There is an ongoing shake-up across healthcare in the US, as incumbents react to an ever shifting target of healthcare reform, while also reaching across horizontally to link up even greater parts of the value chain in new and interesting ways (the CVS-Aetna merger and Amazon-Berkshire-JPMorgan employer partnership being the most recent notable examples). Oliver Wyman recently released its predictions for 2018, which included big themes that will have global significance, even if they will play out first largely in the US.

In Asia, we have the opportunity to “watch and learn” as these big shifts and experiments fail, and others succeed. At the same time, we are sitting on a latent goldmine in Asia – we have more than half of the world’s population and a wide range of diverse healthcare systems ripe for experimentation. Asia has homegrown players that are, we think, more integrated and more nimble at the start than the best from the West (Alibaba versus Amazon), and rather than “wait and see,” we think there is an even better opportunity to “test and learn.”

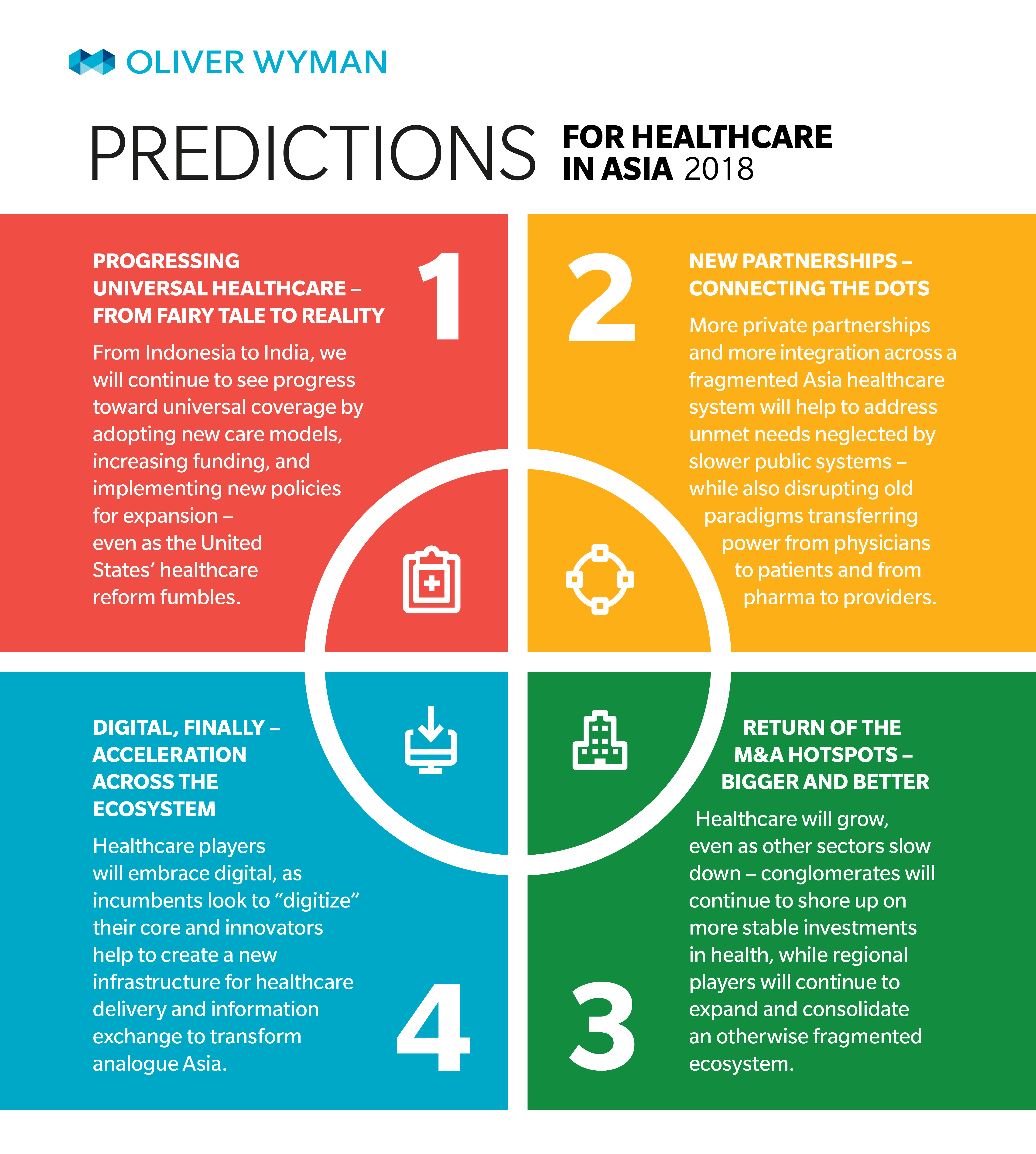

Here are some of our healthcare predictions for 2018:

