Chapter 2

Shifting value from traditional subsectors to those specializing in technology and innovation

The industrial landscape is witnessing a significant shift in value among subsectors. Firms specializing in building technologies, semiconductor manufacturing equipment, and industrial software are experiencing a surge in value relative to the overall market capitalization of the industrial sector. This growth is primarily at the expense of more traditional subsectors, indicating a changing paradigm where technology and innovation lead the way.

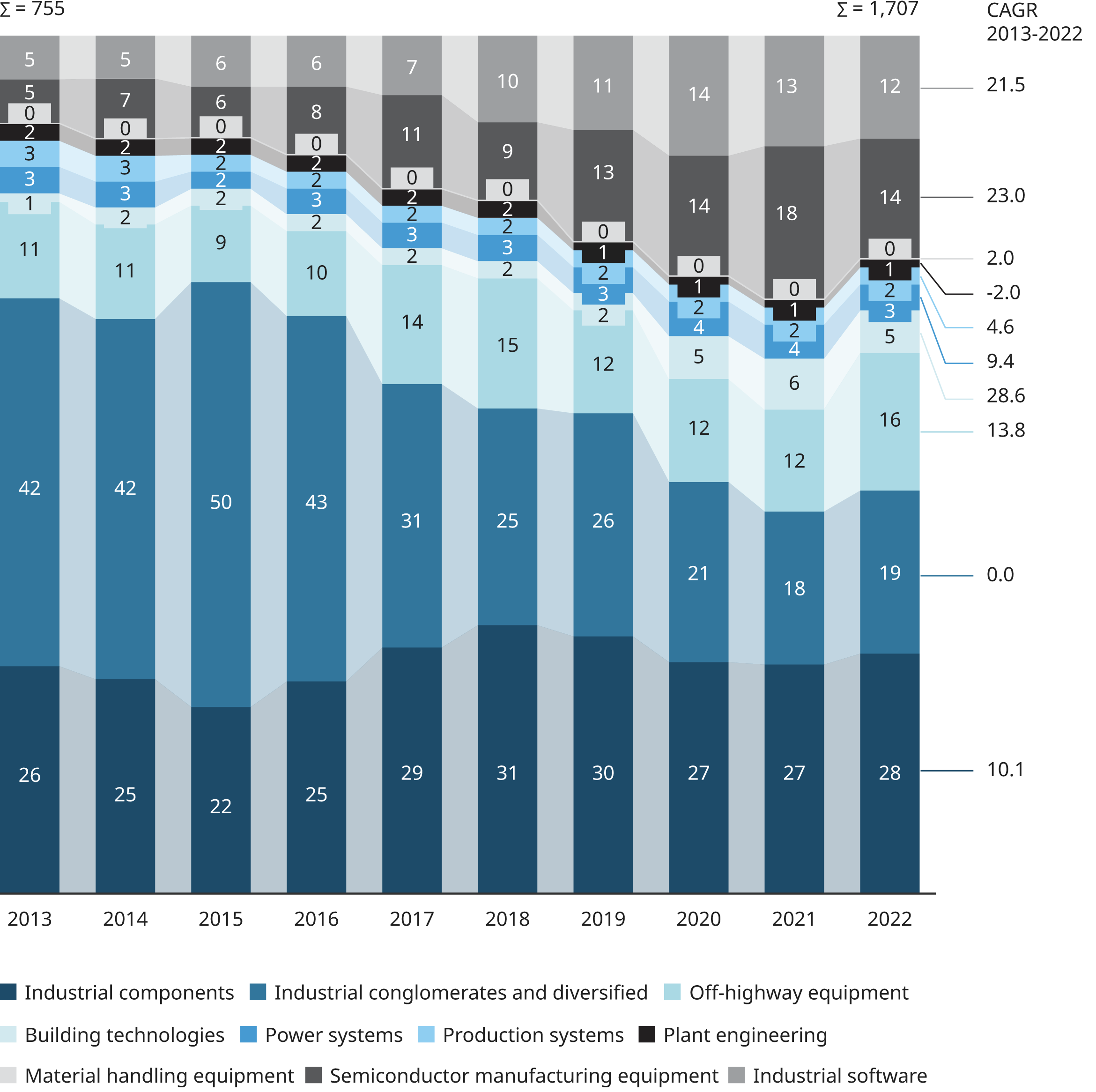

Exhibit 2: Sectors that have been clear winners in the last decade

% of total, US$ billion

The sectors leading this transformation — notably building technologies, semiconductor equipment, and industrial software — have capitalized on major industry trends such as digitalization and advancements in factory and process automation. The off-highway equipment sector has particularly benefited from legislative support like the IRA, demonstrating a substantial increase in value from 2021 to 2022. Traditional industrial conglomerates and areas such as material handling equipment and plant engineering are experiencing a decline, meanwhile, reflecting a shift in investor focus and optimism.

