For heavy-duty transportation, aviation, and shipping, alternatives to fossil fuel propulsion technologies are not being developed fast enough to help these sectors meet 2030 emissions-reduction targets. That makes renewable fuels the only viable, immediate decarbonization solution for planes, cargo ships, and freight-hauling tractor trailers.

Renewable fuels are available now and could cut current emissions in those sectors by as much as 80%. Their use is already well-established in the trucking industry, thanks to regulatory mandates on usage. From 2017 to 2022, consumption across Europe and the United States of renewable fuels made with fatty acids and oils (bio-distillates) grew nearly 30% versus only a 1% growth in overall diesel demand. While that expansion is noteworthy, the global economy needs to see even faster growth going forward to hit 2030 emissions-reduction targets.

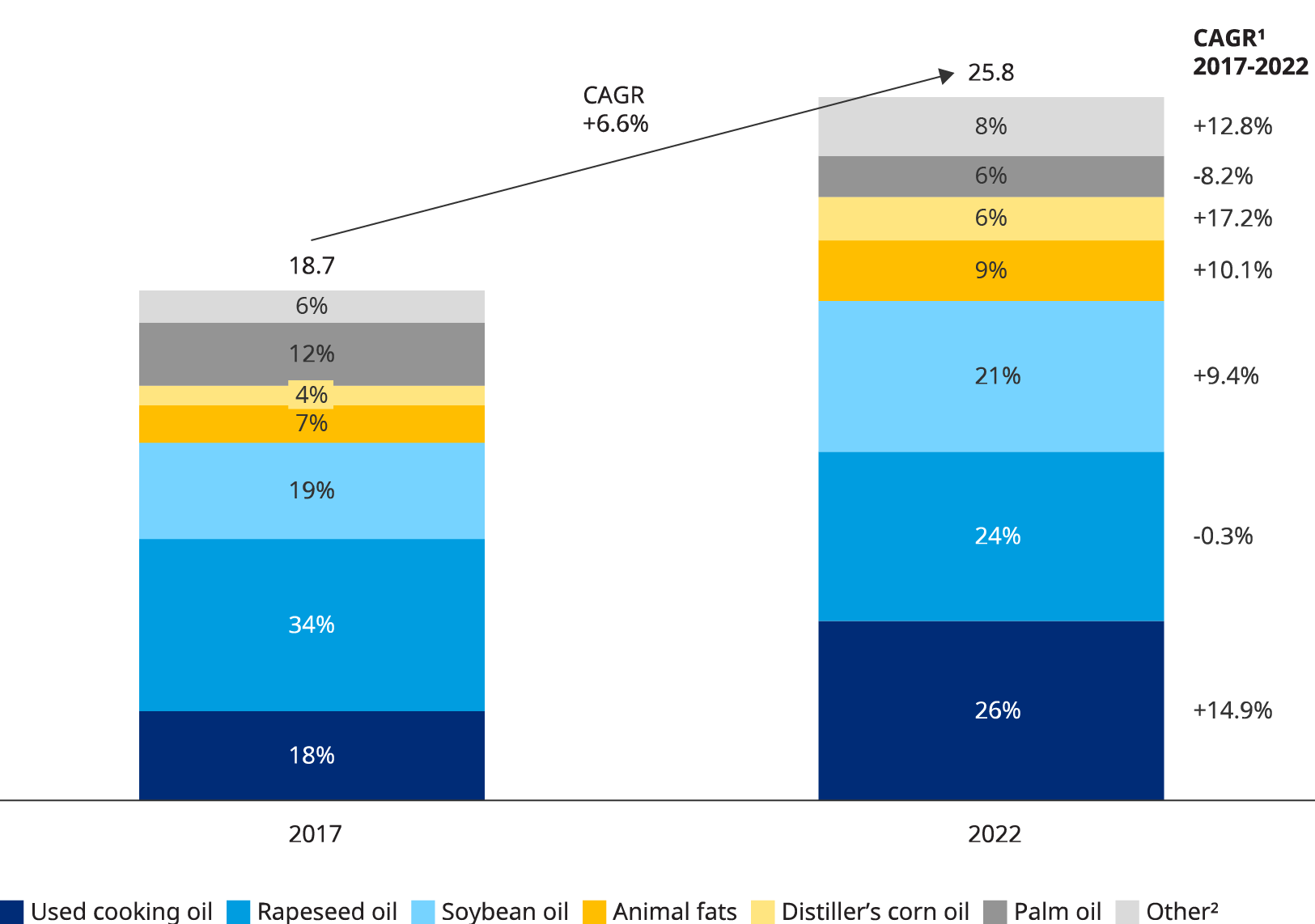

Exhibit 1: Feedstock demand specifically for biofuel production in the US and EU, 2017-2022

In millions of metric tons

1 CAGR stands for compound annual growth rate

2 Other includes but is not limited to canola oil, sunflower oil, pine oil, tall oil, tall oil pitch, palm fatty acids, and free fatty acids.

Sources: U.S. Department of Agriculture 2023 EU - Biofuels Annual, U.S. Energy Information Administration Oct 2023 Monthly Biofuels Capacity and Feedstocks Update and Biodiesel Production Report, Oliver Wyman research and analysis

Several obstacles stand in the way of adding sufficient production capacity of biodiesel, renewable diesel, and sustainable aviation fuel (SAF) to facilitate a meaningful reduction in industrial emissions. One of the biggest is the current inadequate supply of low-carbon feedstock — what the International Energy Agency (IEA) has labelled “the key barrier to raising liquid biofuel output.” Until we overcome that, the markets for alternative fuels will remain constrained.

The good news is that untapped resources are available to bolster the supply, although each comes with its own set of potential drawbacks. Though not the only options, we see an immediate opportunity for at least two new sources in a next wave of feedstock options to emerge: planting cover crops and the collection of Latin American used cooking oil (UCO). Both could be important new additions to the feedstock supply that would enable a faster expansion of renewable fuel production.

Why cover crops make sense

