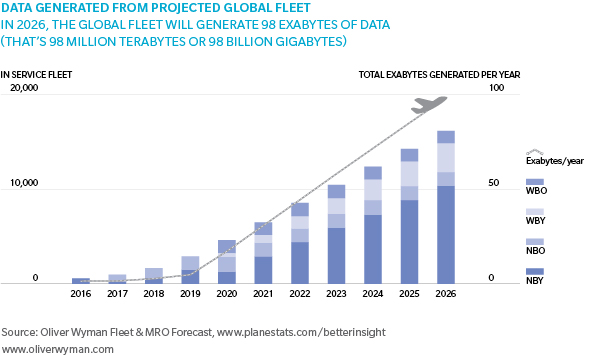

We estimate that the global fleet could generate 98 million terabytes of data by 2026. This surge of data, in the hands of a new breed of data scientists and innovative management teams, could lead to major changes in how modern aircraft are cared for and perform.

In Oliver Wyman’s 2016 MRO Survey, we examine a variety of technology and innovation themes, including how operators, MROs, and OEMs are adopting, utilizing, and investing in big data capabilities – particularly relating to aircraft health monitoring (AHM) and predictive maintenance (PM) systems.

According to survey respondents, big data in commercial aviation already has moved past the early adopter phase for some applications, with a majority reporting implementation of AHM and PM on at least a modest scale. We also discovered that airlines and MROs are beginning to see the first tangible impacts of these initiatives, but the survey does not support the notion of an imminent big data revolution in aviation MRO.

Several obstacles like legacy IT system upgrades, lack of a common data standard, data ownership rights, and still unproven business cases are moderating the pace and depth of adoption.

2016-2026 Global Fleet & MRO Market Forecast

presented by Dave Marcontell, VP CAVOK

Dave Marcontell spoke about fleet trends and their implications for the MRO Market in the Trends and Forecast plenary session at MRO Americas. His presentation covers a variety of topics including industry economic trends and scenarios around GDP growth, interest rate changes, oil price fluctuations, and traffic growth on the 10-year fleet forecast and much more. See below for other topics covered in his presentation.

- Baseline forecasted fleet growth rate over next 10 years

- Scenarios of GDP growth, interest rate changes, oil price fluctuations and traffic growth on the fleet forecast

- Legacy versus next generation aircraft classes

- Technology and advanced analytics

- Aircraft retirements and changes in re-fleeting geographically

- Serviceable materials

- Points of competitive differentiation and advantage for MROs

Global In-Service Fleet Forecast Tool