Oliver Wyman recently concluded the 2015 Survey of Banking and Consumer Finance in order to stay abreast of changing trends. This year’s survey collected responses from over 5,000 financial decision-makers in the US.

Respondents answered questions on many topics including:

- Banking product holdings

- Everyday banking transactions and channel usage

- Payment habits and preferences

- Satisfaction, attitudes, and opinions

The resulting dataset is both broad and deep, enabling insights on such themes as:

- Attracting and retaining customers

- Customer service models

- Relationship deepening and cross-sell

- Customer profitability and segmentation

- Channel strategy and the role of the branch

- New sources of banking revenue

- Rising interest rates

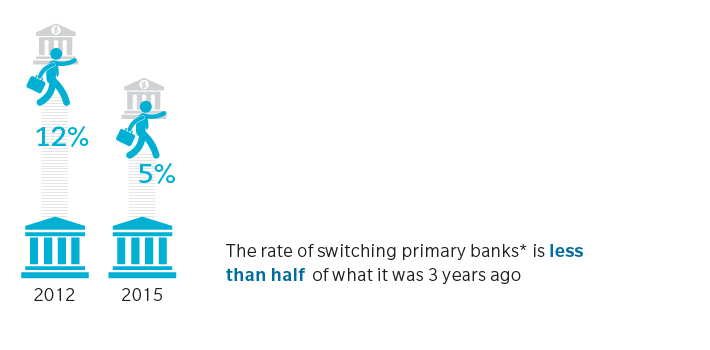

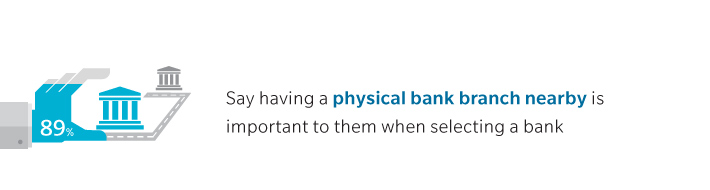

We are excited to present a small section of survey data on several challenges that retail banks face now. These include the low percentage of customers switching banks and the need to engage customers both digitally and with branches.

Customer Satisfaction Is Higher Than We Might Think…

…But Opportunity To Capture Share Is Falling

Digital Offers The Potential For Differentiation…

…But Branch Is Still King When Customers choose Banks

To discuss additional survey insights and business implications in greater detail, please reach out to Vivian Merker

Methodology: Online survey of 5000 financial decision-makers conducted in Q2 2015 in the US. Survey topics included financial services usage, attitudes, and product balances. Respondents were weighted by age and income to more closely align with the US population.

*Switching occurred within 18 months prior to survey completion.