Cover crops are inedible vegetation planted in between harvests to protect agricultural acreage from erosion and weeds. They offer potential alternatives to waste-based feedstocks and can improve overall sustainability.

Planting cover crops like camelina, pennycress, and carinata increases land productivity and offers a high volume of oil for renewable fuel production. In Europe and North America today, 1,000 acres of cover crops can likely produce nearly 400 tons of feedstock. With continued innovation, yields could be increased to as high as 1,400 tons.

Cover crops help extend soil life, prevent erosion and nutrient runoff, reduce machinery costs, out-compete weeds, attract pollinators, reduce water pollution risks, and remove CO2 from the atmosphere, shrinking a farming operation’s carbon footprint.

Additionally, cover crops generally deliver a lower carbon intensity for renewable fuel and are better for the environment than other crop-based feedstock options. From the farmer’s perspective, they add a new money crop to the farm’s revenue base.

Cover crop challenges

Yet, despite their many attributes, the practice of planting cover crops in the US and much of Europe — France being the notable exception — remains quite small. That’s because cover crops present challenges:

- While cover crops increase overall productivity of land, they can also result in lower yields of the existing crop.

- Farmers are hesitant to add the complexities of a second planting and harvest and are concerned about other potential impacts on their existing crop from adopting the practice.

- Because the practice is not widespread, there are still many questions about cover crops and a less supportive ecosystem than exists for other more traditional food crops. For example, it’s harder to determine what’s appropriate pesticide use when two crops are involved. Also, price hedging becomes more challenging, given the lack of public indices for these newer money crops.

- There is minimal existing production of cover crop seeds, and it will require significant investment to provide seeds at commercial scale.

Government incentives and support programs may be needed to help farmers make the transition. More R&D would add to the cover crop knowledge base, provide guidance on best practices to protect the yield of the original crops, and support development of better commercially available seeds for cover crops.

Latin America’s potential

Next, Latin America could be a source of a much sought-after feedstock — used cooking oil. Among US and European renewable fuels producers, the biggest demand is for waste feedstocks, such as used cooking oil and animal fats.

