Companies subject to the latest Securities and Exchange Commission rule on climate-related risk reporting have waited two years for the agency to act to determine the ultimate scope of the regulation. Now the rule, which is less sweeping than the original proposal, is being challenged in federal court for being simultaneously too strict and too lenient.

While the legal challenges continue to whirl around the new rule, executives — particularly chief financial officers (CFOs) — cannot afford to take a wait-and-see approach. Even without the inclusion of Scope 3 emissions covering those emissions generated by suppliers and end users, compliance with the Enhancement and Standardization of Climate-Related Disclosures for Investors regulation threatens to be trickier than what one might initially presume.

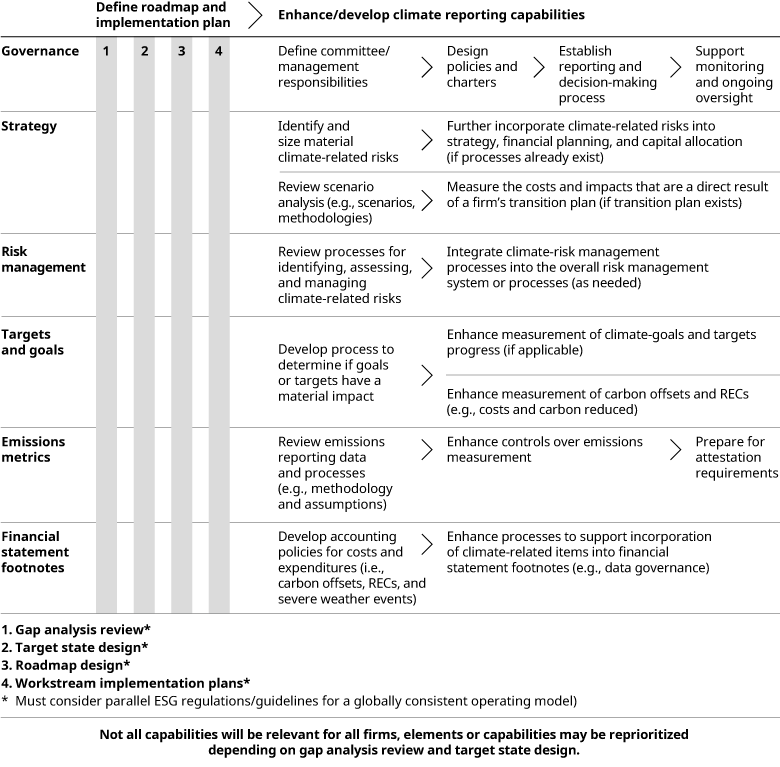

The rule will require a meaningful increase in the amount of work on the plates of CFOs. This work will include the development of the climate capabilities required for disclosure, and CFOs will need to become much more intimately involved with the sustainability efforts already underway in their organizations. The following climate disclosure program provides perspectives on steps CFOs can take to prepare for the rule’s implications.

One of the biggest challenges will be determining the materiality of various climate and nature related disclosures. Among the most significant angles to analyze are actual or potential material climate-related impacts on the registrant’s strategy, business model, outlook, or financial condition. In addition, CFOs will have to consider any material expenditures and impacts on financial estimates and assumptions that are a direct result of the climate target or actions taken to address the target or goal.

CFOs will also have to tackle thorny questions about how to account for and incorporate climate-related items into financial statement notes. These financial statement notes will include the expenditures expensed, capitalized costs, and charges incurred because of severe weather events, such as hurricanes, tornadoes, flooding, drought, wildfires, extreme temperatures, and the rise in sea levels, subject to applicable 1% and de minimis disclosure thresholds. Likewise, expenditures expensed, capitalized costs, and losses related to carbon offsets and renewable energy credits (RECs) must also be included in financial statement notes if the carbon offsets or RECs are used as a material component to achieve climate-related targets or goals.

The rule’s requirements will not fall on all companies simultaneously. The SEC estimates that nearly 2,000 large accelerate filers may have to comply with the new requirements as early as fiscal year 2025. This represents about 95% of US market capitalization.

Many large companies have already begun to tackle these kinds of questions because of the European Union’s Corporate Sustainability Report Directive and the climate-related rules issued under other international and domestic financial reporting standards. Nonetheless, companies putting off compliance building capabilities may find themselves under considerable pressure as the rule moves forward.