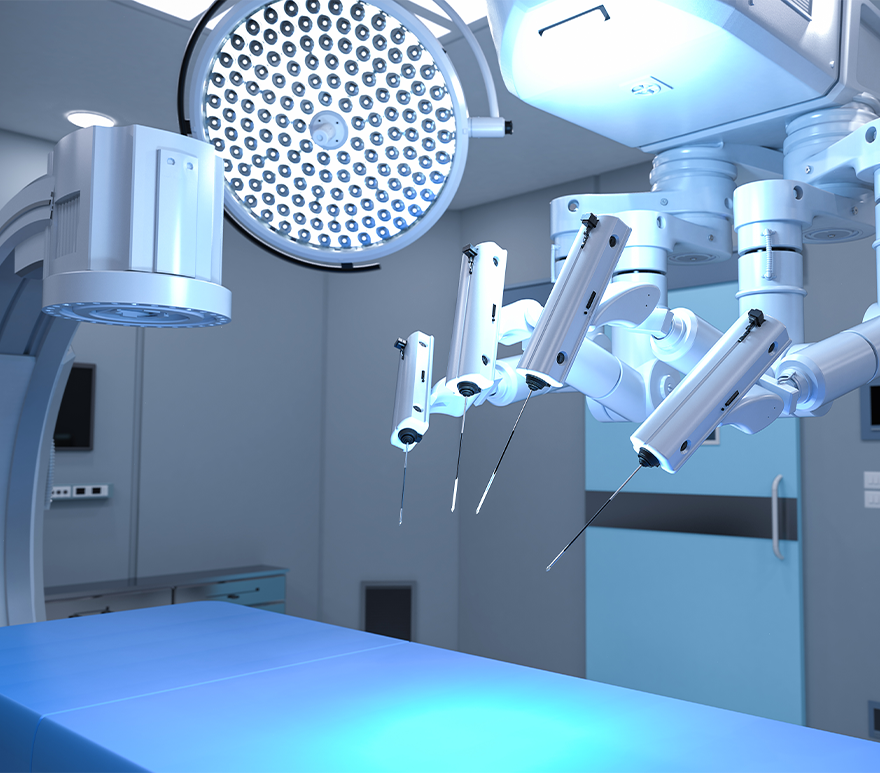

Robotic-assisted surgery has evolved over the past 25 years from a novel and experimental technique to a mainstream practice, transforming the way we approach complex surgical procedures. With advancements in technology and increased experience, robotic-assisted surgery continues to push the boundaries of what is possible in the operating room. But to make it more affordable, safer, easier to use, and scalable, we need to keep adapting and learning. This will require overcoming challenges associated with high costs and steep learning curves while exploring new ways to improve the technology and its applications.

Significant Growth for Robotic Surgery

The robotic-assisted surgery market has grown steadily, driven by technology upgrades, increased demand for minimally invasive procedures, and improved patient outcomes. The market will climb to $14 billion globally by 2026, with a CAGR of nearly 11%, Oliver Wyman predicts.

Exhibit 1: Global Surgical Robotics Market, By Application Type

Source: Oliver Wyman analysis

The most established player is Intuitive Surgical, which pioneered the da Vinci Surgical System in the early 2000s and now controls more than two-thirds market. Intuitive Surgical's position can be attributed to several factors, including consistent investment in research and development, and cultivating strong relationships with key opinion and industry leaders. Moreover, the high cost of acquiring and maintaining the da Vinci system creates a barrier to entry for competitors, limiting the number of players in the market and further solidifying Intuitive Surgical's position.

Other major large-cap players include Medtronic, Stryker Corp., Johnson & Johnson, and Zimmer Biomet Holdings, Inc. New entrants such as Asensus, CMR Surgical, Moon Surgical and Globus Medical are helping to shift the value proposition for robotic-assisted surgery.

Exhibit 2: Surgical Robotics Market, Company Share

Source: Oliver Wyman analysis

Creating Clinical and Economic Value

Despite the upward trajectory, adoption of robotic-assisted surgery is uneven across the globe. Various estimates suggest that it is used in roughly 2% of surgeries across Europe and about 15% in the US. Achieving broader adoption will involve the entire industry, not just manufacturers. And each sector faces its own set of opportunities and challenges.

Manufacturers will benefit from greater adoption by gaining a competitive edge in the market and building long-term partnerships with healthcare institutions. Collaborative efforts with surgeons and hospitals can also enable them to gather valuable data for research and development. However, they must address the high cost associated with developing and manufacturing robotic systems. The industry also lacks a streamlined procurement process for an end-to-end solution, resulting in several decisionmakers with different assessment criteria and multiple procurement options. Balancing affordability while maintaining quality and innovation remains crucial. Robotic-assisted surgery can help hospitals and surgery centers optimize resource utilization. Importantly, overnight admissions can be reduced, freeing up bed space for more critical care patients. That’s also a benefit to patients who can recover in the comfort of their own homes. Robotic-assisted surgery also enhances a healthcare organization’s reputation as a center of excellence and attracts patients seeking cutting-edge treatment options. Still, adoption may be hindered by the initial investment costs, ongoing training, and maintenance expenses. Some studies suggest that capital expenditures to support robotic-assisted surgery are 25% higher than conventional laparoscopic surgery. There’s also concern about ensuring equitable access for all patients. Overcoming these barriers requires careful financial planning, effective training programs, and a commitment to addressing disparities in access, as well as lingering concerns around patient safety.

Surgeons are drawn to a similar set of advantages, including efficiency gains and boosting their professional reputation. For surgeons early in their careers, showing proficiency in the technology can be beneficial in affiliating with a hospital and in attracting patients. Their experiences can also feed into learnings to further advance the field. More seasoned surgeons have a strong foundation to draw on as they add robotic-assisted surgery to their skill set. Whether in the early or later stages of their career, surgeon flexibility and adaptability will be crucial as the field evolves.

For payers — commercial and government — cost-effectiveness remains the primary concern. While robotic-assisted surgery offers potential long-term cost savings, the initial investment poses a challenge. Moreover, there’s no standardized payment model across markets, which not only leads to confusion on how to embed robotic-assisted surgery into surgical practices but also challenges manufacturers and payers when discussing the overall value proposition.

Exhibit 3: Achieving Growth Means Overcoming Key Barriers

Source: Oliver Wyman analysis

Harnessing the Power of AI

It’s also imperative that organizations ready themselves for larger technology innovations to spur broader adoption, including, artificial intelligence and machine learning, augmented reality, and smaller machines.

Exhibit 4: 4 Trends Will Drive Further Adoption of Robotic-Assisted Surgery

Source: Oliver Wyman analysis

Manufacturers, providers, and payers shouldn’t delay in building these innovations into their strategic plans. Consider the rapid pace at which artificial intelligence is being incorporated into every facet of the economy, including healthcare. Organizations that are slow to build AI and machine learning into their strategy risk falling further behind.

Ultimately, it’s about moving away from thinking of robotic-assisted surgery as a point solution to understanding how it fits in the broader healthcare infrastructure and ensuring it is integrated across the entire delivery system.

To learn more contact Matthew Weinstock, Senior Editor, Health and Life Sciences.