Editor's Note: This article is part of an ongoing series offering our strategic advice and expertise for healthcare industry stakeholders in response to the rapidly evolving novel coronavirus (COVID-19) pandemic.

Although the world is increasingly digital, healthcare is not. Healthcare is a predominantly encounter-based (and physical) care model – or at least that was the case before COVID-19 began. The pandemic means digital health is no longer on the fringe, now increasingly a mainstream offering. While key services such as telemedicine and online drug delivery services may have initially been short-term replacement options while traditional services were closed to the general public over various lockdown periods, the added benefits of better value, convenience, and data that in effect afford some staying power. Emerging applications, such as digital therapeutics and digital phenotyping, also saw traction during this period.

In April, we considered how digital health had quickly become the norm in China. Now, let’s consider the opportunity for Singapore based on our new research. During the pandemic, we released the Health on Demand survey, a collaboration between Oliver Wyman and our sister companies, Mercer Marsh Benefits (MMB) and Mercer. This survey was designed to help assess digital health readiness globally. It reflects a pre-crisis snapshot of sentiments, likely further reinforced as a result of the ongoing global crisis. Here are some opportunities this creates for the health industry at large – from public health, to providers, to payers, and other stakeholders.

Health on Demand Survey Highlights

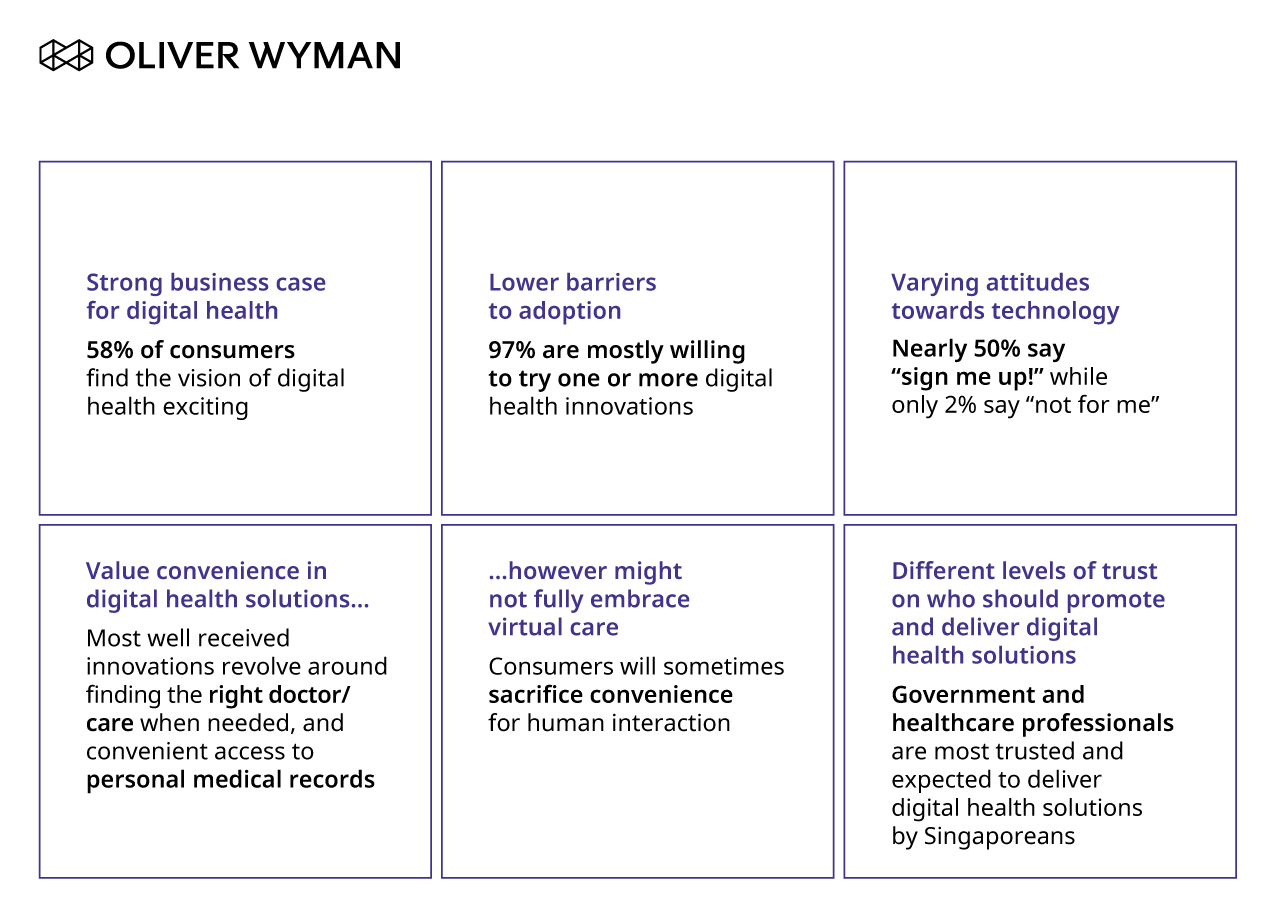

While the results present a call for action to employers to introduce more digital health solutions and cultivate pro-health cultures within the workplace, there is also a clear opportunity for other stakeholders – such as payers and other service providers with access to large customer pools – to get into the game. We see six key insights from the report relevant to Singapore:

Singapore as a market shares many characteristics with emerging Asia when it comes to digital health, even as many consumer sentiments and behaviors are more in common with developed markets. Singapore is an attractive place to introduce digital health solutions because there are low barriers to adoption – most respondents were willing to try one or more of the many digital health innovations available on the market. Also, 91 percent of Singaporeans were willing to share personal health data if they see a benefit to doing so – the most popular use cases to improve medical care quality and receive personalized health services. However, when it comes to sharing personal health data for public health monitoring, this drops to 65 percent of Singaporeans who were comfortable doing so (per more recently published data from the Oliver Wyman Forum). This highlights an important nuance – willingness to share personal health data is largely impacted by what it will be used for.

While there is a range of attitudes toward new technology in Singapore, including a more hesitant older population, the largest group of respondents identify as the “sign me up” category, representing nearly 50 percent of respondents. These individuals are characterized by higher tech-savviness and receptivity to trying digital health innovations. Furthermore, this 50 percent number has likely increased since the pandemic has prompted many to try digital health services for the first time. Singapore is geared to be a healthcare tech playground. The Singapore government has embraced telemedicine and maintains a regulatory sandbox for telemedicine, which includes several new COVID-19 use cases.

