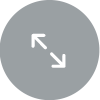

The next Southern California healthcare innovation may very well shape both local healthcare markets and the national landscape. If Southern California were a US state, it would have the fourth largest economy at $1.3 trillion, and would be the fifth most populous with 21.3 million people. Due to its size and complex regulatory environment, Southern California is often unilaterally dismissed as so unique that what works here is not applicable to the national healthcare conversation. However, over the past 50 years, the region has proven to turn out innovative delivery models that successfully scale nationally.

Let’s look back at three key Southern California’s healthcare innovations to get a better sense of what may become the next big thing to come out of this market.

Three reasons Southern California is a healthcare trailblazer:

1. Southern California leads the way in risk-based payment and integrated care

Nationally, adoption of risk-based payments has been slow but remains a priority. National carriers, such as Aetna and Anthem, have set aggressive goals for their portion of revenues coming from value-based care models. UnitedHealth Group reports nearly 60 percent of its medical spend is via value-based models and one-third of enrollees receive medical care from providers paid via alternative models. Southern California has long been ahead of the risk game. Its evolution may hold greater lessons as the rest of the country increases adoption of risk-based payment methods.

The delegated health maintenance organization (HMO) model arose from a unique Southern California healthcare environment to become the logical grandparent of current value-based Accountable Care Organization (ACO) arrangements. HMOs flourished in Southern California as a cost control mechanism following rapid cost increases in the ‘60s. Savvy physicians recognized the opportunity to contract with these plans to take delegated risk (and potentially increase their compensation). Those that performed well built formidable scale. The prevalence of large physician groups – many with close hospital alignment – made it easier to develop the needed practice management infrastructure. Furthermore, players such as Kaiser Permanente (KP) fueled competition and growth, providing downward pressure on premiums. Nationally, the delegated model faced a bumpier scale, though it holds lasting power in some regions, primarily where KP is formidable (for example, in Hawaii, D.C., and Oregon).

Southern California’s physician-led delegated model underpins today’s ACO agreements – both programs create physician networks and seek to control costs by emphasizing smart resource management. According to Oliver Wyman analysis, there are 630 ACOs, with between 59 and 68 million Americans receiving healthcare through ACOs. In Southern California, some high-profile ACOs, such as Vivity (a joint venture between Anthem Blue Cross and seven Los Angeles-area hospitals systems) are similar to the native delegated model that originated from the region. Vivity, for instance, promises to aggressively manage care, with little to no cost sharing, and operate under capitation.

2. Southern California popularized the hospitalist model as a care model innovator

Maturity of the delegated risk model in Southern California in the ‘90s led to the popularization of another healthcare innovation – the hospitalist model. Twenty years later, hospitalists are widely used beyond delegated risk models – 75 percent of US hospitals have them. Southern California’s medical groups taking delegated risk were incentivized to use hospitalists to reduce total cost of care and retain more of their capitated payments through better coordination of hospital resources and shorter length of stay.

