Proven technologies – energy efficiency, electrification, and renewable energy – are currently seen as the most important levers for decarbonizing the European economy by chief sustainability officers (CSOs). Meanwhile, these executives say the top challenges to decarbonizing are many – from high costs and identifying suitable use cases to the scarcity of appropriate market offerings.

These findings come from a 2023 survey by Oliver Wyman (together with the TUM School of Management) of CSOs at more than 200 European companies. CSOs are typically charged with managing the integration of environmental, social, and governance (ESG) issues into a business’s overarching strategy and planning. In this role, they collaborate with other senior leadership, investors, government bodies, and community stakeholders. CSOs also may be charged with ESG-related compliance, monitoring, and reporting, as well as overseeing the sustainability project portfolio. As such, they are in a position to comment specifically on the steps their companies are taking to decarbonize – and what challenges are limiting their efforts.

Many CSOs said that their companies are already driving decarbonization using company-specific ESG criteria. The survey surfaced three groups of cross-industry levers that CSOs are systematically addressing or evaluating to push forward on the decarbonization journey.

Cross-industry decarbonization levers

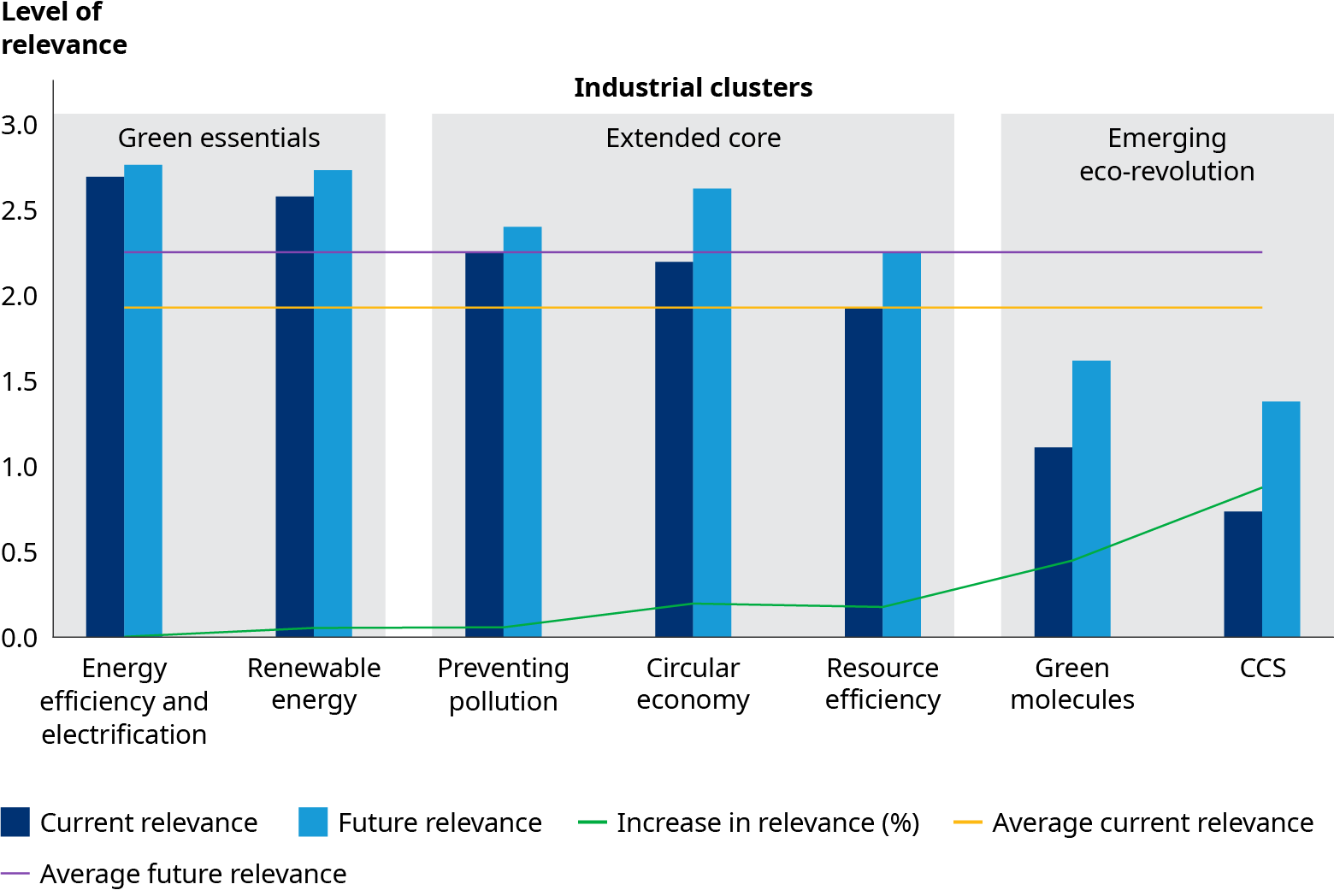

- Green essentials: Using electricity from wind power or photovoltaics and implementing efficiency measures are seen by CSOs as key “green essentials” for quickly achieving their company climate goals. Nearly all of the CSOs surveyed consider these levers to be highly relevant and practicable right now for their industries. These levers serve as the essential building blocks to make quick, tangible progress today.

- Extended core: Nearly 70% of European CSOs see practices such as preventing pollution, engaging in the circular economy, and promoting resource efficiency as equally relevant to their companies today. These levers can both directly impact decarbonization and promote wider ESG goals.

- Emerging eco-revolution: Two emerging decarbonization solutions are carbon capture and storage (CCS) and “green molecules.” CCS refers to capturing carbon dioxide emissions from industrial processes and storing them underground or in materials, so as to prevent their release into the atmosphere. Green molecules (gases) are promising fossil fuel alternatives, such as green hydrogen and green biomass. While CSOs rate these technologies as less relevant today (and more challenging), they are seen as having outsize future potential.

