Retailers’ 2022 negotiations with suppliers will be the toughest in memory. After rises in commodity prices and coronavirus-related operating cost increases, suppliers will aim to raise the prices of many products. The collapse of international buying alliances has weakened the negotiating positions of some retailers. Adding complexity, some regulators are insisting – or are expected to insist – on greater transparency in negotiations and demanding that any term improvement by suppliers be linked to counterparts such as in-store promotions.

We think retailers should take more charge of the negotiating round, by centralizing control over it, making better use of their data, and leveraging their proximity to consumers. Many retailers have many physical and digital customer touchpoints that they often do not fully monetize, and they can make better use of these through offer design, promotions and product recommendations. Retailers’ detailed understanding of sales – such as insights into product switching – can also be a powerful negotiating tool. All this should be done within a simplified master agreement that allows both parties to see through the complexity.

Retailers are also still facing heightened costs due to the pandemic such as hygiene measures and supply chain redundancy precautions, but temporary agreements with suppliers to cover those expenses will soon expire. Additionally, they have had to deal with a shift to online shopping: Even when the retailer retains customers overall, the online sales cannibalize sales in physical stores, for which fixed costs remain. However, it is hard to pass these costs on to consumers amid ongoing intense competition and economic uncertainty.

The pressures start at the beginning of the supply chain with across-the-board price increases. Grains, metals, minerals, fats, and oils are on average between a third and a half more expensive than a year previously, while the price of fertilizer is up by more than two-thirds. Even energy and beverages have seen double-digit price rises. (See Figure 1.)

