This article was first published on May 19, 2020.

Capital planning has moved from “in vitro” to “in vivo.”

COVID-19 represents an unprecedented event in our lifetime and brings major challenges for capital planning processes and CCAR (see note 1). Capital planning teams are wrestling with the pandemic’s global scope, rapid onset, and the magnitude and speed of the macroeconomic impact, as well as the resulting government response and evolving customer behaviors. This is an opportunity for regulators to see a bank’s capital planning and stress testing processes in action, following extensive investment in these processes after the global financial crisis.

Our new paper, Capital Planning and CCAR during COVID-19, focuses on several key messages, recommendations and action steps that we believe are critical for successful capital planning throughout 2020 and the necessary preparation for 2021 CCAR.

Modelers will be forced to address how relevant 2020 outcomes are for predicting the future: Is 2020 the exception, or the rule?

CAPITAL PLANNING DURING 2020

The unprecedented speed of onset and the magnitude of projected macroeconomic decline for (at least the second quarter) 2020, has created enormous uncertainty around the macroeconomic outlook for the rest of the year.

While many US states (and countries) have now “bent the curve” and appear to be past their peak active case rate for the initial wave of the pandemic, enormous uncertainty remains around the likelihood and magnitude of future waves of infection, and thus around the economic fallout. The distinct possibility of a second or even third or fourth wave makes it unlikely that economic recovery will be smooth.

Banks face a capital planning challenge for 2020. While the Federal Reserve’s regulatory “Tailoring Rule” (see note 2) grants relief from mid-cycle stress testing, the ongoing recession and the banks’ own capital planning policies should necessitate a reforecasting to model out the “base” recessionary scenario and at least one downside scenario against that baseline. Many CCAR banks expect that they may need to do this on a quarterly basis (or more) for the next several quarters. Financial planning has become stress testing.

We foresee an increasing need for quick, automated, approximated calculations of overall CCAR results. This would help to inform more holistic and rapid scenario and capital planning analyses, especially in a situation of high macroeconomic uncertainty

WHAT'S NEEDED TO STEER THROUGH THE PANDEMIC

We believe banks will need to triage and focus on their most critical models requiring adjustments or overlays, accepting that greater qualitative judgment will be necessary. Having the ability to run more frequent, approximate forecasts, based on fully up-to-date information and experience, will prove to be much more valuable in most instances. While previous capital planning analyses have needed to cross every “t” and dot every “i,” there is now a steep premium for quick answers that are approximately correct. By the time you’re done refining, the economy will have moved on.

To ensure effective capital planning during the remainder of 2020, banks need to:

- Work towards an immediate “re-baselining” of capital planning projections based on the bank’s latest macroeconomic outlook, including an internal BHC scenario that represents significant downside against that already stressed baseline scenario.

- Work to synchronize planning/budgeting and capital planning/stress testing assumptions where possible, recognizing the distinct purposes, use cases, and turnaround times for these activities.

PREPARING FOR 2021 CCAR

The original Supervisory Capital Assessment Program (SCAP) process, which evolved into CCAR, proved immensely valuable in shoring up capital le vels and confidence in the US banking system after the global financial crisis, and is a key reason there is confidence around US banks heading into this current downturn. CCAR now has a chance to shine again.

