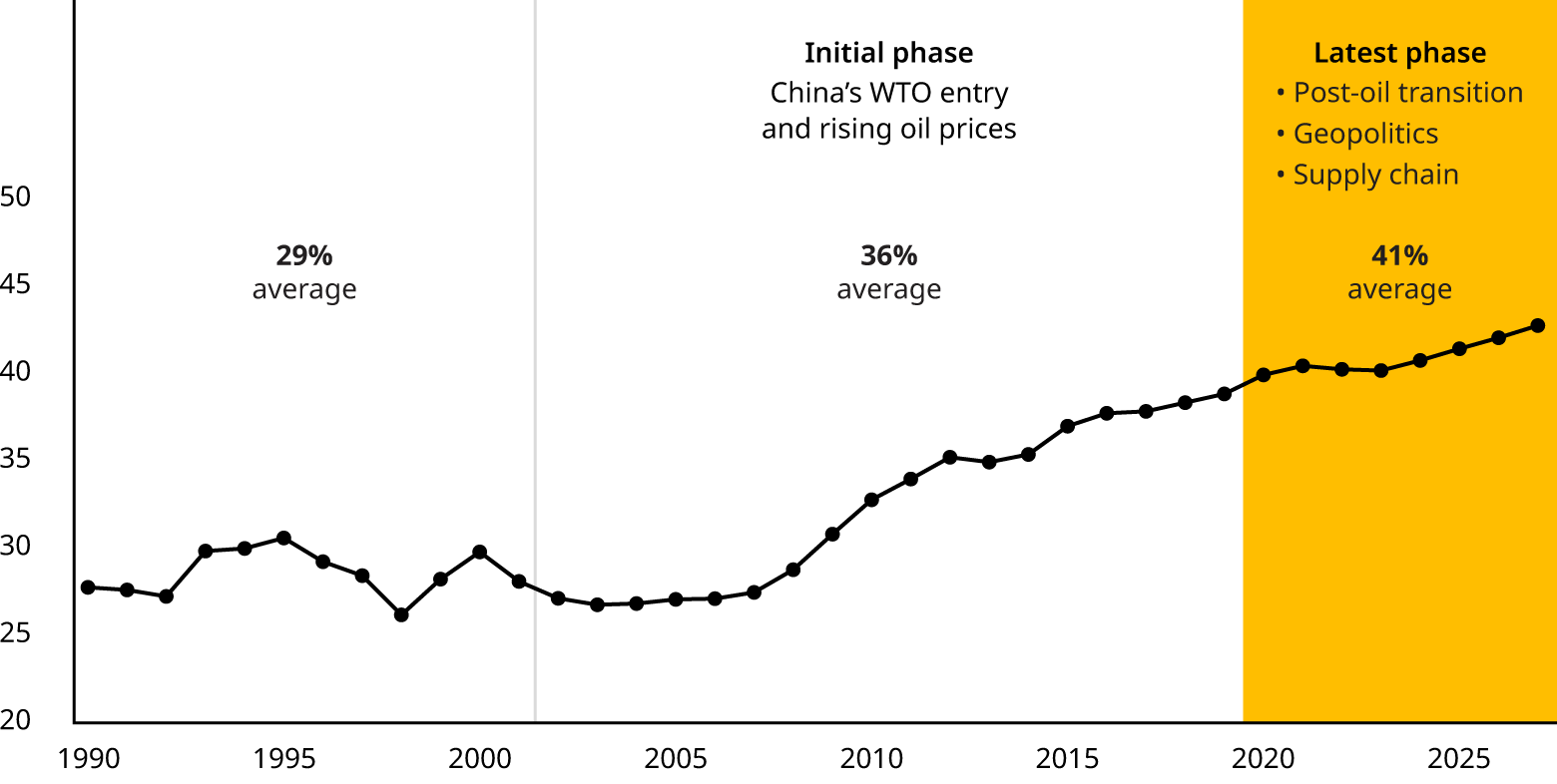

Centuries ago, the Silk Road was a critical network connecting East and West, with linkages across trade, culture, and politics. That network has been revived, and 20 years into its rebirth, the New Silk Road offers dynamic opportunities.

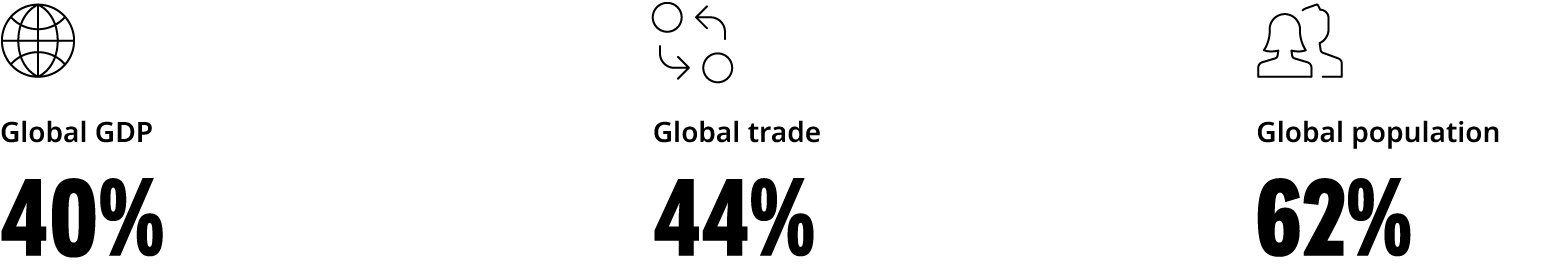

The countries in the New Silk Road region are powering ahead once more, driven by three major triggers: the energy transition, global supply chain disruption, and geopolitical tensions and regionalization. Each of these core shifts are reshaping and generating opportunities in a region that accounts for more than 40% of the global economy.

Flows have also expanded to include not just trade, but also capital, technology, and talent, creating a broader and deeper set of relationships. Today, we see opportunities across energy, mobility and transport, financial services, emerging payments, manufacturing and supply chains, and entertainment and gaming, to name just a few. High levels of integration and transformation will supercharge the New Silk Road, while low levels will hinder the region's progress.

Companies, investors, and governments have an opportunity to capitalize on these flows, but they will need to adopt new strategies, operating models, value propositions, and mindsets. This report outlines a series of action steps that private companies and governments can take to seize the opportunities in front of them.

The New Silk Road is large, complex, and rapidly evolving. There is no linear trajectory for how the next five years will unfold.

How to define the New Silk Road

Our definition of the New Silk Road extends across Asia, the Middle East, and North Africa. In our research and client workshops, we are especially focused on the 20 largest economies that account for 95% of the region’s GDP.

Why the New Silk Road matters

The modern Silk Road matters in part because of its scale. Today, it is home to eight out of the world’s top 20 economies. Its share of global gross domestic product (GDP) has risen to 40%, and we estimate this will reach 48% by 2040. In turn, the number of Fortune 500 companies based in the region has grown to 221, almost half of the total.

The New Silk Road is also fundamental to global supply chains, and the future of these will depend greatly on how economic and political events unfold in the region. Today, its global export share is 86% for semiconductors, 65% for clothing, and 40% for oil, to name just a few products. The region includes some of the world’s largest export manufacturers, including China and Japan, as well as emerging contenders, such as India and Indonesia.

The pathways to opportunity along the dynamic New Silk Road are abundant, but everchanging. However, we believe the action steps outlined in our report will help both the private and public sectors to cement their position and maximize their impact across the region.