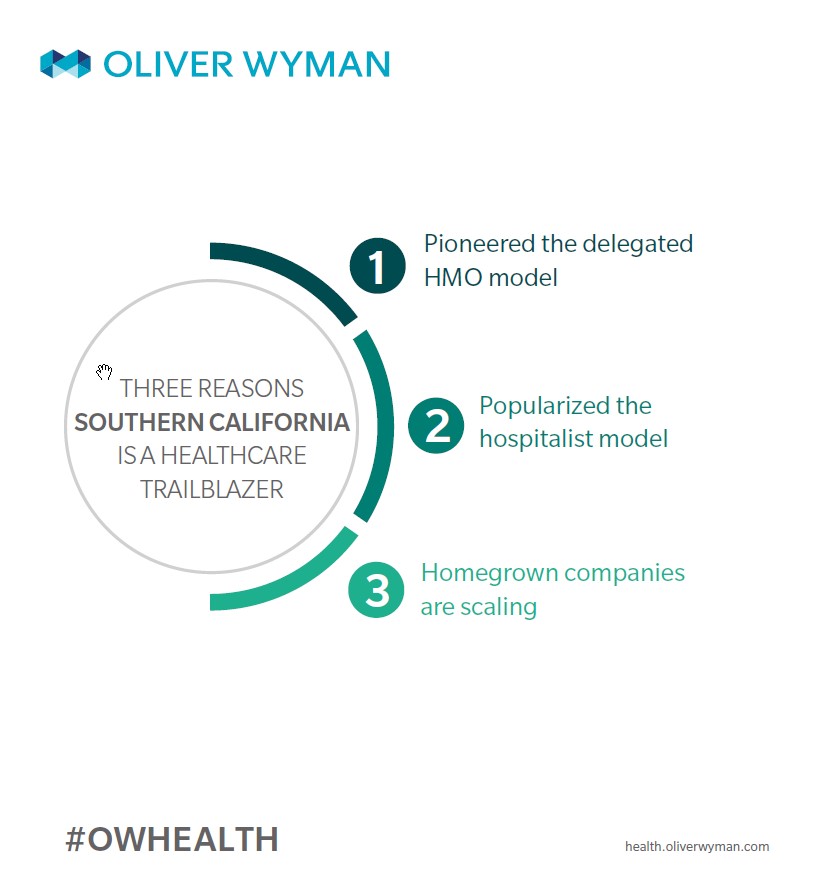

And some Southern California medical groups – such as HealthCare Partners (currently DaVita Medical Group) – even touted use of hospitalists as a key differentiator. HealthCare Partners, for instance, has a specialized team of 100 hospitalists working across 30 Los Angeles-area hospitals to perform a variety of tasks, such as interpreting an MRI. Average length of stay for HealthCare Partners' patients (according to 2013 data) is 3.3 days, compared to the national average of around six days.

3. Southern California is an integrated care leader, brewing home-grown companies that scale nationwide

Two Southern California-born integrated care companies, CareMore and HealthCare Partners, have demonstrated success in taking total capitation and developing truly member- and patient-centric care models. Their performance has made them attractive to national acquirers seeking to drive scale for these companies. CareMore, for instance, has more than doubled its membership and state presence since Anthem acquired it in 2011. And, Optum’s 2017 purchase of HealthCare Partners could quickly grow the model in combination with UnitedHealth’s other delivery assets.

What’s next?

Southern California continues to be a healthcare laboratory, producing innovations in access (providing the right care at the right time using new front doors), partnership-based integrated models (such as payer-provider partnerships simulating KP-like properties and incentive alignment), and safety net collaborations. The unique dynamics of the payer-provider landscape and emerging innovators in Southern California’s major counties are evolving as a bellwether for what may scale next in the rest of the country.

Possible Los Angeles County innovations to watch for:

Will Los Angeles County’s congestion and geographic fragmentation make it a testing ground for flexible access to care, such as home health, digital and telehealth, and retail health models? Considering recent activity such as L.A. Care Health Plan’s commitment to spend $31 million to recruit primary care physicians for smaller clinics and an increase of physician affiliation by health systems, will competition for physicians heat up, leading to increased prices? Is Vivity the catalyst for new Los Angeles County payer-provider partnerships?

Possible Orange County innovations to watch for:

How will Orange County providers adapt to rapidly shifting payer mix to deliver substantially more efficient care? How will private and public providers coordinate to increase Medi-Cal access? Given that, since 2015, KP has increased its Orange County Commercial market share from 21 percent to 25 percent to become the leading player, will other clinically integrated networks and direct-to-employer arrangements emerge to hold the tide against growing KP share?

Possible San Diego County innovations to watch for:

Will Scripps and Sharp’s health plans help sustain the systems’ performance as growth in Medicare and Medi-Cal continues? How will the FQHC collaboration’s ability to drive Medi-Cal volume impact hospital performance? Will provider-owned plans innovate to incorporate unique benefits for the local context, such as genomics or precision medicine, leveraging San Diego’s life sciences nexus? Some plans, such as Blue Shield of California and Geisinger Health Plan, have begun covering such genome-based products and services.