The Inflation Reduction Act is spurring significant investment in the United States’ economy – with more than $1 trillion expected to be invested in power generation, hydrogen, and carbon capture, utilization, and storage over the next eight years.

In a bid to drive decarbonization, non-emitting power generation is the single largest category of expected spend. As a result, traditional energy, manufacturing, and construction players will need to scale up at an unprecedented pace, while ensuring that the quality of the assets they are building is not impacted. Organizations will need to find more effective ways of planning and designing projects, and the construction industry will need to rethink the approach to productivity if they are to succeed in the coming infrastructure boom.

The transmission infrastructure challenge

Incentives for non-emitting power generation are expected to result in renewables drawing an increasing share of capital, compared to traditional generation. However, these new assets will need to be connected to the bulk grid, and so the expansion of transmission infrastructure will be as critical as building the renewable assets themselves.

However, transmission development is increasingly fraught with roadblocks and projects are seeing longer delays and more constraints.

The anticipated build will be a step change compared to the historic expansion of the electric utility system. As such, businesses will have to go back to the drawing board and really challenge themselves to think differently to deliver on these investments. We will need to rethink how we design infrastructure and how we safely deploy human capital for maximum impactChristine Oumansour, Partner, Energy and Natural Resources

The anticipated build will be a step change compared to the historic expansion of the electric utility system. As such, businesses will have to go back to the drawing board and really challenge themselves to think differently to deliver on these investments. We will need to rethink how we design infrastructure and how we safely deploy human capital for maximum impactChristine Oumansour, Partner, Energy and Natural Resources

Adapting supply chain to meet rising renewable energy demands

As an increased percentage of annual installations shift towards renewables, the industry will require more than double the existing supply chain capacity to meet the needs of the anticipated build-out – on top of the existing traditional generation supply chains, which will continue to run at pace.

