Rising ESG expectations

New Ways For Grocers To Successfully Tackle Waste Reduction

By Denise van Wijk, Jens Torchalla, and Alexander Pöhl

Grocery retailers are exploring advanced approaches to manage waste — products that do not sell within their shelf life — in their fresh categories. These strategies stem from altered customer demand patterns amid the high inflationary environment, combined with the retailers’ desire to become more sustainable. We examine the core aspects of waste reduction and how grocery retailers can optimize their fresh assortment to meet local and regional needs, minimizing waste while maximizing profit.

A successful approach to waste reduction considers three core aspects

- Maximizing products’ shelf life through optimization of the end-to-end supply chain, where products are transported efficiently under the best possible conditions.

- Forecasting correct order quantities that reflect seasonality and recent trends, striking the right balance between in-store availability and keeping waste at a minimum.

- Bringing the fresh assortment (both in terms of variety as well as the area in the store dedicated to fresh produce) in line with local demand patterns.

Grocery retailers increasingly express the desire to accomplish the last of these elements, a goal that fits well with the trend of down trading as a result of the current cost-of-living crisis.

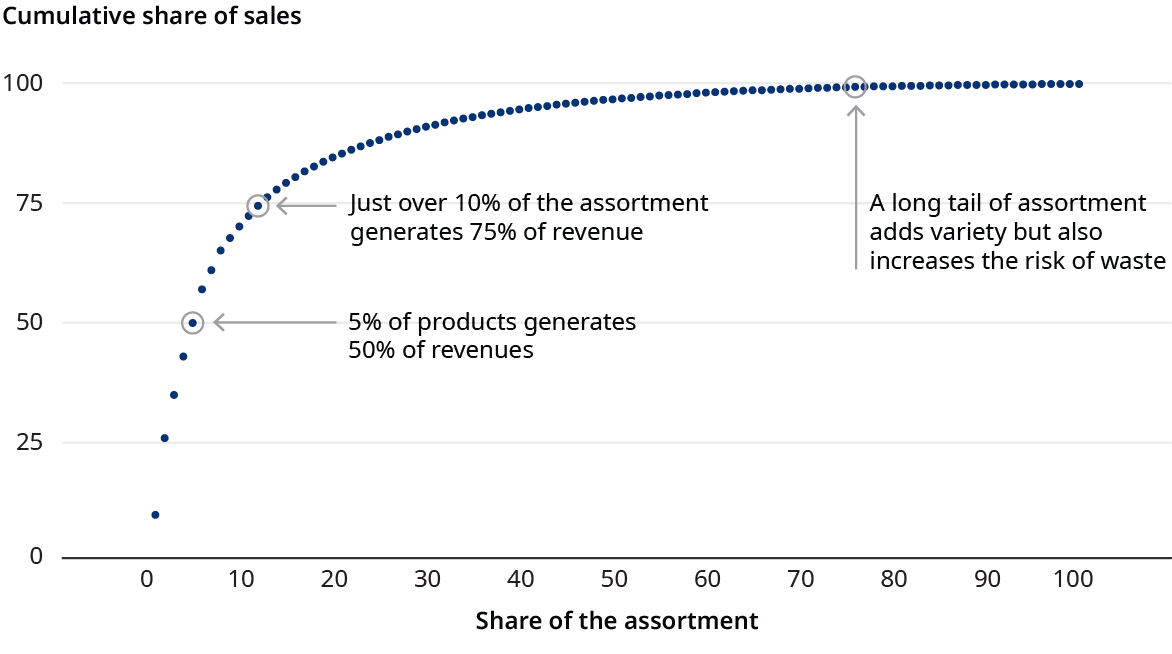

Balancing a diversified offering with an increased risk of waste

A careful review of the assortment is required to ensure that each individual product adds incremental value to the customer (demand for the product cannot be satisfied by other products in the range). The strong competitive pressure in grocery retail has resulted in ever-increasing ranges as a prerequisite to win over customers — even Costco, which prides itself on its no-frills assortment, increased store keeping units (SKUs) to 4,000 in 2023, from 3,700 three years earlier.

Exhibit 1: Typical distribution of cumulative share of sales compared to share of the assortment

Source: Oliver Wyman analysis

Adding variety without incremental value to the customer results in diminishing product popularity and thus lower rotation of individual products; given the short shelf life of fresh produce, that’s a sure way to increase the risk of waste. However, simply removing less popular and slower-moving products may negatively impact choice and by extension customer satisfaction, which leads to missed sales or even customer churn. It’s a trade-off retailers should approach carefully.

Tailoring assortments without increasing central overhead

A store’s profile (comprising size, demand patterns, and shopping mission) influences the overall space allocated to fresh categories at any given time and is an important factor in reducing waste. In the case of fresh, bringing the assortment size in line with weekly demand patterns can increase profit.

