Following a spate of recent global crises, industrial manufacturing companies are now overloaded with inventory. It’s a precarious situation that they can mitigate only through the deft execution of a multipronged ordering and selling strategy.

Factors ranging from low semiconductor supply to Chinese lockdowns increased these companies’ raw material costs and lead time. In response, many built up stock to avert further spikes in procurement costs and prevent production stops due to scarce materials. Unfortunately, the necessary capital outlay, multiplied by rising interest rates, has led to considerable cost pressure. And with money tied up in inventory and less coming in because of the specter of a recession, the organizations don’t have the cash for other substantial investments.

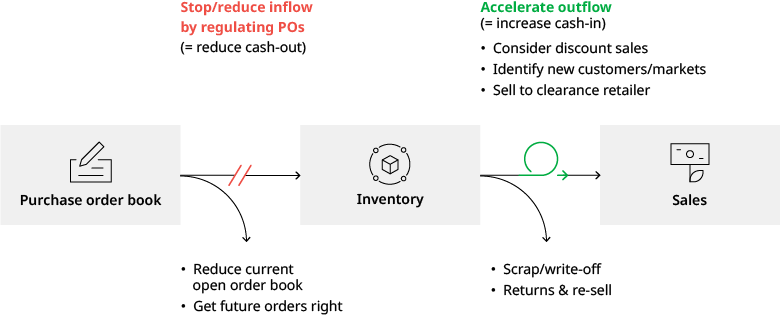

CFOs and COOs must act now to drive inventory levels down quickly while ensuring production can continue. That doesn’t simply mean accelerating sales, a mechanism we have found to have only a 10% to 15% chance of success in the current market environment. Instead, the key is to reduce inflow by reviewing the company’s open purchase order book and ensuring that planners only place orders that the business needs.

The best way to reduce inventory

Our recent experience shows that many manufacturing companies lack a dedicated demand planning and inventory steering function. As a result, limited alignment between the procurement, production, sales, and logistics departments leads to sub-par decisions for the company. For example, procurement might order materials for a project that sales already know will change, or logistics might know of a shipment delay that puts the production plan at risk. There is three-step approach to consider when it comes to supply chain strategies:

Accurate forecasting and cross-functional alignment

Besides making organizational and processual changes, systematically building the right internal capabilities is crucial. The first step is to set up proper planning of future demand through accurate forecasting, an area where companies’ efforts often fall short. In our experience, machine learning forecasts outperform traditional statistical and experience-based methods and unlock significant potential. Demand planning also entails implementing a sales, inventory, and operations planning (SIOP) process where members of all relevant functions combine their specific knowledge for a forecast review and sign-off.

Optimizing inventory management

In the second step, companies can determine optimal target inventory ranges and re-order placement for each part using the demand forecast and additional information, such as historical supplier delivery performance. Many manufacturing companies leave the decision of when and how much to order to their employee’s experience instead of following clear business rules. As a result, the fear of stock-outs leads to too-high purchase amounts.

Streamlining open orders

Lastly, to quickly drive inventory levels to target ranges, companies must review their current open order book and push out, split up, or cancel open orders where possible. They should also create a list of parts blocked from any future ordering and set up a purchase order control tower comprising experienced material planners and managers that can make buying decisions. The team reviews new purchase orders against the calculated targets and only releases orders that fall within the ranges to the supplier; for those that don’t, the material planner or buyer must justify the decision.

Using the outlined approach, we were able to drive down inventory levels of a manufacturing company by 17% within nine months – freeing up significant cash for other investments while keeping service levels towards customers stable. (See Exhibit 1).

Avoiding future inventory crises

Moving forward, companies must make deliberate new investment decisions that will affect future inventory. For example, buying to avoid price increases, last calls from suppliers, or covering for delivery problems. When such decisions arise, they should fill out a standardized business case form and revise it periodically to make better-informed choices.

While getting inventory down to manageable levels is paramount, organizations must figure out how to avoid getting into this situation again in the long term. These supply chain crises will likely not be the last we have seen. That means acting now to build a better planning capability that leverages state-of-the-art forecasting algorithms and adapts internal processes, organization, key performance indicators, and tools.