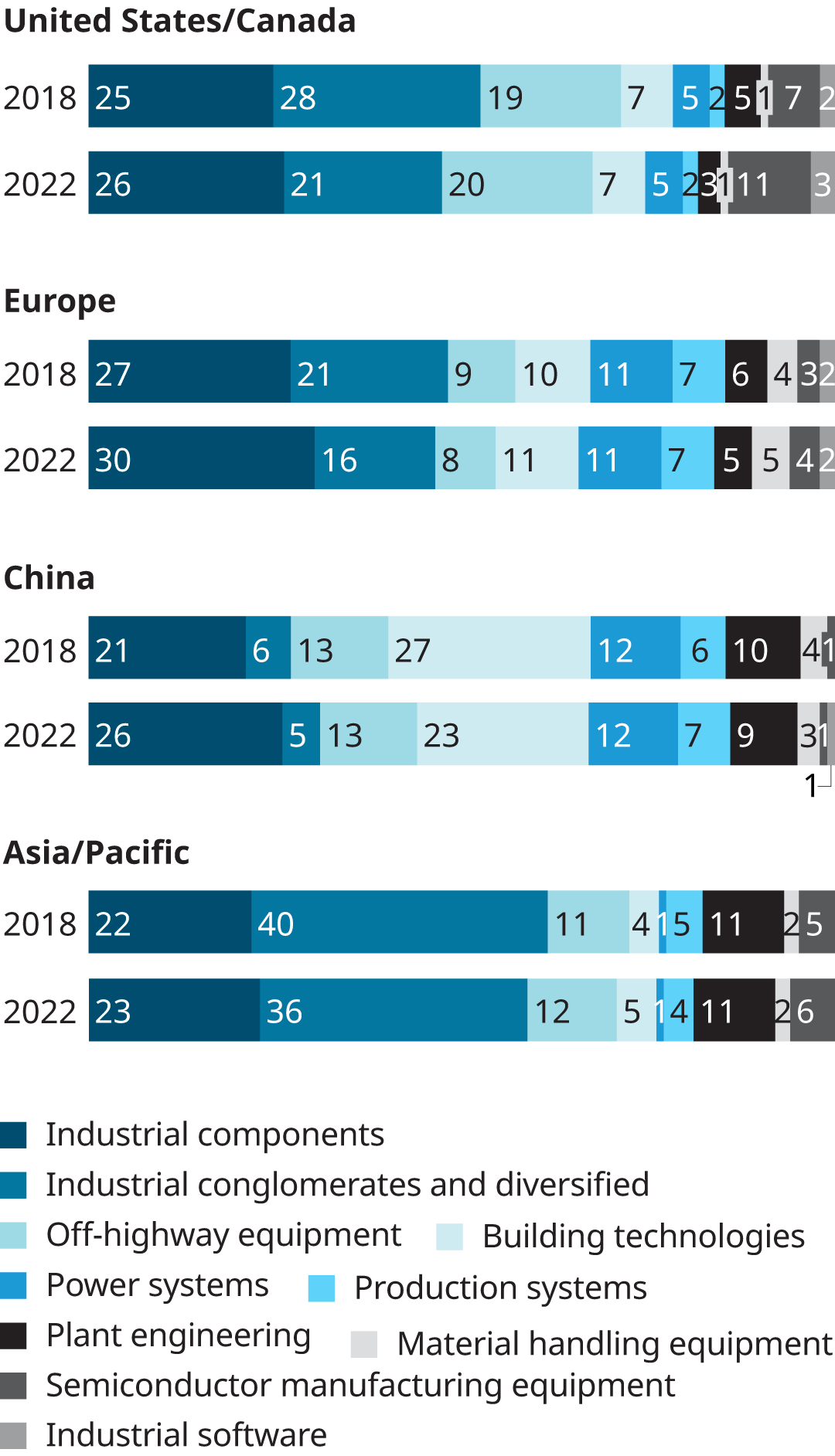

Exhibit 3: Revenue share and sector mix of industrial goods by region

The regional analysis reveals that the US and Canada hold a significant portion of the high-performing subsectors, driving a notable shift in value to those regions. This is further evidenced by the market share of North American firms, which grew from 33% to 37% of the total global industrial goods sector’s value from 2021 to 2022. This trend is not only a result of the inherent strengths of these subsectors but also the direct and indirect impacts of policies such as the IRA, the Infrastructure Investment and Jobs Act, and the Buy American Act.