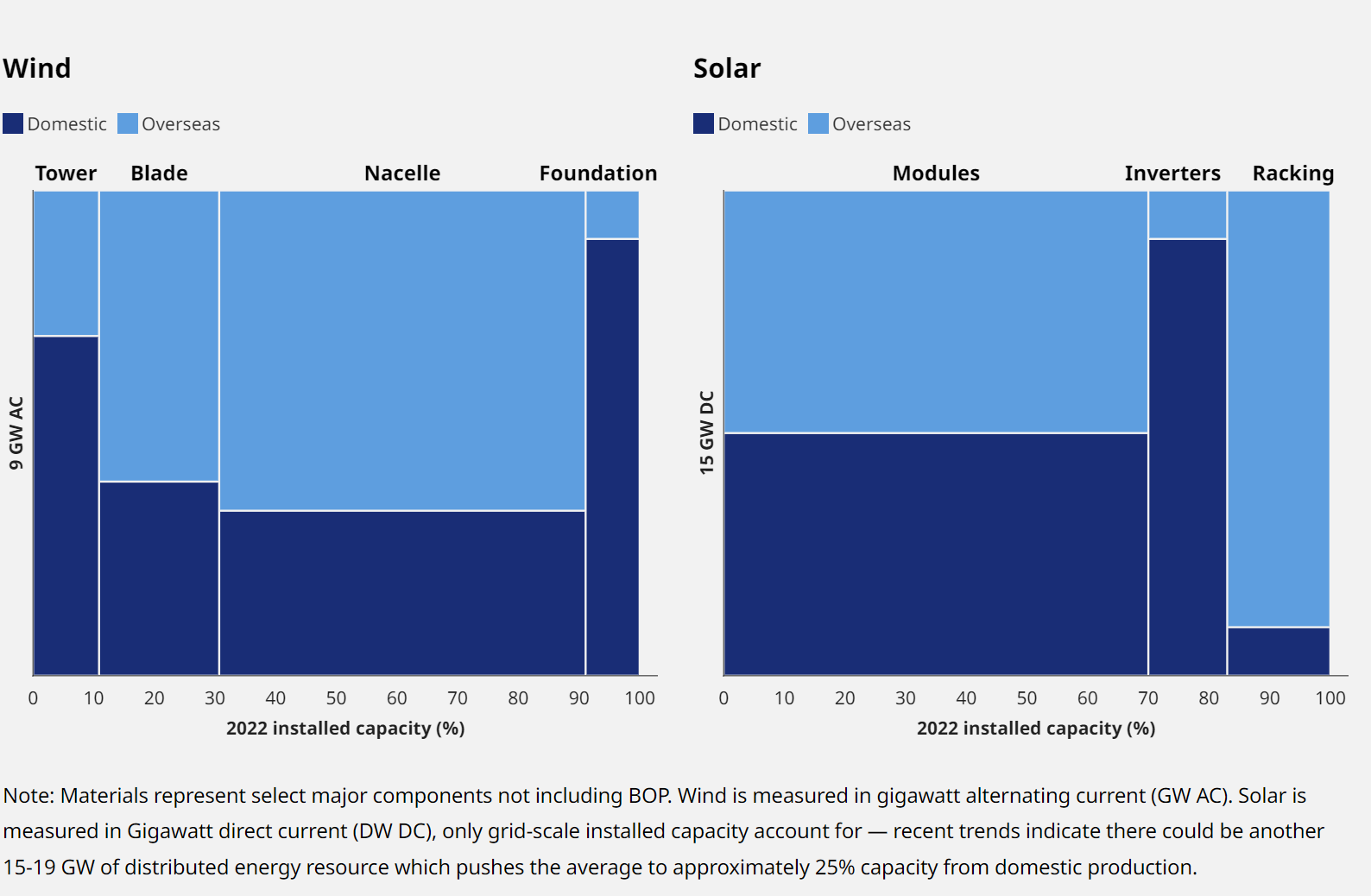

As the Inflation Reduction Act incentivizes domestically manufactured content with a 10% bonus, the onshoring of local renewable energy supply chains is expected to accelerate at a record rate. Installed supply chain capacity for solar energy will need to increase 15% by 2026, and wind will require a 25% increase by 2027.

Whether or not to pay for domestically manufactured components will be decided on a per-project basis after accounting for project economics perspective. If the 10% increased incentive makes financial sense, then projects will seek out domestic components. However, it may not make sense to do so for all projects.

While there may be supply chain constraints, as renewable facility installation grows, it is anticipated that industries will increasingly be able to leverage economies of scale across traditional and renewable generation, and therefore see a price drop.

