Partnered products may look like traditional narrow networks, but they work very differently, offering a new range of opportunities to collaborate on the clinical and financial model, member experience, and marketing. Over the past few years, ACO- and CIN-based products have become increasingly sophisticated, and their challenges are much better understood. But success in partnered products requires a tighter relationship between payer and provider, and a new approach to contracting.

The Growth of Partnered Products

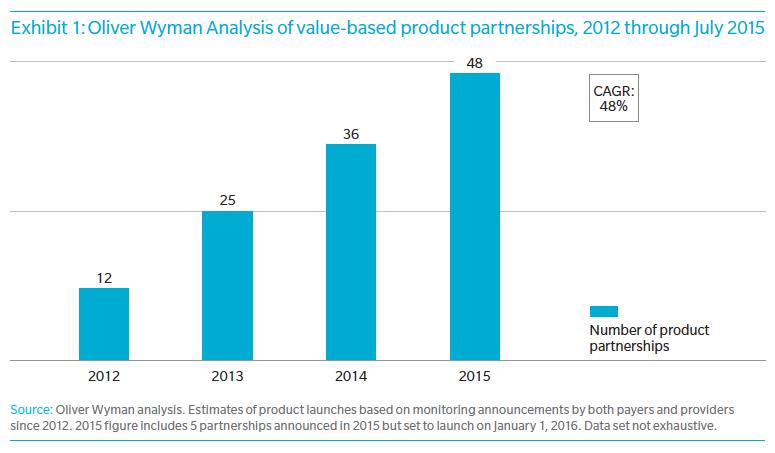

Oliver Wyman has been tracking the growth of partnered products since 2012, when they began to emerge as a response to the Affordable Care Act. The absolute numbers of products are still only moderate—just under 50—but the pace of growth has been rapid, with a compound annual growth rate of 48 percent.