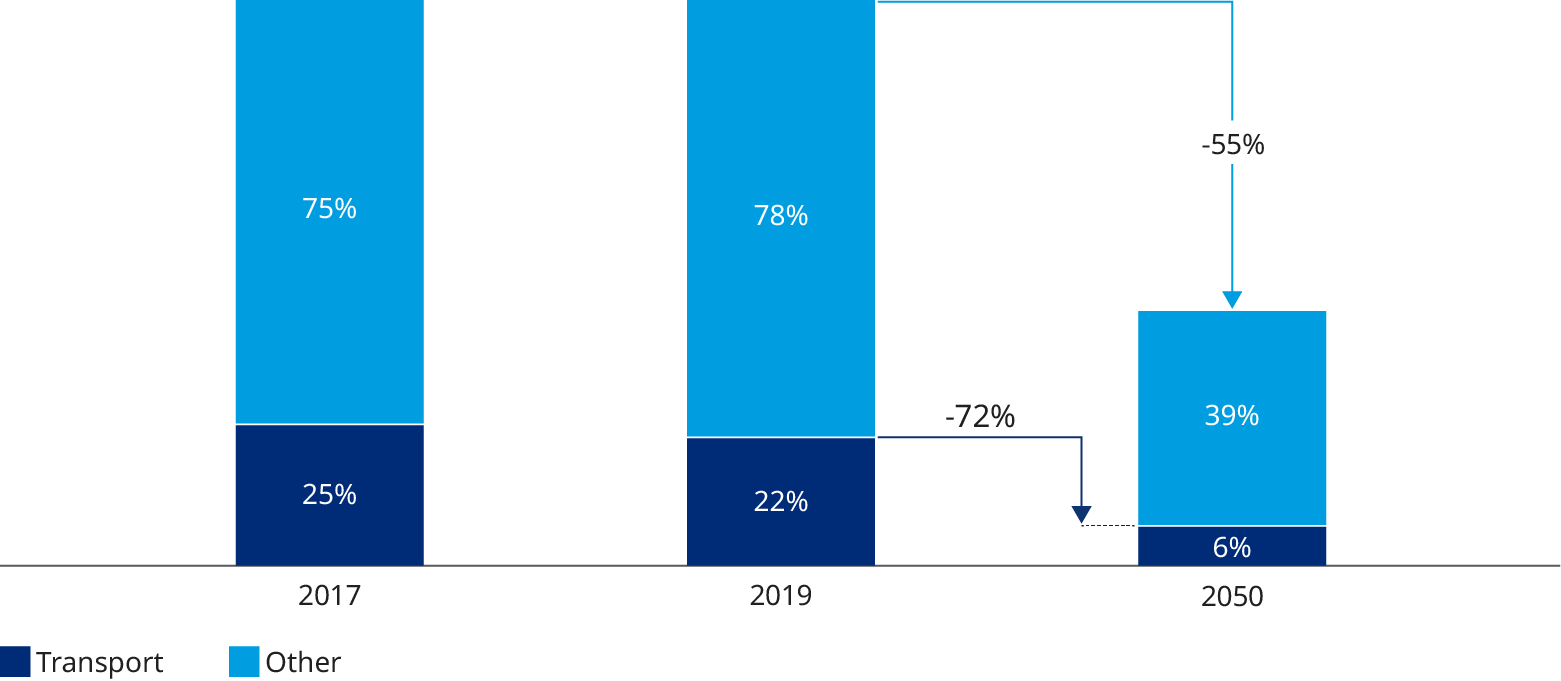

Trucking accounts for the majority of freight transportation in the European Union today. But rail is much more fuel efficient than trucking (in terms of tons of goods moved per liter of fuel), meaning that shifting the transport of goods from road to rail would reduce greenhouse gas emissions, a key goal of the European Green Deal (Exhibit 1). And rail offers additional benefits compared to trucking, including more efficient land use, less air and noise pollution, and less congestion and wear and tear on roads. Exploiting these advantages over the next 5 to 10 years is critical, not least to increase rail competitiveness, as trucking is expected to make steady progress in decarbonization (such as through electrification).

