In the dynamic world of telecommunications, the European market is a constantly shifting landscape where customer loyalty and provider reliability play pivotal roles. In our last communications, media, and technology industry study, titled “Telco: Mobile and Fixed Broadband Connectivity”, we delved into this complex ecosystem. This study, based on our annual “Global Consumer Survey”, explored churn rates, the factors influencing customer decisions, 5G adoption, and the evolution towards fiber connectivity.

Churn in the mobile service provider market

The European mobile operator market is highly competitive. Across Europe, the willingness to switch mobile phone service providers is a significant trend, with a substantial 44% of consumers expressing their readiness to make the move. Among those, more than 40% intend to do so within the coming year.

By deeper analysis of each country in the study (France, Germany, Italy, Spain, and the UK) reveals interesting patterns. French consumers are the most likely to change their mobile service provider, with 51% of them considering it. In contrast, consumers in Germany and the UK are the most loyal, with over 60% not planning to change.

However, customers in the UK, while predominantly loyal, display a paradoxical inclination to switch providers. Interestingly, the highest percentage of these customers actually make the move within the subsequent six months (25%).

In terms of churn intention in the mobile service provider sector in Spain, we observe that it aligns with the EU average, standing at 46%. This indicates that consumers' willingness to switch providers is relatively moderate, providing evidence that convergence offers are gradually losing lost their binding power.

Factors that shape mobile provider choices

What drives these decisions to switch providers? When considering their next mobile operator, price is the key determinant in all geographies, followed by network performance and data allowance. Italy is the exception, where regional coverage takes precedence over data allowance which ranks fifth in importance in most of the countries. Meanwhile, Germans, Italians, and British consumers emphasize data allowance over network performance/speed, a distinctive preference compared to the rest of the EU. It's noteworthy that more holistic offerings — such as telco suppliers offering services beyond the telco core like financial services, energy solutions, and home security — are not particularly appreciated by consumers as competitive advantages when choosing their next operator. Likewise, environmental, social, and governance (ESG) considerations are among the least relevant decision factors, indicating that consumers are primarily focused on more immediate concerns like pricing and network quality.

Demographics also play an important role in mobile provider preferences. Younger consumers -those under the age of 35- are more prone to switch operators, with 58% declaring their willingness to make a change. In contrast, seniors -those aged 55 and older- exhibit greater loyalty, with 67% preferring to stay with their current supplier. While this may appear obvious, it underscores the need for providers to cater to the preferences of different age groups.

The influence of age on consumer behavior is particularly pronounced in Germany. Here, up to 64% of young adults express their willingness to change operators, showcasing a high degree of mobility within this demographic. In contrast, a substantial 75% of seniors in Germany indicate their intention to maintain their current supplier. While this observation may not seem immediately actionable, it highlights the importance of targeted marketing and service offerings for different age segments.

Across all markets, low-cost operators have successfully established a foothold among consumers of all age segments. This phenomenon is particularly robust among seniors (those aged 55 and older) in Germany and the United Kingdom.