Despite this openness to technology, digital health innovations aren’t created equally. When asked to choose between more convenient online services and less convenient in-person services, most chose the latter, likely because access to quality healthcare providers is less of a problem in the relatively compact island state. Consumers are interested in convenience via apps to help find expert doctors and want access to electronic health records. However, respondents were concerned with not having in-person interactions to address their medical issues. They were also less interested in receiving virtual care or relying on artificial intelligence (AI) for medical diagnosis. Although virtual visits are typically nearly 20 percent cheaper than physical ones in Singapore, the draw for consumers must be more than convenience or access based, given relatively good local access, but also needs to enforce another principle, such as better outcomes, or even better safety.

Singapore Stands Out as a Mature Market Compared to its Peers in Asia

The survey results highlight Singapore’s position as a mature market among growth markets such as China, India, and Indonesia in Asia. Compared to these others in Asia, Singapore consumers are seemingly less open to new technologies and less eager to jump into a digital health future. Consumers in China, India, and Indonesia expressed more overall interest in digital health solutions, and over 80 percent of respondents in these countries found the vision of digital health exciting compared to Singapore’s 58 percent. This difference in consumer attitudes within the Asia region can be traced to the maturity of the Singapore market. Singapore consumers answer very similar to those in mature markets outside Asia such as in the United States or United Kingdom.

The distinction between growth and mature markets has implications for the types of solutions that would do well in Singapore versus for its neighbors. For example, both growth and mature markets ranked “An app that helps me find the right doctor or medical care when and where I need it” as the top solution consumers want, out of 15 proposed solutions; however, the underlying need for the solutions is a matter of healthcare access in vast growth markets such as China and India, whereas this is driven by convenience in Singapore’s context.

Here is what distinguishes Singapore compared to other markets:

- Consumers have high trust in government solutions. Sixty-one percent of Singapore consumers think the government should be the main driver to deliver digital health solutions, compared to an average of only 39 percent globally.

- Consumers are more willing than in other mature markets to share data, including personal health data and shopping behavior.

- Singapore is a leader in access to insurance but lacking in additional service offerings. A lower percentage report having access to services such as vision care, mental health counseling, and lifestyle support.

Overall, mature markets like Singapore stand out as attractive places to try new digital health solutions because of widespread access to digital consumers and more data. But care must be taken when designing solutions for specific markets as there are often subtle differences between them.

