When margin calls hit the billion-Euro mark in 2022, European utilities lacked processes and tools to manage their liquidity. Risk management functions had typically focused on market and credit risk, with liquidity deprioritized or ignored. Treasury processes were designed to operate based on yearly budgets with quarterly reviews, which were no match for the liquidity needed to manage the ‘new norm’ of volatility and higher prices. And rate rises of 300 basis points meant financing grew more expensive and keeping track of working capital became imperative.

It did not help that exchange prices for key energy commodity benchmarks fluctuated widely, with front-month natural gas (TTF) ranging between €80 per MWh at the start of 2022 and nearly €340 per MWh in August — before dropping back under the €80 mark by the end of the year. Driven by the fluctuations in input price, power prices were also volatile, meaning that for utilities, margin requirements on the exchanges used to hedge risk skyrocketed.

While price volatility has been at its highest in Europe, the structural issues underpinning liquidity crises can be seen in examples across the world. For example, winter storms in 2021 caused unexpected liquidity pressures that forced several North American utilities into bankruptcy or required significant refinancing or restructuring efforts — with those in deregulated markets most affected. And despite a high level of vertical integration, players in Asia and the Middle East have also faced margin pressures of increased working capital requirements.

Margin matters

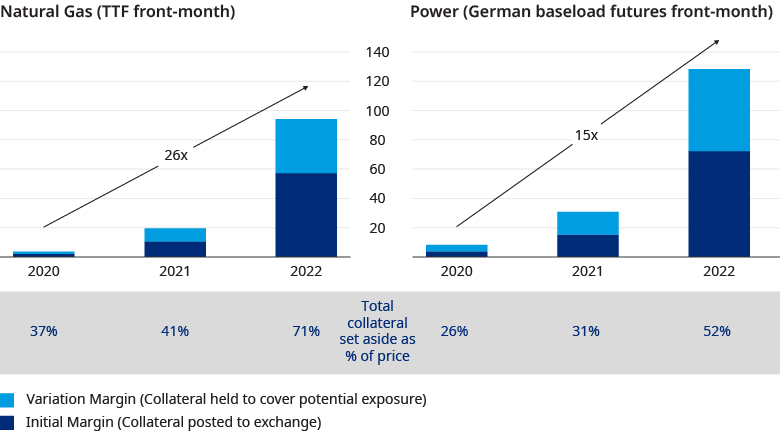

Margin is a type of collateral posted by traders to clearinghouses to cover the latter’s market and credit risks. While variation margin requirements always rise in line with the prices of commodities, clearinghouses have started raising initial margins too — akin to a deposit — making every trade more expensive in terms of working capital.

In highly volatile situations, rising margins can cause liquidity issues for energy market participants. This was apparent in early 2022 when at least one large German power producer raised €10 billion to cover variation margins due on power futures. Later in 2022, the European Federation of Energy Traders — which includes utilities, industrial players, and commodities traders — also requested funding, stressing that margin requirements raised fundamental questions about market-wide liquidity risk management.

Oliver Wyman estimates that those trading German baseload power faced huge rises in the amount of capital they reserved to cover initial margins and potential variation margin – from around €8 per MWh in 2020 to more than €125 per MWh in 2022 in power (see Exhibit 1). Similar trends were therefore visible for European gas, with total margin requirements rising from €3.5 per MWh in 2020 to more than €90 per MWh in 2022. And, despite falling prices in the first quarter of 2023, the total margin paid on German gas futures was approximately 75% of the underlying price — up from approximately 25% in 2019 — meaning each Euro of trading activity required three times the capital, with a similar multiple seen in German baseload power.

The impact on energy players

Market participants who had taken long positions on energy products have primarily been affected over the last two years, as they sold power in advance at low prices and acquired inputs at subsequently higher prices. While those on the short side also suffered from the rise in initial margin, that was compensated by inflows in variation margin on profitable hedges.

However, as prices now decline, it is the market participants on the short side — those that may have bought power forward at the sky-high rates of 2022 — who are at risk. Now these companies will have high variation margin outflow.

Given that neither side of the market remains safe, utilities must effectively manage liquidity and remain competitive by following three essential steps – gaining visibility, building robust processes, and establishing strong governance.

How to improve visibility for effective liquidity management

Currently, many utilities do not have accurate, holistic, and automated liquidity forecasts to inform real-time decision making, boost collaboration, and provide a basis for liquidity preservation measures. Without ongoing clarity on liquidity requirements, risk managers cannot deploy tools quickly enough to mitigate short-term impacts, and strategic planners are unable to look ahead to restructure businesses for longer-term resilience.

An automated liquidity forecast tracks the key drivers and how they change over time, enabling better operational management in the short term and the evaluation of structural changes in the long term. A successful forecast builds on raw data and is modelled based on drivers (see Exhibit 2). Information can be updated live and presented to key stakeholders in a digestible format.

Even where margin-related liquidity pressures are less acute, strong liquidity forecasting — and liquidity management — helps utilities manage billing and cash management.

How to build robust and agile liquidity management processes

Building strong liquidity management processes is not trivial, and some utilities may need to reorganize their risk and treasury operating models. Both short-term and long-term tools to manage liquidity should be clearly articulated in an ‘action catalogue’ — tactical for short-term solutions, operational in the medium term for durable changes in the way of working, and structural in the long term to change the cash culture.

Operationalizing these processes requires clear interfaces and responsibilities between treasury departments, risk managers, and trading desks to be defined. A well-designed liquidity management process, when coupled with strong liquidity forecasts, would facilitate rapid action when there is an opportunity to reduce demand quickly, or to net positions for a margin reduction. Further, crisis playbooks outlining escalation mechanisms will help utilities manage risk rapidly in real time.

As prices continue to fall from their 2022 highs, longer-term measures to control liquidity are becoming more important. These include assessing structural portfolio adjustments that can lower long-term risks. They can be identified through holistic forecasts that point to the asset and portfolio level drivers of liquidity risk capital consumption.

How to develop strong liquidity governance

Strong governance is needed to build long-term thinking into liquidity risk management. This starts with a centralized risk control concept that balances liquidity costs with credit and market risk to avoid situations where risk is not mitigated but transformed. For example, a utility under margin pressure on exchange-traded futures might choose to transact instead in unmargined over-the-counter contracts. In a siloed risk operating model, this would appear to be a successful liquidity risk management strategy, but in a centralized control concept, the true costs — the transformation of liquidity risk into credit risk — would be identified.

This type of liquidity governance, underpinned by visibility, can be crucial for integrated utilities – many of whom are active in Asia. At present, most such utilities believe that they benefit from a natural hedge between their upstream and downstream activities. Appropriately governing this natural hedge needs visibility and analysis of the actual payments and balance of risk – again dependent on liquidity forecasts. Moreover, while the natural hedge may protect utilities against margin-related liquidity pressure, without the right attribution of costs and risk capital use between entities, improperly governed liquidity regimes will inflate costs for parent organizations.

Unlocking resilience

For utilities to respond to ongoing volatility, it’s essential to gain strong visibility over the drivers of liquidity pressure, define clear processes and toolkits to manage those drivers, and develop robust governance that ensures constant operational and strategic focus on managing liquidity.

While the energy crisis of 2022 seems past, constraints on global supply and dislocations in trade flows are structural factors that will continue to create energy commodity price volatility. Acting now to properly manage liquidity could save utilities from existential threat the next time around and keep financing costs under control.

Additional contributors Alex Franke, partner, Ernst Frankl, partner, and Ojasvi Goel, senior consultant.

Additional regional insights contributors Christine Oumansour, partner, Arnaud Delamare, partner, and James Koh, principal.