It’s hard to find a segment of healthcare that touches patients’ lives more frequently than life sciences. More than 50% of US adults say they take a prescription drug and 23% take four or more. Yet most of us feel disconnected from the sector.

Pharmaceutical companies have long been viewed more as a product vendor than a partner in the industry. Changing that relationship could be one of the most significant—and lasting—outcomes of the COVID-19 pandemic. We are beginning to see a shift in the way life sciences are not just talked about, but how companies are integrating into the larger healthcare ecosystem. Building on those trends will be critical in order move beyond the pill and deliver more value to patients, providers and other stakeholders.

We have identified a couple of areas where that impact is starting to be felt:

Value: Retail prescription drugs accounted for 10%—$367 billion—of total healthcare spending in the US in 2019, with more than 80% of the costs usually being picked up by commercial and government payers. And 1% of the population is responsible for one-third of pharmacy costs, according to an analysis from Oliver Wyman Actuarial. Yet nearly 80% of Americans polled by the Kaiser Family Foundation said that drug costs are unreasonable and 30% said they don’t take their medicine as prescribed due to costs.

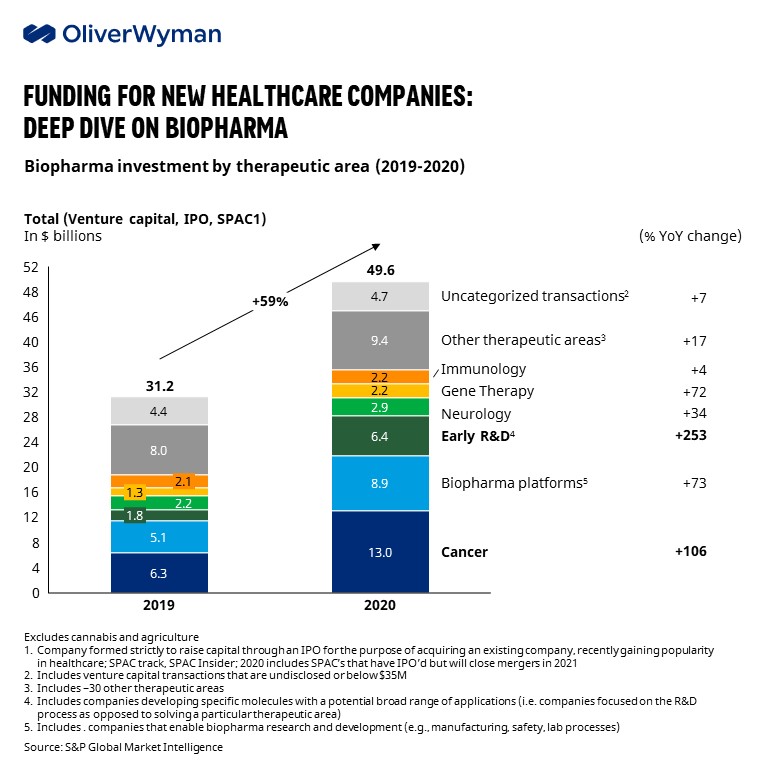

But value isn’t just about costs. There are a lot of resources flowing into life sciences, too. Investment in biopharma climbed to $49.6 billion in 2020, a 59% rise from 2019, according to an Oliver Wyman analysis. The biggest jump in funding came from initial public offerings, totaling $19.9 billion in 2020 compared to $9.1 in 2019. Venture capital infused $28.7 billion into the sector while special purpose acquisition company—SPACS—made up the remainder. These investment groups are looking for a solid return on investment.

To change the value proposition, life sciences companies will become more active players in embracing new care and payment structures. We are starting to see that happen incrementally, with growing interest in value-based pharmacy contracting as an example. We also expect to see an uptick in how organizations collect and analyze outcomes data, which will further propel them to taking on more financial risk.

And as outcomes data is analyzed, coupled with translational biomarker research and broadening understanding of the human genome, the ongoing push toward more personalized medicine will continue. In fact, an opportunity exists, as was spotlighted during the opening keynote of Oliver Wyman’s Health Innovation Summit, to better integrate drug therapies across a patient’s care journey and build a business model that supports precision population health at scale.

Collaboration: Life sciences companies won’t get there on their own. Collaboration is needed both within and outside the sector. As we saw in COVID-19 vaccine development, there will be evolving relationships in R&D. The acceleration of digital therapeutics will also drive more collaboration and, importantly, greater patient engagement. Partnerships that further promote value-based care and pricing models will continue to expand. Some of these partnerships are already developing as evidenced by payers, retail chains, and pharmacy benefit managers coming together through mergers and other ventures.

Employers, too, are looking to become more engaged. That includes integrating their medical and pharmacy benefits, especially around specialty medications to support site-of-care solutions, according to a 2020 survey from the National Alliance of Healthcare Purchaser Coalitions. They are also more open to collaboration and information sharing to create evidence-based formularies.

Moving forward, pharmaceutical and other life sciences companies can no longer be satisfied with being high-quality vendors of a product; they need to be more engaged in delivering care in different ways and building high-value partnerships across the entire healthcare landscape.

We are excited for what the future holds for life sciences. It’s a big part of why Oliver Wyman has entered into an agreement to buy Huron’s life sciences practice. Bringing the two organizations together will help us deliver more comprehensive solutions to the entire healthcare ecosystem and promote greater innovation.