Lidl’s Threat to Incumbent Grocers is Real

June 12, 2017

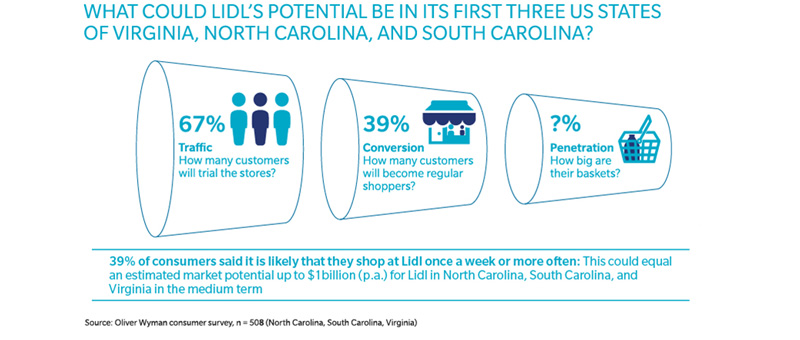

June 12, 2017 (Boston) – Global discount supermarket chain Lidl’s entry into North Carolina, South Carolina, and Virginia could remove $1 billion in local sales in the medium term, according to global consulting firm Oliver Wyman.

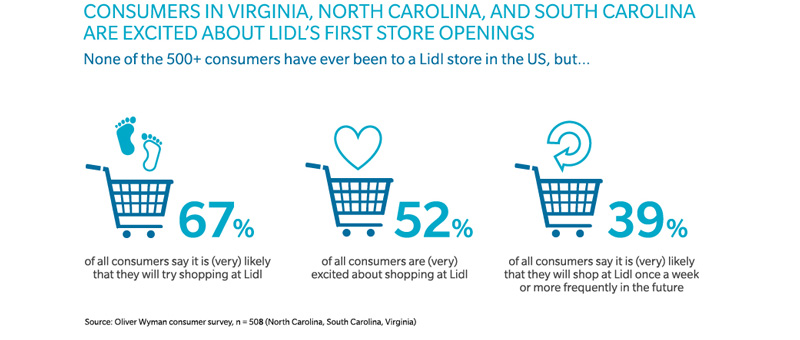

A new survey by the firm reveals that consumers are overwhelmingly excited about trying Lidl, even though they have never stepped into one of their stores before, with 39 percent saying they would shop at Lidl once a week or more in the future. These high levels of trial and intent to return as a regular shopper were driven by their expectations of high quality and innovative new products.

“Incumbent grocers need to take notice. The threat from Lidl is real and will only get clearer as their stores generate trial and repeat sales,” said George Faigen, partner in the Retail and Consumer Goods practice of Oliver Wyman. “Grocers who believe my customers would not shop at Lidl or Aldi will likely be surprised. The US and European trends we have measured over the past five years tell a clear story of consumers moving portions of their weekly shopping from incumbent grocers to these private brand retailers.”

Key survey findings:

- Even though none of the survey respondents had ever been to a Lidl store in the US, 67 percent said it is (very) likely that they will try shopping at Lidl, and 52 percent are (very) excited about shopping there.

- Contrary to commonly held industry wisdom, households at all ends of the income spectrum are excited about Lidl’s store openings. In fact, 49 percent of households with an annual income over $75,000 are excited about Lidl compared with an almost identical 48 percent of households earning less than $25,000 last year.

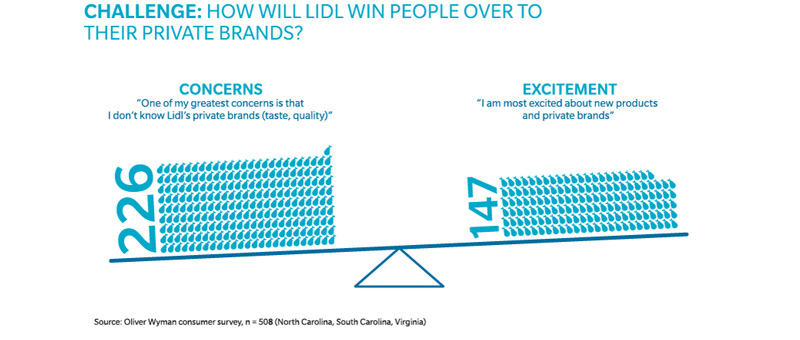

- We found particularly high excitement from consumers around Lidl’s new product offering and their highly awarded private brands. Although, being unfamiliar with Lidl’s private brands was also one of the top concerns among respondents too.

- Concerns around fewer services for consumers and no deli or other service counters at Lidl were less of an issue for consumers.

- Whether consumers shopped at traditional, specialty, or regional grocers in the past, there is a very high interest in shopping at Lidl in the future.

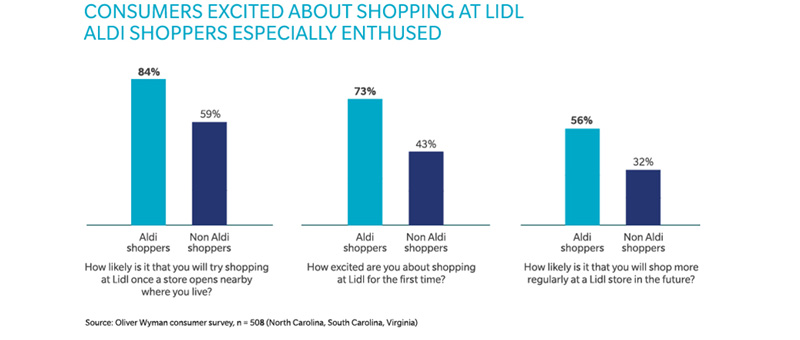

- Consumers who already shop at Aldi, another hard discount grocer, are overall more excited and likely to try Lidl than non-Aldi shoppers.

The results show us that consumers are ready to give hard discounters, like Lidl, a chance and incumbent grocers need to be ready. Grocery retailing is a zero sum game, meaning every dollar spent at Lidl will be missing from the pockets of the incumbent grocers. With more pressure on already razor-thin margins, working on step-changes in cost efficiency will be critical. Incumbents will also have to go beyond cost and improve their connections to their customers especially in areas where Lidl will find it hard to replicate.

Oliver Wyman recommends grocers revisit their corporate growth strategies and find ways to tune them to take into account the new entrant Lidl and a maturing Aldi, who have 1,500 US stores and are investing heavily. Everything should be up for consideration, with the idea of crafting each to deliver the unique experience you want your brand to stand for: price and promotion strategies, category strategies, private brand architectures, third party relationships, store services, the uniqueness of the fresh offer across the store, and shopper engagement and loyalty.

Media Contact:

Rachna Krishnan

+ 617-424-3818

rachna.krishnan@oliverwyman.com

About the survey

The online questionnaire was fielded in the US in June 2017, gathering 508 responses from consumers in North Carolina, South Carolina, and Virginia. All of the people polled had never been to a Lidl in the US before. The sample we asked consists of 54 percent female consumers, 60 percent with a household income between $25,000, and $100,000 and 30 percent millennials (ages 18-34).

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With offices in 50+ cities across nearly 30 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. The firm has more than 4,500 professionals around the world who help clients optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman is a wholly owned subsidiary of Marsh & McLennan Companies [NYSE: MMC]. For more information, visit www.oliverwyman.com. Follow Oliver Wyman on Twitter @OliverWyman.