Editor’s Note: The following article is part of a series exploring how the evolving novel coronavirus (COVID-19) pandemic, upcoming policy changes, and employer dynamics have and will impact payer enrollment mix. In Part 1, "The Post-Pandemic Payer Mix: What Happened and What’s Next?” we reviewed how COVID-19 impacted the payer enrollment mix relative to projections. Now we’ll look at how upcoming shifts in policy and evolving employer dynamics may impact payer enrollment mix in 2022 and beyond.

The healthcare insurance market has shown resiliency throughout the last year and a half, especially as employment levels have fluctuated due to the COVID-19 pandemic. As we detailed in Part 1 of this series, despite over 10% national unemployment during the summer of 2020, the uninsured rate actually declined as the newly unemployed retained employer coverage, enrolled in Medicaid, or purchased Affordable Care Act plans. In other words, COVID-19 has caused only modest disruption to the way US residents receive health care.

That’s not to say that the health insurance market will remain as stable in the coming year and beyond: multiple regulatory and legislative changes, as well as evolving approaches to employer-sponsored health insurance may cause shifts in payer enrollment mix.

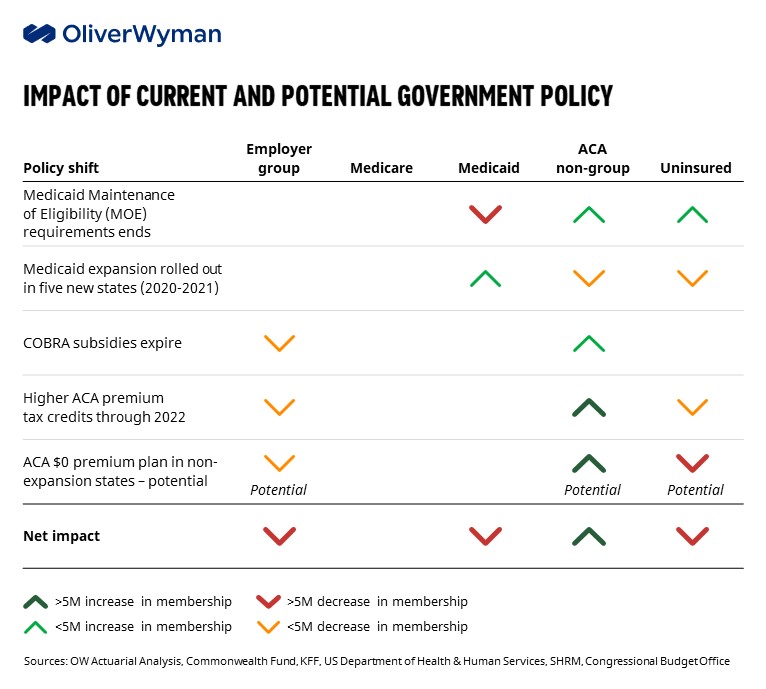

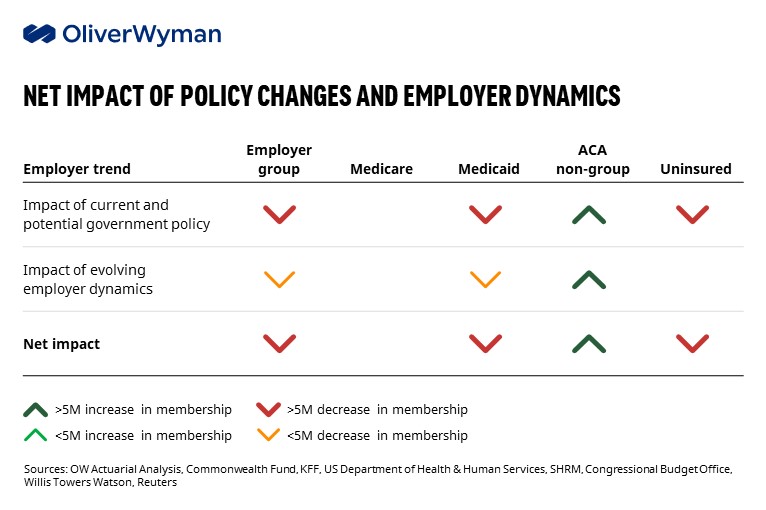

A variety of federal and state-level policies will influence the availability of health coverage options and how expensive these options are to members. Aggregated near-term policy impacts suggest an increase in ACA membership, a decline in Medicaid enrollment and the uninsured population, and the continuation of employer group member attrition.

Over the next year, we expect the following policy shifts to have significant impact on the payer enrollment mix:

- Medicaid Maintenance of Eligibility (MOE) requirements end: The Families First Coronavirus Response Act (FFCRA) mandates continuous Medicaid enrollment and suspends termination of benefits as long as the Secretary of HHS keeps the COVID-19 public health emergency (PHE) in place. Researchers at the Urban Institute projected that Medicaid enrollment would grow by 17 million adults (17%) by the end of 2021, partially as a result of FFCRA, outpacing growth in all other coverage groups. Those gains could be wiped out once public health emergency ends and states revert to their redetermination processes. As ineligible members lose FFCRA protection, there will be substantial Medicaid attrition: the Urban Institute estimates that around 15 million current Medicaid members will lose their coverage. A portion of this population may gain subsidized ACA or employer group coverage, but many will likely become uninsured.

- Additional states adopt Medicaid expansion: In 2021, the American Rescue Plan Act (ARPA) introduced higher federal funding matches for states expanding their Medicaid programs. Missouri and Oklahoma expanded state Medicaid programs in 2021, retroactively benefiting from ARPA incentives. If patterns in enrollment increases following expansion hold, there will be a modest increase in Medicaid lives as newly eligible uninsured residents gain coverage.