The absence of planograms in fresh categories allows stores to tailor assortments without significantly increasing central overhead. This is especially relevant considering the modular approach to furniture whereby stores can choose their desired furniture set-up and thus the share of modules and shelf types used (for example cold versus ambient, organic), which grants further flexibility. This means retailers can introduce a larger share of refrigerators with on-the-go products in transit locations, for example, or a larger share of loose fruits and vegetables in destination stores.

On top of the increased flexibility from a space allocation point of view, the absence of planograms allows stores to order different Fruit & Vegetable products at different points in time to reflect weekly demand patterns.

Further, assortments can be tailored to local and regional demand patterns through the introduction of behavioral clusters (grouping stores based on similarities in shopping behavior) or algorithms which automatically adapt planograms (product positioning as well as number of facings used per product) in line with local and regional needs.

Fine-tuning the assortment to address local demand patterns

The variations in shopping behavior across stores require customization to bring the assortment in line with local demand. Differences in shopping mission, catchment area, and store profile have a noticeable impact on local product popularity. Although central assortments can be tailored through a combination of modularity and regionalization, product performance should be reviewed at a local level to remove any products that would not sell a delivery case within the product shelf life. Products that are not part of the central assortment but have proven popular in the local area can be added as replacements. To enable stores to make these adjustments, access to the right insights and tools (for example easy-to-use software which highlights product waste over time across stores) is essential.

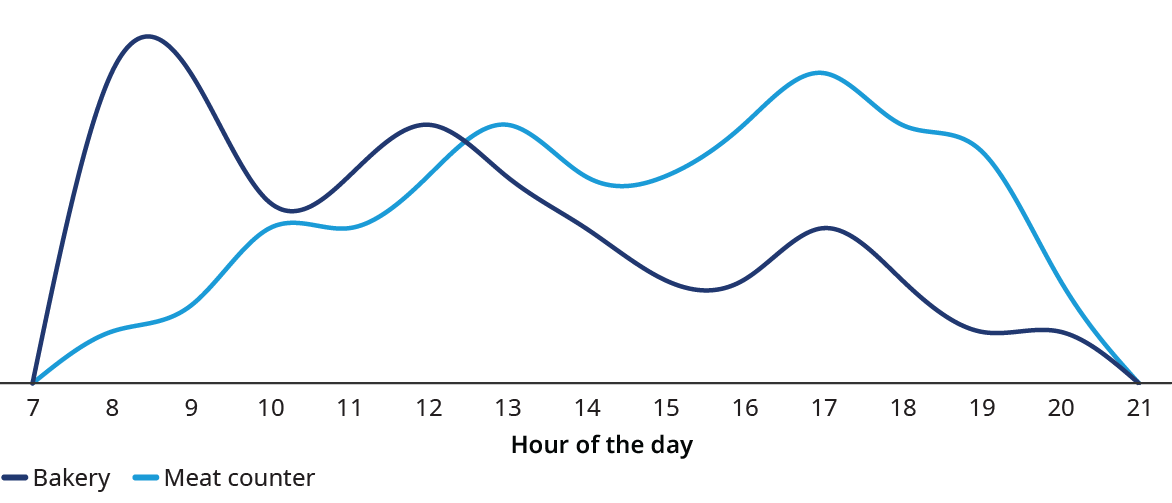

Taking advantage of demand fluctuations

Exhibit 2: Example of typical intraday demand patterns for the bakery and meat counter

Source: Oliver Wyman analysis

Seasonality plays a crucial role in fresh categories. Finding space for seasonal produce and adjusting the overall subcategory allocation across seasons is a key success factor. Demand also fluctuates based on the day of the week. Whereas variety and availability for fruits and vegetables should peak just before or during the weekend, the assortment should shrink both in size and variety on weekdays. This should also be reflected in the range offered, whereby a more premium offering is displayed on weekends and ramped down on Mondays.

For products produced in-store, production planning defines the assortment giving stores the flexibility to turn intraday demand patterns to their advantage. After the morning spike in demand for bread and fruit, for example, they could prepare for the lunch rush of premade sandwiches and on-the-go salads by repurposing the assortment. Using fresh produce at the brink of expiration for store-produced meals not only reduces waste, but also turns these products into higher-margin alternatives and improves offer perception.

Delivering early value

Average food wastage in fresh grocery retail stands at 5.5% of fresh revenue, according to Oliver Wyman analysis. The ability to bring this share down has direct implications for the bottom line while improving fresh perception has spillover effects for the entire store which will drive sales across categories. A best-in-class approach recognizes the differences in demand patterns and will tailor the assortment accordingly to curb avoidable waste while maintaining availability. For retailers wanting to reduce food wastage in fresh grocery retail and thereby improve fresh offer perception, we recommend ensuring data availability and quality which outlines sales trends for each product, at each store throughout the day. Once good data is available, the right tools and processes ensure that central assortment recommendations can be reviewed locally, and adjustments can be made as required. Once these prerequisites are in place, retailers can look at making the next steps to further enhance their fresh offering.