Churn dynamics — Traditional telcos versus low-cost operators

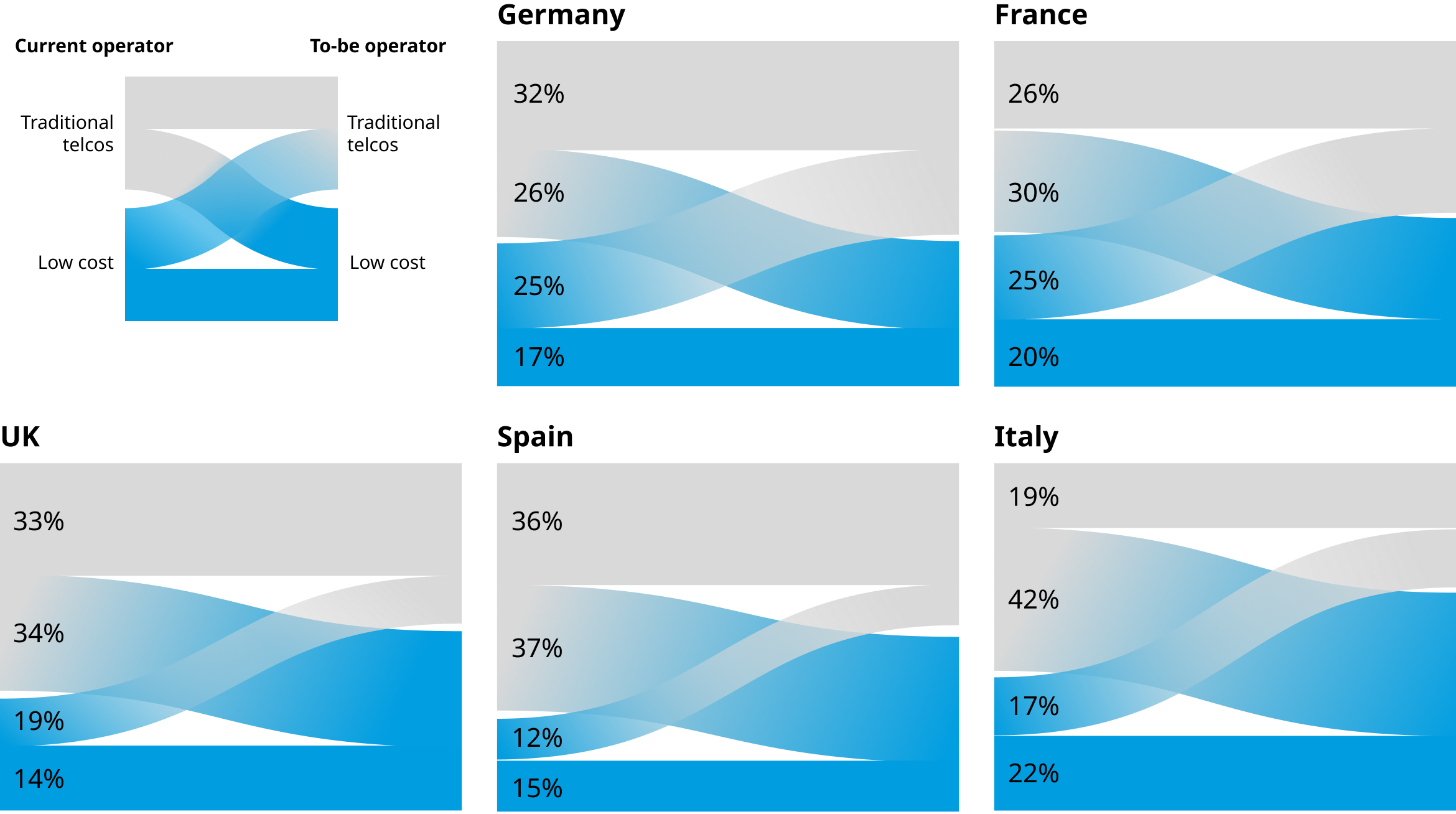

A shifting landscape is evident in the European mobile market, with low-cost operators poised to gain market share primarily due to their appeal to price-sensitive consumers who are switching from traditional telcos. The majority of intentional churners in Europe are currently subscribed to traditional telecom operators, with only 37% opting for low-cost tariffs. However, 53% of intentional churners currently with traditional operators express their intention to consider switching to low-cost players. This suggests that low-cost operators are gaining ground and attracting customers away from more established providers.

In Germany, traditional telcos exhibit a unique resilience. While low-cost operators have made inroads, trading flows between the two run in both directions, resulting in a relatively stable market balance.

France tells a different story. Here, traditional operators face a progressive erosion of market shares, with 56% of intentional churners presently aligning with them. More than half of these consumers are inclined to switch to a low-cost operator, indicating a significant shift in market dynamics.

Italy presents an intriguing scenario where low-cost operators are highly attractive. A remarkable 61% of intentional churners in Italy are presently subscribed to traditional telcos, and a striking 69% of them plan to transition to low-cost tariffs. Among low-cost intentional churners in Italy, 56% intend to shift to another low-cost operator, indicating a competitive landscape within the low-cost segment.

Spain stands out as a market where the migration from traditional telcos to low-cost operators is particularly pronounced. An astonishing 73% of Spanish intentional churners currently subscribe to traditional telco operators, but half of them are considering a shift to low-cost operators. Furthermore, only 12% of total intentional churners in Spain contemplate upgrading from low-cost to traditional telcos.