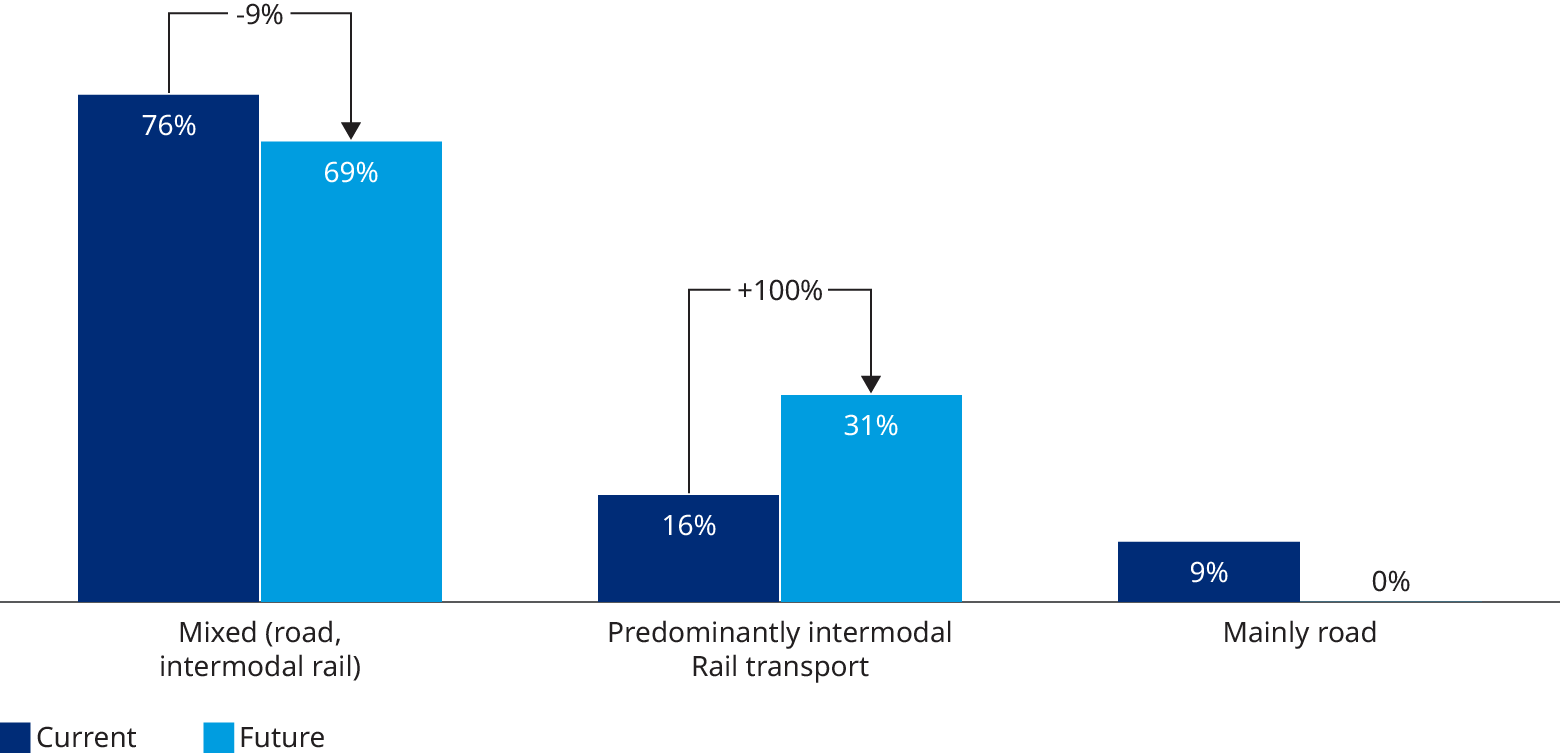

Market conditions have never been better to attract more freight to rail. A recent survey by Oliver Wyman of 40 companies in the manufacturing and trade/transport sectors found that twice as many companies want to use rail freight as do now (Exhibit 2). But these customers will not switch because of rail’s environmental benefits alone: Service performance and reliability demands for just-in-time supply chains must be met.

Unfortunately, potential new customers often face high barriers to accessing rail freight. And once they do gain access, precisely managed logistics chains, supplier diversification, and accelerated digitalization often clash with inflexible and outdated rail freight systems and processes. Adding to this are performance deficits in punctuality and customer information as well as capacity bottlenecks due to inadequate infrastructure. All these barriers must be addressed if rail freight is to attract more traffic.

What potential rail customers want

To ensure the competitiveness of rail freight, operators will need to respond to new and different factors driving customer shipping decisions (Exhibit 3). Traditional criteria such as punctuality, cost effectiveness, and reliability are now considered to be “table stakes.” New customer expectations driving mode choice include high performance through solutions expertise and digitalization, easy access to capacity, and complete transparency throughout the transport process. Specific drivers called out by survey respondents included:

- Transnational and long-term availability of capacity on relevant corridors, to provide stability for today’s high-performance logistics chains

- Simple door-to-door solutions from a single point of contact. In the future, this will require closer cooperation between rail logistics operators and freight forwarders.