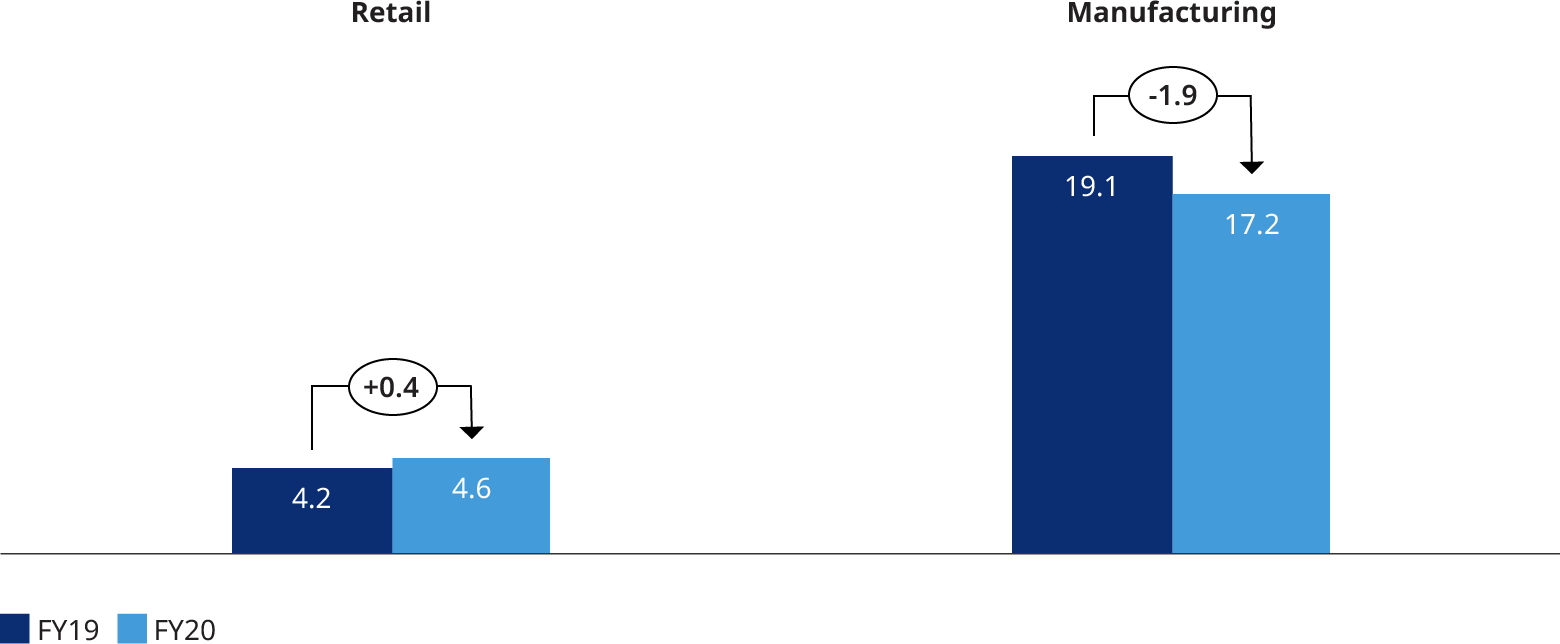

Profits are under pressure at all stages of the supply chain. From 2019 to 2020, manufacturing profitability has dropped significantly, while retailers have made marginal improvements from a much lower base. (See Figure 2.) That means that even a 1-percentage-point rise in supplier costs could reduce earnings before interest and taxes (EBIT) by a quarter.

Here are five actions that could help retailers weather the storm:

Own the analytics

Retailers’ databases put them in a unique position to understand sales drivers on most granular levels. Especially as loyalty programs expand, their information now covers the time and store at which a product was bought – as well as the customer and what else they bought at the same time. This provides insights into product switching and enables retailers to break down and allocate costs to understand products’ true profitability. Traditionally, suppliers have brought such kind of analysis to negotiations, despite having less detailed information: Mostly they only know how much is shipped to their distribution center and need surveys to understand more. We think the retailers should better use their strength in data to provide the analytics that drive the negotiations.

Be (more) confident on retail brand strength

There is a lot of admiration for big brands, but retailers should not underestimate their own brand and products. An Oliver Wyman consumer survey showed that consumers gained trust in supermarkets and discounters during the pandemic, with a strong majority of respondents indicating that retailers’ handling of the crisis was either good or very good. While major brands can sometimes be perceived as anonymous, retailers are seen as close to consumers – they have people working in neighborhood stores. Consumers gravitated towards retailer brands during the pandemic, our survey showed, indicating that own-label brands could be stronger than previously thought. Retailers should consider pushing them more. In Europe we are seeing some astonishing examples such as one retailer successfully launching an own brand cola in a notoriously brand-dominated category.

Take counterparts to a higher level also using digital touchpoints

Traditional retailers can do more to monetize their own customer touchpoints, especially the digital ones, and take counterparts to the next level. Terms and conditions are still often linked to older means of consumer interaction, such as leaflets. But pure online players have already found ways to design their terms around digital touchpoints, and we think omnichannel retailers could better leverage their own. Digital counterparts can include visibility in promotion banners, personalized product recommendations and joint customer data mining. A customer who has on occasion tried different brands of toothpaste, for instance, might be a good target for a promotion of another brand.

Simplify terms and streamline master agreements

Agreements between retailers and suppliers cover many types of counterpart funding – for promotions, the marketing of new products, in-store displays, and a range of other measures. This makes it easy to lose track of all the terms and penalties. Working within a streamlined master agreement can remove some of the complexity, making the negotiations clear for both parties. Increased transparency will also let retailers preempt the risk of losing conditional and thus temporary commercial terms over time.

Set up a negotiation control tower

As commodities prices rise, retailers might not be able to pass on supplier price hikes to consumers. But retailers’ margins on earnings before interest and taxes (EBIT) are tight, typically between 2% and 5%. That makes it more important than ever to manage the negotiation progress closely, tracking progress and ensuring that nothing falls between the cracks. Retailers need a clear view of suppliers’ demands and offers and of their own ability to raise store prices. We think retailers can still establish tighter control over negotiation progress, equipped with the analytics to provide instant visibility of the state of all the concurrent negotiations at the push of a button.