Among renewable fuel feedstocks, used cooking oil is one of the most environmentally friendly and economically attractive. This economic advantage is particularly true for SAF. Used cooking oil is a preferred feedstock because it offers a lower carbon intensity than other feedstocks and, thus, qualifies for more lucrative governmental tax credits and other incentives.

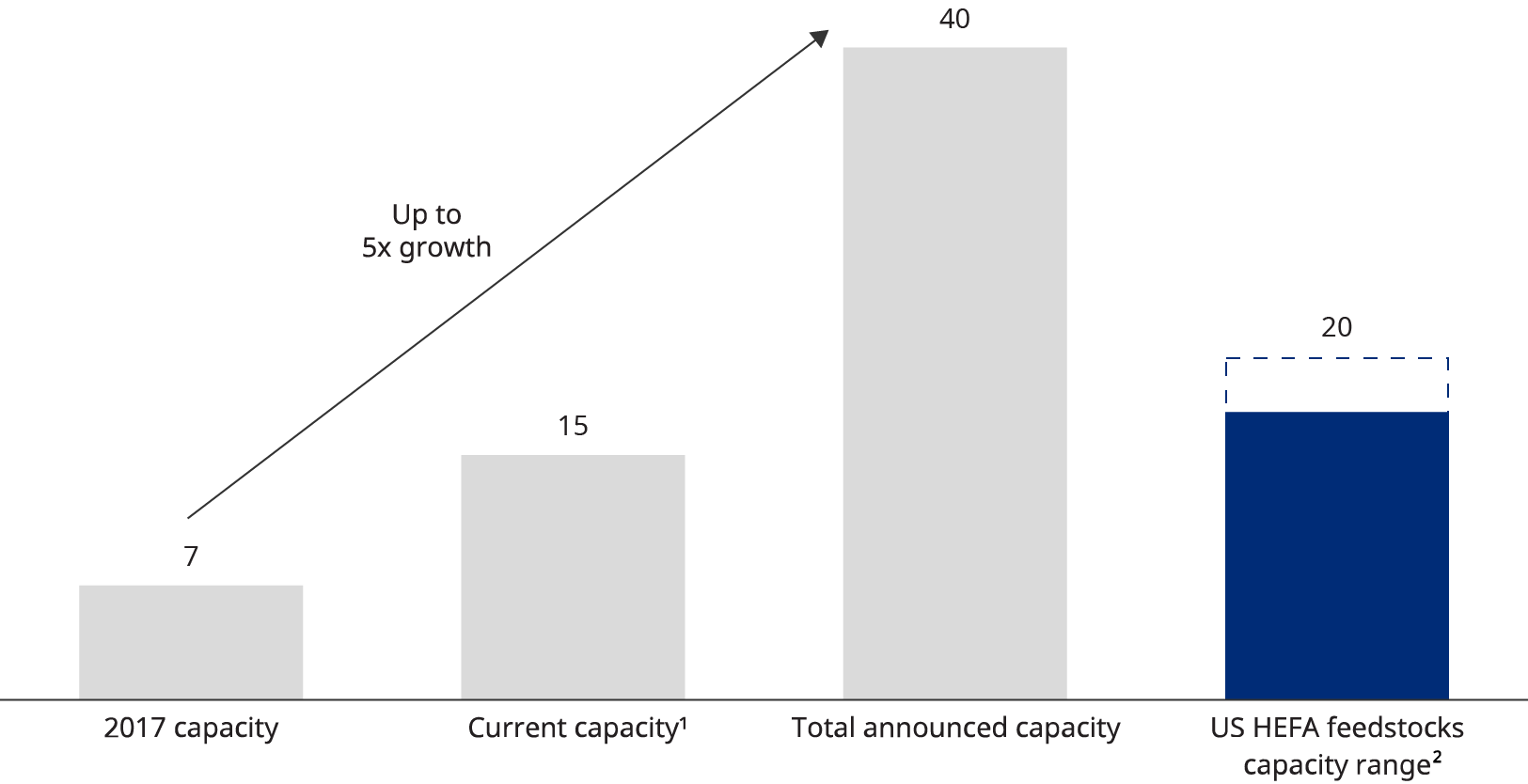

But where the production of renewable fuels continues to grow rapidly — capacity could triple in North America based on announced projects, for instance — the supply of used cooking oil is failing to keep pace. Without new sources, that gap will widen as announced production comes online. There has already been significant investment in used cooking oil collection networks in North America, Europe, and Asia, which limits potential for continued expansion of supply in the region.

Thus, significant growth in the used cooking oil supply requires new sources. Latin American cities like Mexico City, Sao Paulo, Lima, Bogota, and Santiago could be important new avenues, given the immaturity of their collection and aggregation of used cooking oil relative to other regions. We estimate Latin America could supply between two million and three million metric tons of used cooking oil, which would be worth somewhere between $3 billion and $4 billion.

Exhibit 2: US biofuel production expansion and feedstock supply limits

Estimated US bio distillates production capacity and domestic HEFA feedstocks capacity (in billion liters)

1 Includes currently production capacity of operating RD / SAF facilities and BD in 2022

2 Includes major vegetable oils, fats, and grease produced in the US in 2022, converted to RD at a 82% yield rate for vegetable oils and 79% yield rate for fats and grease

Sources: U.S. Energy Information Administration, 2023 Fuel Ethanol Plant Production Capacity Report, 2023 Biodiesel Plant Production Capacity Report and 2023 Renewable Diesel Fuel and Other Biofuels Plant Production Capacity Report, .S. Department of Agriculture, Oliver Wyman research and analysis

More feedstock, more production

This new supply could expand current global used cooking oil volumes by as much as 25%, support the expansion of renewable fuel production worldwide and provide economic development and job creation in the region. Most importantly, collecting used cooking oil for renewable fuel production also could reduce emissions by as much as nine million metric tons of carbon dioxide equivalent — or the equivalent of taking two million internal combustion engine cars off the road.

