments, feedstock guarantees), in some sectors moving away from spot pricing, and in general identify mechanisms that allow systemic replication of commercial success. Business models will need to also proactively de-risk the greatest areas of innovation risk, co-developing solutions with stakeholders across the climate ecosystem.

Targeted public intervention

The need to offer incentives for early movers, significantly de-risk investments in innovative solutions and establish clear policy signals is urgent. Four thematic enablers can support progress on this front:

- Improve the risk-return profile of breakthrough decarbonization projects, by offering predictable, adequate and long-dated incentives and de-risking measures.

- Coalesce a multistakeholder ecosystem for collective action, catalysing diverse sources of public and private capital through enhanced investment frameworks and strategic risk allocation/sharing, with multilateral development banks playing the anchor investor role.

- Establish clear pathways, standards and mandates globally, to focus efforts on the most impactful climate solutions, mitigate the risk of stranded assets, avoid financiers having to pick “winners and losers” and ensure a level-playing field with consistent schemes and mandates.

- Design away perverse incentives and outcomes, where policies/regulatory activities may unintentionally divert capital away from the “greening” of hard-to-abate sectors and/or emerging markets and developing countries.

While the transition will likely be complex, there is a real appetite from industry for thoughtful partnership and for collaboration between private and public capital providers. It is mission critical to capitalize upon this appetite immediately through meaningful, structural action. By proposing an initial set of financing approaches and de-risking solutions, this report seeks to initiate an important discussion on how to rapidly accelerate the deployment of capital towards breakthrough technologies.

To read the full report, download the PDF below.