How Should Payers and Other Service Providers Approach Digital Healthcare?

Digital health presents an opportunity for payers and other service providers with large customer bases to redefine their role in consumers’ lives. Opportunities to offer innovative solutions can expand an organization’s ecosystem to create more user value. Digital demand in Singapore opens opportunities for businesses to introduce effective, consumer-focused solutions. While digital health may not be directly linked to the core business, insurers, banks, and telcos see health engagement as an important window into their customers’ daily lives.

Here are some key considerations for companies looking to make their mark in Singapore’s digital health space:

1. Leverage Partnerships

Partnerships are critical in this environment of rapid innovation and ecosystem-oriented businesses. Stakeholders can leverage partnerships to support their reinvention from products to solutions and provide more holistic care through robust ecosystems. Many Singapore life- and non-life insurers already offer wellness services as part of their front-end platforms through partners. Increasingly, and especially during COVID-19, many insurers expanded access to other digital health solutions such as digital therapeutics, drug delivery services, and even online symptom checkers, including those for COVID-19 offered by start-up technology players or government tech applications. Similarly, banks, payment platforms, and others continue to establish lifestyle ecosystems that include health. For example, Oversea-Chinese Banking Corporation (OCBC) launched HealthPass by OCBC during the pandemic, offering telemedicine services through its network of general practitioner partners via its proprietary app. Telco companies are in a unique position to offer services and hardware partners can leverage to deploy effective digital health solutions immediately to consumers, such as through native apps. Singtel had recently partnered with AIA to promote consumer wellness by offering a digital wellness platform that rewards consumers for steps and offers content on health, fitness, and nutrition. New partnerships like this may bring in previously untapped consumers from different ecosystems, along with offering them more solutions through a single touchpoint. Companies should explore these opportunities to draw on distinct business and industry advantages to build attractive solutions.

Public sector partnerships offer another unique avenue for partnerships in Singapore as the government garners high trust from its citizens in delivering healthcare solutions (61 percent approve). Examples include the National Steps Challenge, now in its fifth season, with over 1 million signups within Singapore’s population of 5.6 million, and the Eat Drink Shop Healthy Challenge – both digital platforms anchored by several community and retail partnerships. Additionally, there is the LiveHealthy technology partnership between the Health Promotion Board and Fitbit, which delivers personalized health and fitness guidance to its users.

The benefits of partnership, however, are not just in sharing expertise. These partnerships can drastically affect consumer perception and determine how a health solution enters the market, whether this is through leveraging government or other medical partnerships. Notably, in last year’s Health on Demand in Singapore, 41 percent of consumers said they trust doctors and healthcare professionals to deliver digital health solutions, compared to only 26 percent of respondents saying their employers and only 24 percent saying technology companies should deliver their healthcare solutions. Thus, a multidisciplinary approach, and in combinations, such as government plus insurance plus technology, for example, may ensure adoption beyond the trust in individual institutions, which alone may not be at a critical mass.

2. Focus Convenience

Cost, quality, and convenience are consumers’ main needs, but convenience emerged as the major driver for how Singapore consumers ranked their digital health interest. Overall, top solutions consumers were willing to try facilitate convenience, such as finding a doctor and electronic medical records. Forty percent of Singapore respondents were open to wearable technology for self-managing health conditions and general well-being. When designing exciting new digital solutions, companies must recognize buzzworthy devices by themselves are not a draw – these must be coupled with interventions (such as reminders) and incentives (such as rewards) to keep them relevant in customers’ daily lives and survive beyond the initial luster.

3. Integrate Across Bricks and Clicks

Consumers said they would be most willing to try solutions that revolve around facilitating their healthcare, but when it comes to solving more complex or chronic care, consumers were generally less comfortable in a future where this would be done remotely or by robots. They highly value human interaction and the comfort that comes with it. The solutions that the highest percentage of people were not willing to try include virtual counseling, telemedicine (unless for simple issues like a rash or cold), and AI diagnosis tools. Communicating remotely, even if over video-chat with a qualified professional, isn’t as appealing, and 58 percent still prefer to face longer wait times to see a doctor in person rather than use online virtual care. Thus, the success of digital interventions is still tied to the comfort with and availability of traditional brick and mortar facilities and professionals.

Where Are the Opportunities?