But challenges must be overcome in Latin America before this new industry can get off the ground. First, setting up a used cooking oil aggregation network in Latin America requires significant infrastructure, including collection containers, truck fleets, and treatment facilities. Incentives and/or mandates may be necessary to encourage restaurants and food producers to participate. Finally, compliance with the United Nations' Intergovernmental Panel on Climate Change supply chain protocol is also essential to ensure the origin of the collected oil.

Surmounting these hurdles will require collaboration with in-region partners and governments, as well as the involvement of multinational chains and food producers to build the supply chain. Either these chains or food producers with a regional presence could be strong partners for building a supply chain.

Right now, the biggest impact of the shortage of feedstock has been to push up prices on renewable fuel feedstocks. Ultimately, this will make airlines, shippers, and other big customers hesitant to rely too heavily on these alternative fuels. In response to rising prices and short supply, some big renewable fuel producers are moving to secure access to feedstock supply through mergers and trying to expand supply through R&D partnerships.

Incentives address supply shortfall

Overcoming feedstock constraints is vital to continued growth in alternative fuel capacity and meeting 2030 decarbonization targets. While the US and European Union have provided incentives through legislation like the 2022 Inflation Reduction Act, more support is needed to ensure enough capacity will be there to help industrial customers meet 2030 emissions reduction targets.

Meanwhile, leaders in renewable fuels should focus on identifying levers they can pull in the feedstock space to guarantee an affordable and sufficient supply. Here are four important questions renewable fuel producers need to ask themselves and others:

- How can they help build up low-carbon feedstock supply?

- How do they secure their own access to feedstocks?

- Who are the right partners in agriculture, waste collection, and government?

- What do these global feedstock supply chains look like, and how can appropriate quality and certification of feedstocks be ensured for end-to-end tracking through the supply chain?

These will be critical questions to answer as renewable fuels continue to increase in importance as part of the world’s pathway to net zero over the coming years and decades.