The UK presents a challenge for traditional operators, with 67% of intentional churners currently subscribed to their services, and half of these consumers expressing a strong inclination to migrate to a low-cost operator. This trend points to a substantial erosion of traditional operators' market shares.

Adoption of 5G connectivity

The advent of 5G technology has generated varying levels of excitement and skepticism among European consumers. A notable finding is that only 37% of Europeans are willing to pay extra for a 5G connection, with substantial variations across countries. Italy leads the way, with 43% of consumers open to paying more for 5G, followed by Germany (38%) and Spain (37%), while nearly half of the French (48%), and British (46%) consumers do not see any added value in this advanced technology. For those in the EU willing to pay extra for 5G, the majority would accept a modest annual price increase of 0-5% (59%), emphasizing the price sensitivity of European consumers. Here, the UK and France stand out with the lowest willingness rates to invest in 5G across EU markets, with only 33% and 35% respectively of consumers open to paying extra.

Uniting mobile and fixed broadband services

Convergence, where customers have both their mobile and fixed broadband services from the same provider, indicates that consumers' willingness to switch providers is relatively moderate in Spain and France, providing evidence that convergence offers are gradually losing their binding power.

In countries where Fixed+Mobile combined offers (convergent products) are not widely extended, owning both fixed and mobile products with the same operator does not necessarily ensure customer loyalty. In the UK, Italy, and Germany, where less than 43% of consumers have fixed and mobile services with the same operator, convergent products prove ineffective in preventing mobile churn.

Churn in the fixed broadband provider landscape

In the fixed broadband sector, 42% of Europeans consumers are considering switching their provider, and among those, nearly 40% of them plan to make this transition within the next 12 months.

While the fixed broadband market typically exhibits lower intentional churn rates compared to the mobile sector, there are exceptions. Italy, displays the highest churn intention in EU (48%), followed by the UK and France, which also stand out with greater levels of volatility, where 45% of consumers are considering switching their fixed broadband provider. Moreover, 25% of UK consumers looking to change their fixed broadband supplier are motivated to make the switch within the next 6 months, indicating a sense of urgency among potential switchers.

Germany presents a different scenario, where trading perspectives seem relatively stable across EU markets. This stability is partially influenced by the prevalence of fixed-term contracts. A significant 65% of German consumers declare their intention to stay loyal to their current mobile suppliers, highlighting the importance of contract terms in customer retention. In Spain, the churn intention falls slightly below the EU average, standing at 38%.

Factors influencing fixed broadband provider switching

Price remains the dominant factor influencing decisions to change fixed broadband providers across all EU countries. Quality factors such as speed, reliability, and customer service also play significant roles in these decisions.

As in mobile providers, more holistic offerings and ESG considerations are not particularly appreciated by consumers as competitive advantages when choosing their next operator.

The path to fiber connectivity

Over 65% of European Union consumers now have access to FTTH (fiber to the home), a technology perceived as superior across age segments in most EU main markets as opposed to 5G. Spain and France are leading the EU in fiber deployment, with impressive coverage of 95% and 85%, respectively. In contrast, Germany and the UK lagging behind, with only 38% and 47% of homes connected to fiber.

A substantial percentage of French (68%), Italian (65%), and Spanish (65%) consumers plan to upgrade their fixed broadband to fiber within the next 12 months, emphasizing the growing demand for high-speed connections.

However, challenges persist in Germany and UK, while they are progressively catching up with other EU markets, lags with an estimated 38%, and 47% FTTH availability respectively. Here, the technology has yet to firmly establish itself or be effectively marketed, leading to skepticism among Germans. Only 37% of those with FTTH access in Germany are considering upgrading their internet services in the next 12 months.

In conclusion, the European telecommunications landscape is a dynamic field shaped by consumer choices, preferences, and evolving technologies. Providers must remain attuned to these market moves and adapt their strategies accordingly.

In conclusion, the European telecommunications landscape is a dynamic field shaped by consumer choices, preferences, and evolving technologies. Providers must remain attuned to these trends and adapt their strategies to meet the ever-changing demands of the market, especially in the face of 5G adoption, convergence, and the march towards fiber connectivity.