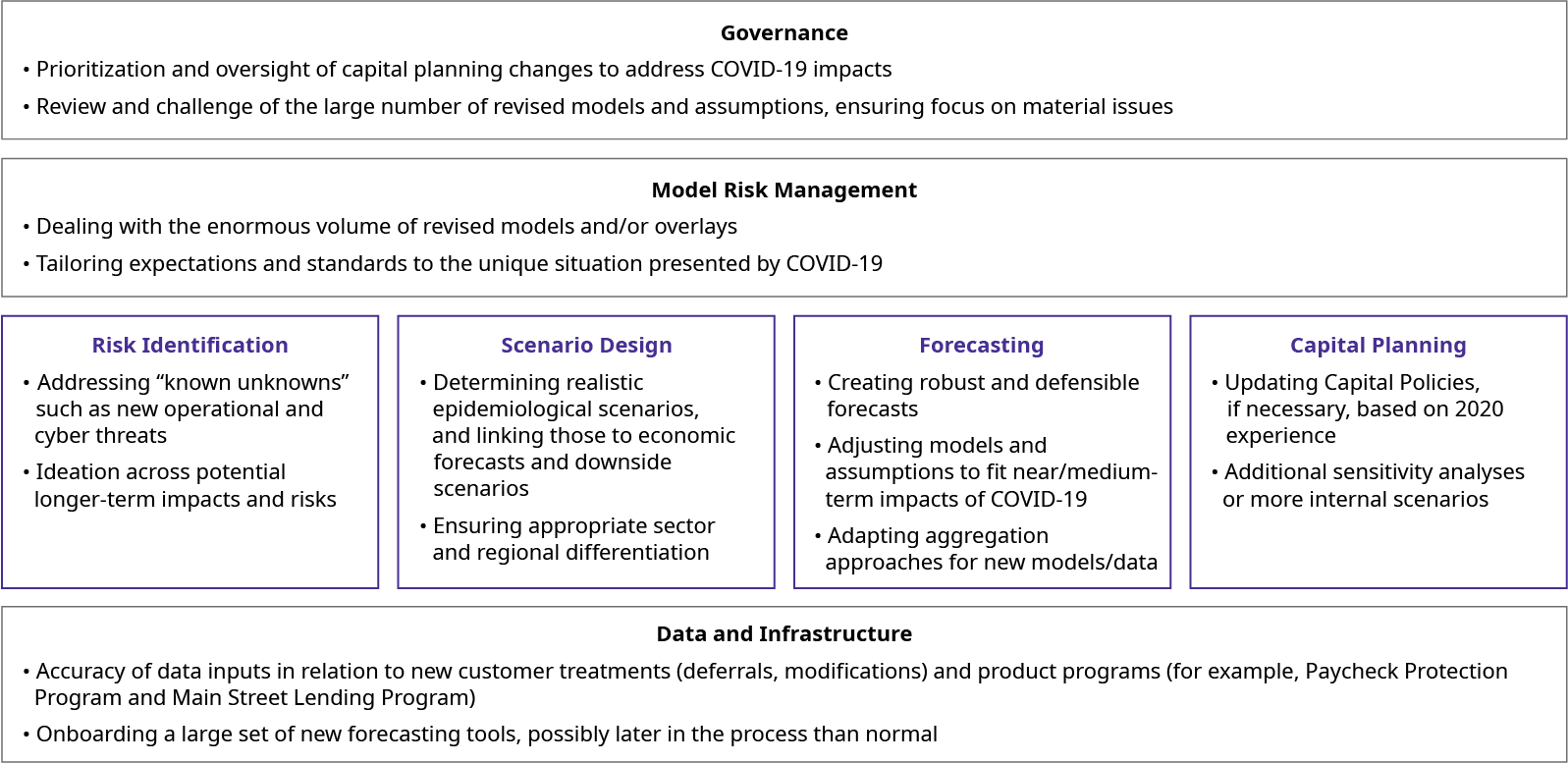

COVID-19 presents major challenges for all core components of the end-to-end CCAR process. In order to prepare for a successful 2021 CCAR experience, banks also need to:

- Anticipate and prepare for CCAR capabilities to be placed under significant stress due to COVID-19. This will require significant work in core areas such as risk identification, scenario design, forecasting models/analytics, model risk management, overall governance, and supporting infrastructure.

- Begin advanced planning now for CCAR 2021. Triage will be necessary to ensure tractability; materiality will need to be more of a focus than ever before; and mindsets may need to change around what can reasonably be expected in terms of forecast accuracy.

KEY CCAR COMPONENTS, AND A SUMMARY OF CHALLENGES PRESENTED BY COVID-19 (NON-EXHAUSTIVE)

Please see the Capital Planning And CCAR PDF version for a comprehensive breakdown of each of these CCAR components.

PLANNING AHEAD IS CRITICAL

The CCAR annual calendar leaves little space for increased or unexpected workloads, and yet we now face an upcoming CCAR cycle where — at the very least — new and revised forecasting tools are likely to be delayed so they can benefit from the second quarter and the third quarter experience, pushing back validation, implementation, and testing processes.

The implications for CCAR timelines will not be pretty — how can you compress something that participants view as being largely uncompressible?

STEERING WITH CONFIDENCE

At the start of 2020, who thought that completing and polishing CCAR submissions would be done while working from home? After forming a cornerstone of restoring confidence in the US banking system following the global financial crisis, it is time for stress testing to shine again. While CCAR has sometimes been viewed as a tedious compliance exercise, now, as we navigate through the pandemic, capital planning analyses will once again be at the center of every bank’s near and medium-term decision making. Capital planning will help to inform important decisions around strategy and balance sheet management, and support banks with steering through the pandemic with confidence — with a sound hull and their compass pointed in the right direction.

Doing this right requires an enormous effort, harkening back to the early days of CCAR when it felt like everything had to be redone every year.

And this time, capabilities will need to meet today’s regulatory expectations. COVID-19 has thrown down the gauntlet…it is time to rise to the challenge!