Progressing Universal Healthcare – From Fairy Tale to Reality

Much of the global spotlight on healthcare reform in 2017 focused on Obamacare – repeal, replace, or remain? In Asia, however, universal healthcare is, quietly but steadily, moving ahead. Earlier this decade, Indonesia’s launch of its national healthcare program, Jaminan Kesehatan Nasional (JKN), unfolded like a drama full of promises, rhetoric, and uncertainty about the future. While there have been implementation challenges, JKN has come a long way since then and seems to be more steady. Similarly, India recently announced an ambitious healthcare plan to cover half a billion people with low cost insurance. Universal coverage in large, emerging markets fuels overall industry growth, leading to increased healthcare consumption and private sector participation, but also impacts individual bottom-lines – be it hospitals, pharma, or medical devices, who need to stay agile and find out how to chase the healthcare dollar under evolving coverage frameworks. We are now seeing new care models, such as managed care, once reviled but now rewarded, take root. Even as US reform struggles, this year we expect to see more traction – though cautious and gradual – toward right setting care models, and funding and policies of universal coverage across key markets including Indonesia, India, the Philippines, and China.

New Partnerships – Connecting the Dots

Healthcare systems in Asia are disjointed – complicated by paper-based systems, privacy laws, and an ecosystem of small, fragmented players. Private partnerships (for example, Payer + Pharma working together to develop disease management programs, and Providers + HealthTech providing remote monitoring tools for chronic patients) are beginning to plug in the gaps of access to information and influence on the patient. These partnerships are also working to shift the balance of power in value capture – collaborations in online medical commerce in China (for example, idsMED in Hong Kong + WeDoctor – backed by Fung Group in Hong Kong and Tencent) will shake up hospital procurement and the traditional pharma distribution model in the world’s arguably most attractive healthcare market. And, on the financing side of the aisle – is there an Asian version of the Amazon-Berkshire-JPMorgan tie-up for employee healthcare on the horizon?

Return of the M&A Hotspots - Bigger and Better

Private healthcare in Asia was poised to take-off this decade, but 2017 witnessed a vacuum of deals in traditional large healthcare markets, namely Japan, China, and India. In 2018, we expect a return of the investor appetite for three reasons. First, cash-rich conglomerates are increasingly eyeing healthcare as their next venture and seeking opportunities to diversify and leverage their portfolio companies. Second, larger healthcare groups across Asia are hungry for the next phase of growth which will be fuelled by domestic and cross-border acquisitions. Last but not least, as a generation of founder-owners gets ready to cede control, and a new generation of health-tech entrepreneurs emerge, private equity is turning its gaze back to healthcare. The deal hotspots are going to get hotter, not only in major markets, but also in emerging markets like Indonesia, Vietnam and Philippines where unmet needs and economic growth converge, encouraging more investment.

(Finally) Digital Acceleration Across the Ecosystem

Digital healthcare has had fewer unicorns and more high-profile failures than other disrupted industries. Nevertheless, Asia has more than its fair share of digital players, with $2.6 billion in investment last year alone. These market shapers are working steadily to tackle Asia’s unmet needs in access, affordability, and adherence, and are generating a lot of noise in the process. The big bets for 2018, however, will be the players that can fix the foundations – enabling data integration, generating data insights, and linking stakeholders together in meaningful ways – and thus rising above the “noise” of consumer-friendly apps that are soon becoming commoditized, and with limited real commercial value. Governments going digital (Singapore’s National Electronic Health Record, Philippines PhilHealth e-claims, and others) will set the stage for a whole host of other solutions (application program interfaces, data warehouses, forests, and lakes) that enable process efficiencies and information capture across the ecosystem.