- COBRA subsidies expire: Under ARPA, the government provided 100% COBRA subsidies via employer tax credits, allowing terminated employees to remain covered under their existing employer group insurance. However, lack of clarity from the US Department of Labor around subsidy eligibility resulted in many missing the 60-day post-termination enrollment window and resulted in lower COBRA enrollment than the Congressional Budget Office had anticipated. With that in mind, the end of the COBRA subsidy in September is unlikely to significantly change payer enrollment mix (slight decrease in employer coverage and increase in ACA coverage).

- Enhanced ACA marketplace premium tax credits continue: Alongside COBRA subsidies, ARPA expanded ACA subsidies through 2022. Wealthier individuals – those with an income over 400% of the federal poverty level (FPL) – who received no subsidies prior to ARPA must now contribute no more than 8.5% of household income towards the cost of a benchmark ACA policy. Premium subsidies also increased for less wealthy populations: individuals with incomes less than 400% of the FPL can access increased subsidies and individuals with incomes between 100% and 150% of the FPL have $0 premium ACA coverage. If these subsidies are made permanent, which Congress is considering as part of the Build Back Better Act at time of writing, Oliver Wyman Actuarial projects a significant decrease in uninsured lives and a small decrease in employer group enrolment, with these lives shifting to ACA coverage.

- Potential to offer $0 premium ACA coverage for select low-income populations: Lawmakers are also considering alternative coverage options for the low-income population currently not eligible for Medicaid or the ACA subsidies (i.e. individuals with incomes less than 100% of FPL in non-expansion states). The proposal would offer ACA plans at $0 premium to these individuals in the remaining 12 Medicaid-non expansion states. The Commonwealth Fund estimates that this proposal would reduce the number of uninsured by 5 million as these individuals gain ACA coverage.

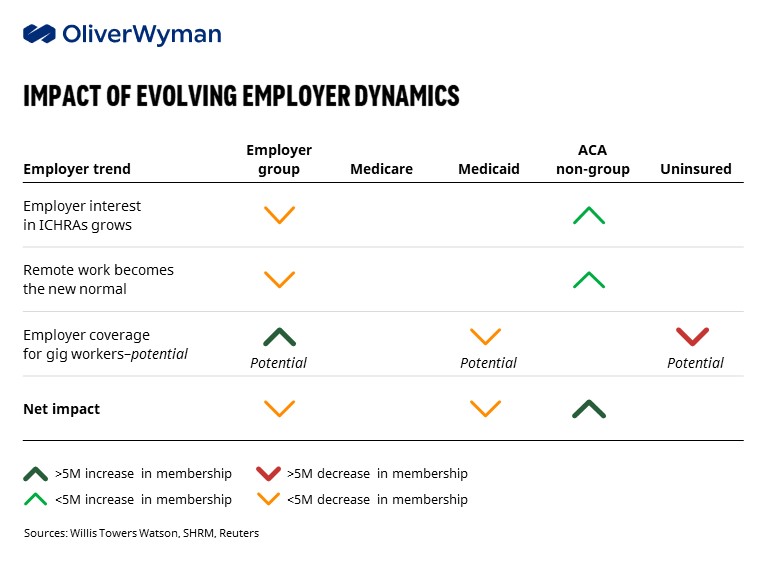

Employer-sponsored health insurance faces unique market dynamics as employers adjusted to the “new normal.” There are numerous unknowns as the nature of where and how employees work evolves, and the pandemic continues. However, based on current employer benefit trends, there is potential for an increase in lives covered by ACA individual market.

- Employer interest in ICHRAs grows: Employers looking for avenues to control spend associated with health insurance are increasingly considering individual coverage health reimbursement arrangements (ICHRAs). ICHRAs allow employers to give employees pre-tax dollars to buy ACA coverage in lieu of providing employer coverage. A 2020 Willis Towers Watson survey found that 15% of large employers were planning on offering ICHRAs to their employees in 2022 and beyond. If deployed, ICRHAs would shift a portion of employer group lives to ACA coverage. We would note that if the ARPA ACA premium subsidies are made permanent, employer interest in ICHRAs may wane as they generally make sense only in areas where premiums are low or for employers with a highly compensated workforce.

- Remote work becomes the new normal: Hybrid in-person and work-from-home will continue to be popular--77% of corporate employers responding to a LaSalle Network survey plan to continue the models past 2022. While employees view the added flexibility as a benefit, remote working presents challenges for employers selecting plans with appropriate networks. Some employers may choose to deploy multiple plan options tailored to employee location, while others may keep their pre-COVID-19 plan design and subsidize ACA coverage for non-local staff.

- Employer coverage for gig workers gains attention: The gig economy accounts for almost one-third of all US workers, or 55 million people. Currently, employers are not required to offer health insurance coverage to this population, resulting in more than 30% of independent contractors remaining uninsured, according to Stride, a benefits platform for independent workers. The Biden administration earlier this year publicly announced support for classifying gig workers as employees. While no legislation is actively being considered, a shift towards mandated coverage for gig workers could substantially increase the number of employer group-covered lives. For now, employers like Lyft and Uber have started offering drivers stipends to cover qualifying ACA plans in lieu of rolling out ESI.

While the pandemic will continue to make its mark on the health insurance industry, these policy and job market factors will have an impact on payer enrollment mix, too. Most notably, they have the potential to promote substantial increases in ACA individual coverage. We are already seeing some insurers gear up for those changes with incumbent ACA plans expanding their geographic footprint-- . Cigna and Oscar Health, for example, plan to enter new ACA markets in 2022 -- and new players offering ACA coverage via the exchanges. Health plan leaders need to anticipate how forces will alter the landscape in 2022 and beyond and be ready to respond.