Telecommunications is at the center of the digital revolution. While operators have lost relevance, services that offer over-the-top connectivity by other players have captured most of the value unlocked through new technology waves (for example 4G, 5G, and fiber). In the pursuit of a better outlook, operators have tried to diversify their portfolio beyond connectivity, but many have struggled. In this report we delve the learnings to better select what ventures to pursue and how to build them.

The urge for change

Telecom operators faced challenging economics in the past decade, with sluggish growth and lower returns leading to mediocre stock performance with regard to other sectors. Further, the sector lost relevance in the economy, dropping from 2.6% to 1.8% of the global gross domestic product (GDP) between 2012 and 2021, despite being instrumental in an ever-more digital world.

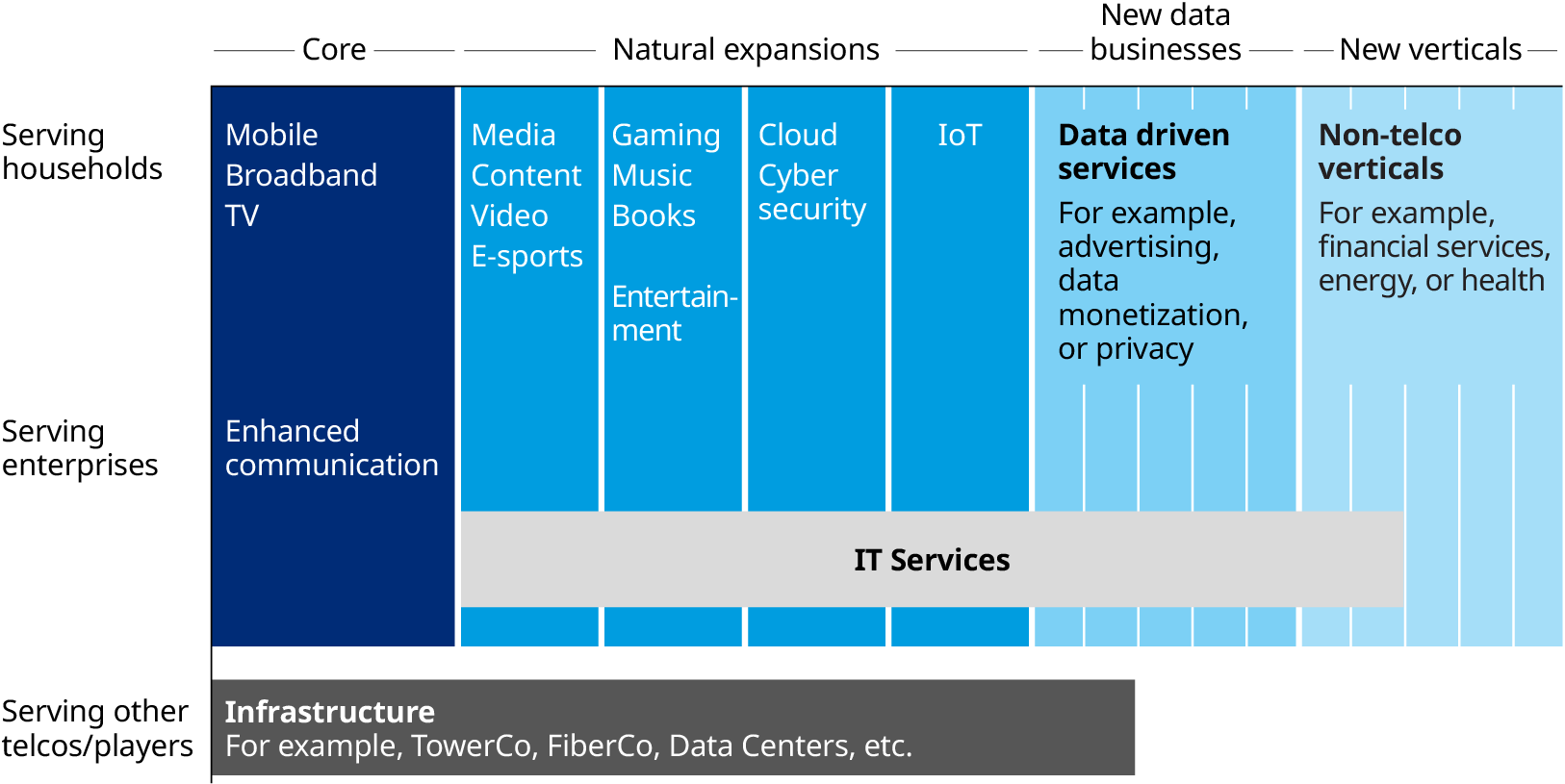

Telecom’s core traditional connectivity service is increasingly seen as a commodity in the eyes of consumers, and this commoditization is further accelerated by the rising trend of infrastructure sharing, which ultimately reduces the relevance of ‘network quality’ as a competitive edge. In this context, operators must instead differentiate via superior or differentiated customer service, brand, and the ecosystem of adjacent and non-telecom services they can add to their portfolio.

To the latter, some operators have indeed made some efforts (with limited success) to diversify their portfolio beyond their core in pursuit of: competitive differentiation, pricing power, greater relevance in customers’ life, customer loyalty, and growth as additional business streams per se.

In our view, the inconsistent performance of telcos when venturing outside their core business indicates that operators must better identify the services where they have a ‘right to win’ as well as how to play in those markets to capture sustainable value while building a defensible value proposition.

Understanding where to play and how to pick the right battles

In addition to the typical assessment of the attractiveness of the different markets, to maximize the odds of success, operators should start by carefully selecting the markets where they can compete and win, with those being markets where operators add meaningful value to the ecosystem by leveraging their distinctive advantages, and consumers see legitimacy in telcos to assume those roles.

In our view, telecom carriers' most valuable assets that can be leveraged beyond connectivity include:

1. Massive customer bases. With a national scale and a market very often concentrated amongst a handful of players, operators may provide immediate access to more than one-fifth of the population.

2. Deep customer data and insights. Telecom carriers hold one of the richest consumer information databases, possibly only second to FAAMG plus TikTok, with an in-depth understanding of consumers’ behavior, credit history, preferences, devices, applications — just to name a few.

3. Presence inside the home. Telcos have already been invited into the homes of their customers, giving them an edge to deepen their home offering with services such as security, smart controls, and lightning to ultimately “own the home”.

4. Brand equity. While recognizing that telcos are far from having the most desirable brands in this regard, the brands of well-regarded carriers are usually top-of-mind at national scale and carry a significant amount of trust amongst consumers.

5. High consumer engagement. This is more specific to pre-paid operators, whose customers are in constant interaction with the operators’ platforms and channels to top-up their phones. These recurring touchpoints with consumers are clear opportunities to build upon ancillary services and generate flywheel momentum to sustain growth — a condition well-known and exploited by SuperApps.

6. Invoices. Outside the more developed economies, a large share of the population still doesn’t have credit cards, and many are unbanked. In these regions, the invoices of telecom operators become a decisive channel to access and charge consumers.

A recent survey we conducted indicates that telcos fare favorably in consumers’ perception to advanced offerings beyond their core services. Consumers place a fair degree of trust in telcos for dealing with their data, and they see telcos as a more natural supplier of a single platform to aggregate their service needs.

Additional contributors Allan Gomes and Gabriel Moura