- An end-to-end digital offering and digitized customer interfaces that provide convenience and a positive user experience. A customer’s own control towers and system must be easy to integrate.

Generally, both manufacturing and transport customers attach importance to these criteria. For transport customers, however, capacity, lead times, and flexibility are the most critical issues, while manufacturing customers see the complete door-to-door offer as most important, followed by capacity access. The challenge for rail is to develop a more secure, simple, and modern offer that can meet these diverse demands.

Regarding specific rail operational capabilities that customers are looking for, both transport and manufacturing customers place the most value on the availability of real-time information and end-to-end corridor management (Exhibit 4). About a quarter of transport customers also value carbon footprint information.

Key rail transport development initiatives

Faced with margin weakness, the difficulty of transforming complex operations, and the need to work with infrastructure limitations, rail operators may see evolving customer requirements as difficult, if not impossible, to meet. But Oliver Wyman believes that many improvements could at least be initiated by leveraging customer goodwill and the exceptional loyalty and enthusiasm of employees.

Even though the focus will vary for each operator, in light of our study findings, six themes for development stand out as critical to ensure rail competitiveness into the future:

Modernization through automation and digitalization

Digital offerings will play a growing role in optimizing processes and service performance. This extends from the digitalization of customer interfaces for end-to-end control to accelerated offer generation and digital platforms that provide enhanced transparency. Access points and booking processes must be simplified and transport information must be available continuously (including real-time arrival times and delays). One fast-start option for rail operators would be to pursue integration with existing digital providers, such as freight exchanges, e-forwarders, or tendering platforms, for targeted service purchasing pre- and on-carriage. Investments in future technologies, such as artificial intelligence for traffic and incident management, perception-based sensor technology, and a sound information technology basis for automated train operation also will be necessary to ensure long-term competitiveness.

Increased flexibility

Rail organizations and resources must become more flexible by breaking rigid planning and control processes. Active capacity management is a critical capability here. This includes rolling planning for rail freight and forecasting that is used as a standard to identify and optimize critical bottlenecks within the rail network.

Less complexity and more customer-centricity

The rail organization must be simplified along the value chain and interfaces must be reduced. Closer linkages among planning, information, and control processes, together with a precise understanding of customer requirements, are needed to optimize supply management. To this end, we expect more integrated business models will emerge that can anticipate customer needs and respond to the market more quickly and precisely.

Solutions design competence

Logistics chains must be designed much more actively, through strong solutions competence and high-frequency offers that evolve out of collaboration between rail operators and customers. Rail freight must position itself as a business developer and offer solution-oriented sales and adapted solutions designs.

Corridor and construction management

End-to-end corridor management that plans train paths from a single source and manages trains along an entire corridor is crucial. Rather than keying in on specific route segments, as has been the case up to now, the full transport run, including pertinent nodes, must be the focus. The goal is to think transnationally and to implement centralized European corridor management. Optimizing construction management (i.e., integrated construction site planning) also will be important; construction must be carried out in a way that reduces its impact on capacity, such as by introducing construction cycles and bundling measures. To guarantee capacity, long-term cooperation models with the construction industry and planning horizons of several years are required.

Evolving the rail freight ecosystem

Finally, solidarity must be sought in the “ecosystem” of rail freight transport. Customers and industry participants are willing to engage in a transparent and open process to clear major hurdles. For example, securing capacity in the short and medium term could be addressed through greater cooperation between operators, third-party logistics providers, and shippers.

To reduce potential future constraints, the industry will need forward-looking capacity measures. This will require utilizing more sophisticated and collective demand forecasting to predict baseline traffic demand by industry, as well as the potential traffic that could be shifted from truck by better meeting the needs of customers looking to switch to rail. Changes in industry and demand clusters in Europe, customer requirements, prioritized traffic types, and traffic volatility also must be taken into account. This would allow for the calculation of both present and future capacity on a risk-adjusted basis, resulting in bottlenecks being identified, prioritized, and urgently corrected.

In summary, only by adapting to satisfy evolving customer requirements, reduce complexity, and improve service performance and reliability will rail freight operators be able to win share from trucking and play a larger role in helping combat climate change. Expectations have been defined — the task now is for all rail industry participants to find a collaborative and comprehensive way forward to meet them.