Exhibit 4: North America has been the beneficiary of a recent shift in value

Chapter 3

Sustainability takes center stage in the industrial sector, but reporting still lags

In recent years, sustainability has become much more critical to industrial firms. This heightened emphasis is driven by several factors including regulatory disclosure requirements and increasing demands among customers for transparency about products’ carbon footprints. Additionally, financial institutions are steadily incorporating environmental, social, and governance (ESG) criteria into their lending decisions, with interest rates and credit approvals now often contingent on meeting these standards. Institutional investors and asset managers consider those criteria more and more when making investment decisions as well.

Most industrial companies have embarked on the sustainability journey, albeit at varying paces. The many that set Scope 1 and 2 targets (for direct and indirect greenhouse gas emission levels, respectively) from 2018 to 2022 managed to reduce their emissions by 24% in that time frame. That’s clearly a move in the right direction, though it trails the 37% reduction for all European companies reporting. It’s also worth noting that taking 2021 as a base (it is the last year with full sample availability), only 60% of firms are reporting their Scope 1 and 2 emissions at all.

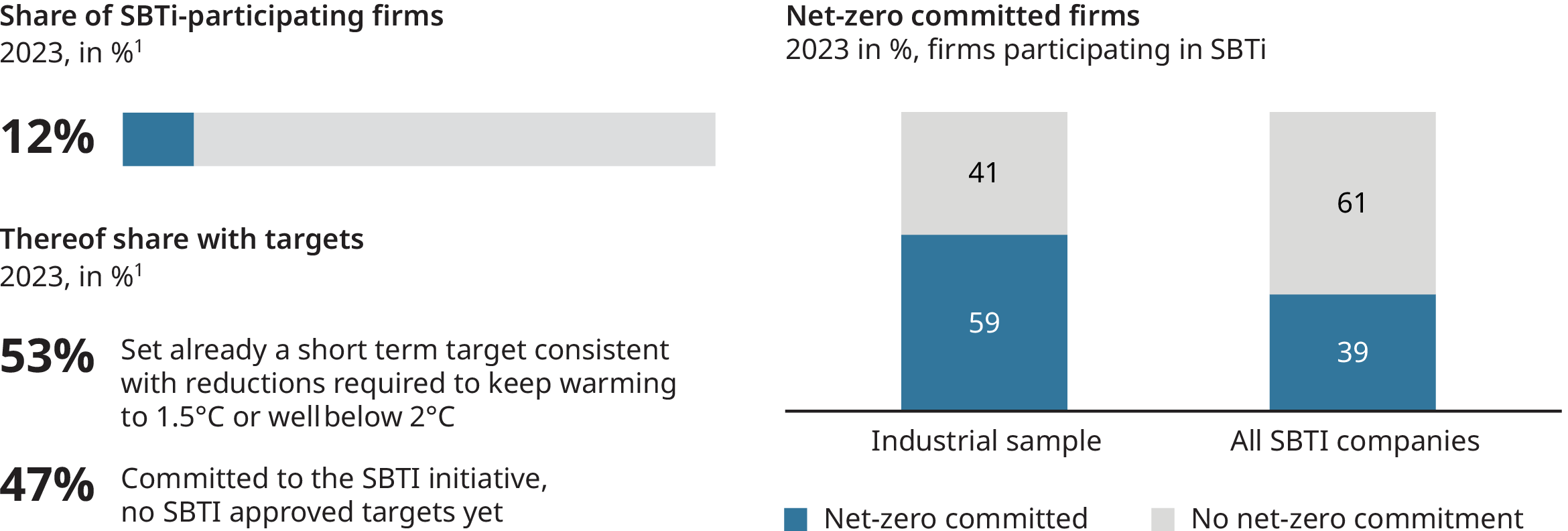

Exhibit 5: Net-zero commitments of industrial goods companies are above average

While the reluctance to disclose might be attributed to the challenges involved in baselining and modeling carbon data, this type of transparency is not just a regulatory expectation; it is increasingly demanded by customers, making it business critical. Consider target setting: Around 60% of all industrial firms in our sample report Scope 1 and 2 targets. However, only 12% are participating in the Science-Based Targets initiative (SBTi), one of the leading non-governmental institutions approving emission targets. Of those 12%, just 53% have an approved target for 2030 that is aligned with the Paris Agreement goal of limiting the average global temperature increase to 1.5°C above preindustrial levels. Additionally, only 59% of SBTi-participating firms have committed to net-zero greenhouse gas emissions.