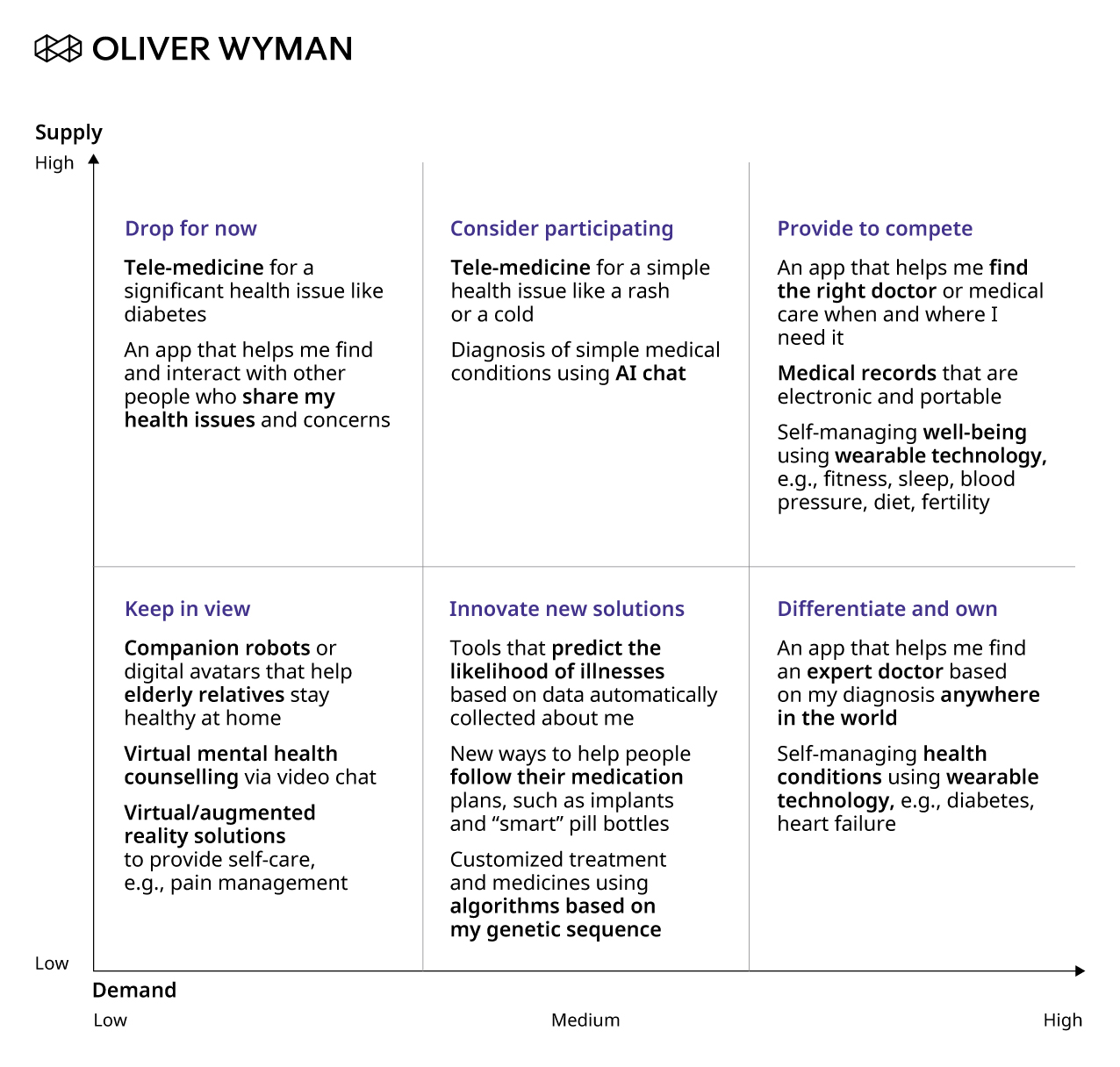

The digital health solutions tested in the survey are mapped onto the above chart of supply versus demand. Businesses considering how to enter digital healthcare should consider the supply and demand implications of the solutions. A robust business strategy involves targeting the top three segments – “differentiate and own,” “provide to compete,” and “innovate new solutions” – each serving a clear customer and having a specific purpose in their lives. These become key building blocks to differentiate and compete in the market as they become the norm.

Health on Demand’s story paints a “ready but not yet there” landscape of employers and consumers excited but not yet sold on digital health. The pandemic’s realities pushed aside key barriers to adoption and have created a context where key stakeholders consider digital health and a requirement to survive the crisis. There is a key opportunity now for key stakeholders – from employers to insurers to larger ecosystem players – to consider how digital health supports ambitions for growth and creating value in consumer lives.