Tackling the workforce challenge

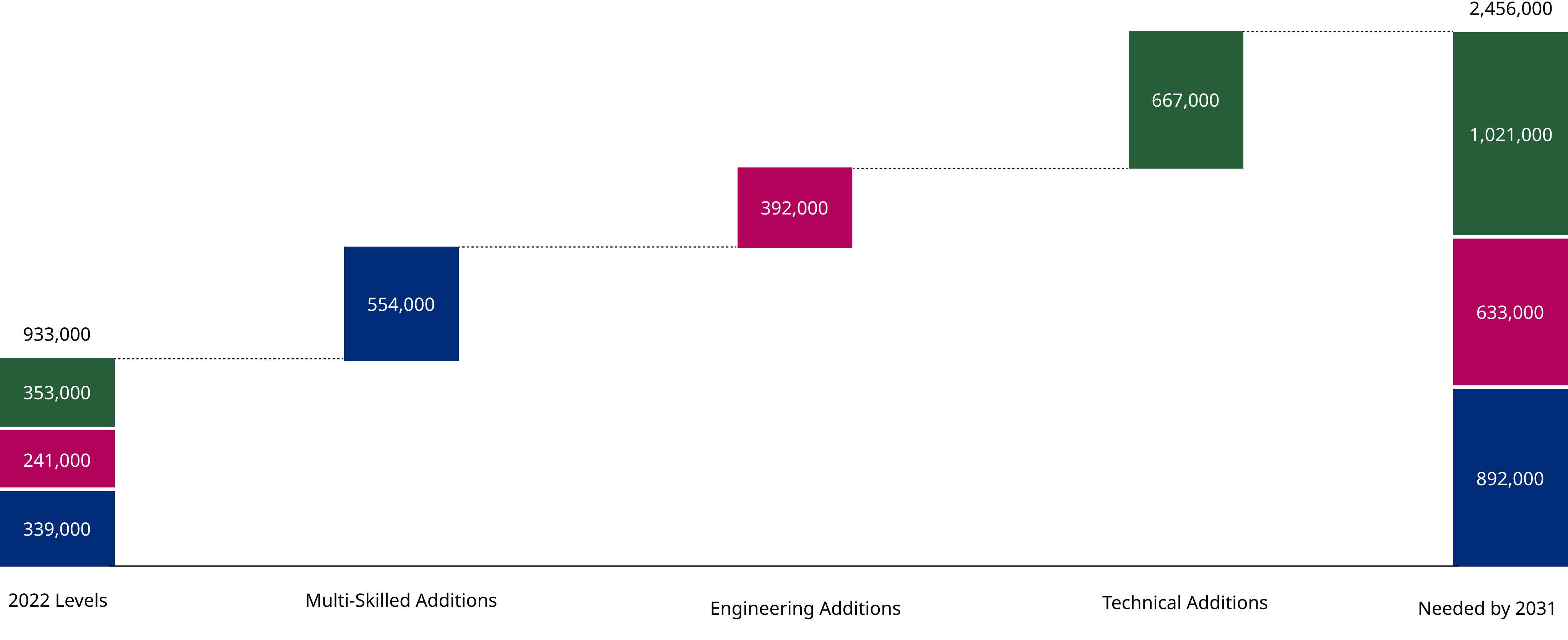

Facilitating the build-out will require more than twice as many workers to participate in the engineering and construction fields in the energy sector.

To support critical trade growth, the Inflation Reduction Act includes prevailing wage and apprenticeship requirements, which – if met – would see organizations receive a tax credit of 30%. However, if these requirements are not met then the available tax credit would be the base amount of 6%.

While the ramp up of apprenticeships should be feasible in a relatively short timeframe – with workers typically starting on-the-job apprenticeships after one to two years of training – apprentices cannot perform the full set of duties of certified and licensed professionals.

Highly skilled construction workers, such as welders, linemen, and wind installers, take three to five years to complete training and longer to reach peak efficacy. As the United States is already reaching peak capacity for many of these specific highly-skilled trade classifications, there is a risk that there will not be enough skilled workers to deliver the planned assets under construction after 2026.

To overcome this challenge, organizations will need to not only accelerate the training of engineers and constructors but find ways to use their skills and their time more efficiently. To make productivity gains and keep new workers safe businesses will need to reimagine construction workflows and take work out of human hands.

What the future holds for other decarbonization technologies

Tax incentives for hydrogen and carbon capture, utilization, and storage (CCUS) are also significant but could easily be understated should certain technologies prove more commercially effective than currently assumed.

The actual installed capital expenditure will vary due to the mix of green versus blue hydrogen, the price of natural gas as the feedstock for hydrogen, and the decrease in costs as the technologies mature and end-use markets develop.

What will be critical for businesses to succeed in developing commercially viable hydrogen and CCUS projects is the willingness to invest to get to scale in these industries. It took over 4,000 projects across wind and solar generation technologies to reach commercial and technical efficacy in renewable power generation. Hydrogen and CCUS technologies will need to move even more quickly down the same learning curve. As the Inflation Reduction Act incentives run for a period of 10 years for most production tax credits (12 years for CCUS), the firms that invest in a scalable portfolio and keep costs low stand to gain. Driving scale also has the double benefit of making hydrogen applications more feasible in transportation and other downstream markets.

How to drive value for energy investments

The sheer magnitude of the expected build will necessitate a rethink of how companies approach the traditional capital expenditure cycle, including how firms approach early-stage decisions that will have long-term impact on cost and performance. Projects will need to be actively managed throughout the lifecycle to ensure businesses are getting the most value from deployed capital investment.

Projects are evaluated as a success by achieving cost, schedule, and safety goals, but critical to these ultimate outcomes is how projects respond to unexpected events. The ability to recover from an unexpected event is predicated on good planning, a well-structured and clear operating environment where roles are well-defined, and good working collaboration and knowledge-sharing across parties. With good governance, and a tested resilience and response plan in place, projects can mitigate the delays and cost increases that come with the inevitable unexpected event – whether it be a bird nesting on a lay-down yard, a permit delay, or late-arriving materials.

The industry will need more enablement via investing in the resources and governance “infrastructure” that will enable this magnitude of build to succeed. This means finding a more efficient way to address permitting, parallel transmission/generation load planning, and incorporating environmental and species constraints alongside project planning so that projects can move expediently through the planning stages without losing the depth of information that goes into a successful and well-ordered project execution plan.

Additional contributors Meredith Gurnee, Warren Smith, Cathy Hennessy, Alessandro Tricamo, Bob Orr, and David Kaplan.