Chapter 4

Navigating the future of the North American industrial goods sector

The industrial goods sector has a strong mid-term future with numerous opportunities in the pipeline, including artificial intelligence, low-carbon technologies, and new markets. However, inflation, geopolitical turmoil, and potential recessions pose major risks. Industrial firms must navigate these dynamics with skill and foresight. Success will hinge on striking the right balance between making bold, transformational moves to align with long-term structural trends and maintaining strategic flexibility to adapt to potential disruptions. The coming years will be pivotal for the sector, promising to be as full of surprises as the previous ones.

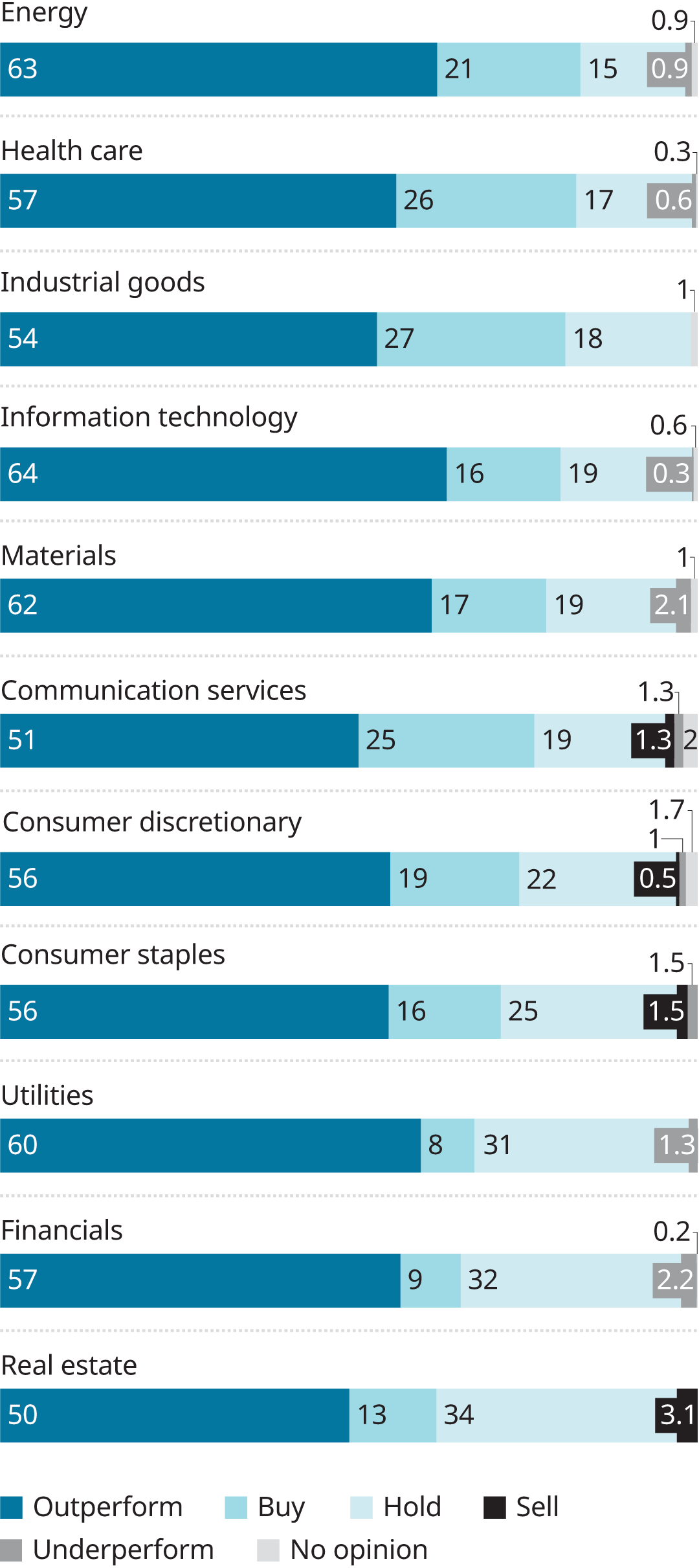

Exhibit 6: Analyst recommendations for investment in North American industries

Ranked by sum of outperform and buy recommendations

The overall sentiment toward the industrial goods sector is more positive now than it has been in the past decade, with 81% of companies viewed favorably. This optimism underscores a sector poised for continued growth and innovation, ready to confront the challenges and capitalize on the opportunities that lie ahead.