With suitable offerings and the required regulatory frameworks, CCS and green molecules are expected to be particularly important for industries that are carbon intensive and have high energy needs (extractive industries, chemicals, energy, transportation). Targeted funding in the early phases of development will be crucial for accelerating deployment.

Decarbonization challenges

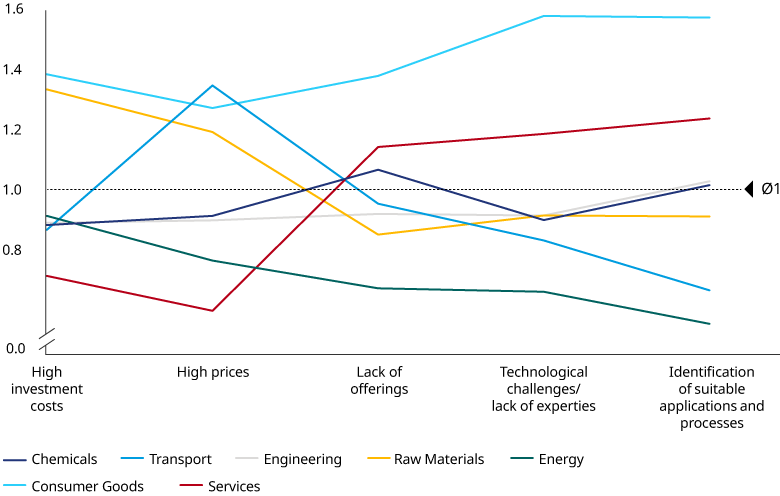

All decarbonization levers come with their own challenges, but across the board, potential investment requirements and recurring operating costs are front of mind for nearly all CSOs. Highly competitive and price-sensitive industries, such as consumer goods/retail, raw materials, and transportation, are particularly concerned with how decarbonization will affect costs and pricing to customers. In both the consumer goods and services industries, CSOs report being challenged on multiple fronts, from a lack of decarbonization offerings and technological issues, to difficulty identifying the most suitable levers.

These senior leaders see a key role for the energy industry in helping overcome some of the challenges of decarbonization – by partnering with other sectors. Given that renewables and energy efficiency are part of utilities’ day-to-day business, they have a unique opportunity to function as transition enablers for other industries. For example, energy company E.ON and steel company Salzgitter AG have partnered on developing green hydrogen for use in steel production. Similarly, building materials company Holcim has partnered with energy company Eni to explore using CCS in raw materials that can then be used to produce “green” cement.

The role governments should play in helping industries overcome decarbonization challenges is less clear, but some combination of regulation and incentives to drive down costs – particularly for nascent technologies – would seem to be in order. Governments also can send important signals to markets and investors based on the technologies they embrace and promote.

To begin building the broadest possible base for decarbonization, companies will want to look first at how they can combine Green Essentials and Extended Core levers, as solutions are available today and competitive, as is third-party expertise. Emerging Eco-Revolution levers, on the other hand, may require some level of government support to accelerate development and reduce costs. Over the long term, decarbonization will depend on industries finding a balance between financing the transition and keeping their customers happy.

Additional contributor: Verena Kleinschmidt