Supply chain disruption

An Investor’s Perspective On Warehouse Automation

By Tushar Narsana and Rishi Kinra

Until recently warehousing investment was characterized by generally slow growth in returns. Constraints included labor shortages, the predominance of manual processes, data management challenges, lower margins, and the difficulties in joining up pockets of automation. It was viewed as fairly unattractive from an investor’s perspective.

However, with the ascendancy of supply chain issues to the boardroom at almost all major companies that manufacture, sell and move products, warehousing automation has started to become a hot topic in the investment community.

While this trend was already apparent prior to COVID-19, the pandemic undoubtedly gave e-commerce a major boost as customers switched to online supply. That transition, combined with the impact of current international supply chain challenges, is driving the rapid evolution of logistics, as companies seek to become more agile and responsive to customer needs, including the demand for same-day or next-day delivery.

More fundamentally, technology is providing opportunities for advancement in warehousing automation. The continued and rapid evolution of robotics, automation, and artificial intelligence have been bolstered by the promise of Industry 4.0, increased investment by major players and the presence of automation startups. In sum, warehousing automation, and investing in technology that supports automation, is set for a step change.

The push for end-to-end warehouse automation

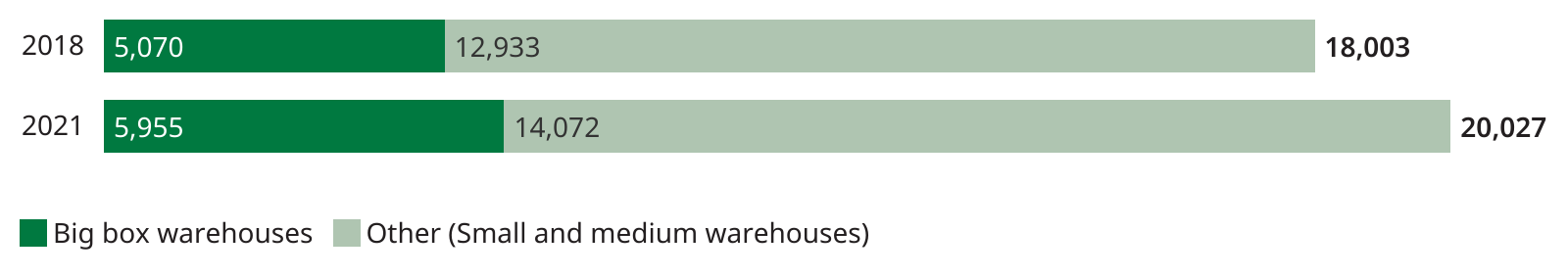

A major private equity firm recently acquired a large warehouse asset company with more than 50 million square feet across the world. The deal valued close to $20 billion, is just one example highlighting the increased interest in warehousing and warehouse automation. This interest is underlined by both big box and smaller warehouses seeing double digit growth in the three-year period 2018–21 (Exhibit 1).

Exhibit 1: US warehouse growth

Source: Statista, BLS

Warehousing investment opportunity

Somewhat surprisingly, according to Oliver Wyman research, approximately 80% of warehouses do not possess any automated systems whatsoever. This gap creates a significant investment opportunity, according to the report of a leading logistics and supply chain firm. The report predicts that the warehouse automation market is poised for accelerated growth and will reach $41 billion by 2027, with a compound annual growth rate (CAGR) of 15% in the period 2022-27 (Exhibit 2). This growth will be led by consumer markets in the major economies of the United States, China, and Germany.

Investment in warehouse automation is led by six industries: wholesalers, retailers, grocery, e-commerce, logistics, and manufacturing. Certain market segments such as e-fulfillment have been more attractive recently, while small warehouses incur limited investment. The investment growth in these areas is fueled by not only by the industry leaders, but also by investment banks and private equity companies, as three recent examples highlight:

- A major Japanese investment trust invested $2.8 billion in an automation provider geared to the e-commerce and grocery industries.

- A large e-commerce platform acquired an AI technology firm for $450 million, with the goal of extending its AI-enabled fulfillment network.

- The world’s largest online retailer created a $1 billion investment fund for advancing warehousing technology.

Exhibit 2: Warehouse automation market

$ Billion

Source: Logistics IQ

Opportunities in warehouse automation manufacturing

The warehouse automation market currently comprises fewer than 20 companies with revenue of $1 billion or more and another 20-30 companies with revenue between $200 million and $1 billion. While multiples vary depending on the offering, valuations of six to nine times revenue are possible for players with significant software solutions.

Warehouse automation companies can be broadly segmented into three types:

- Large or established, companies with a significant, and usually diversified presence in automation. This includes traditional hardware companies that have been expanding their artificial intelligence and machine learning (AI/ML) based solutions.

- Small and medium “pure-play” companies, such as those specializing in palletizers, automated storage, and retrieval systems.

- “New age” companies focused on robotics for uses such as picking and small parcel shipments.

The penetration of automation in warehousing appears to be at a tipping point due to the dramatic decrease in the cost of critical elements such as infrared sensors and machine vision sensors, combined with the emergence of new standards for operating systems. Oliver Wyman believes the number of companies will more than double by 2027, providing several interesting investment theses that include strategies such as consolidation of similar technologies, selling state-of-the-art technologies to large e-commerce retailers looking to gain a competitive advantage and selling cross-industry warehouse technologies like robotics and end-to-end automation.

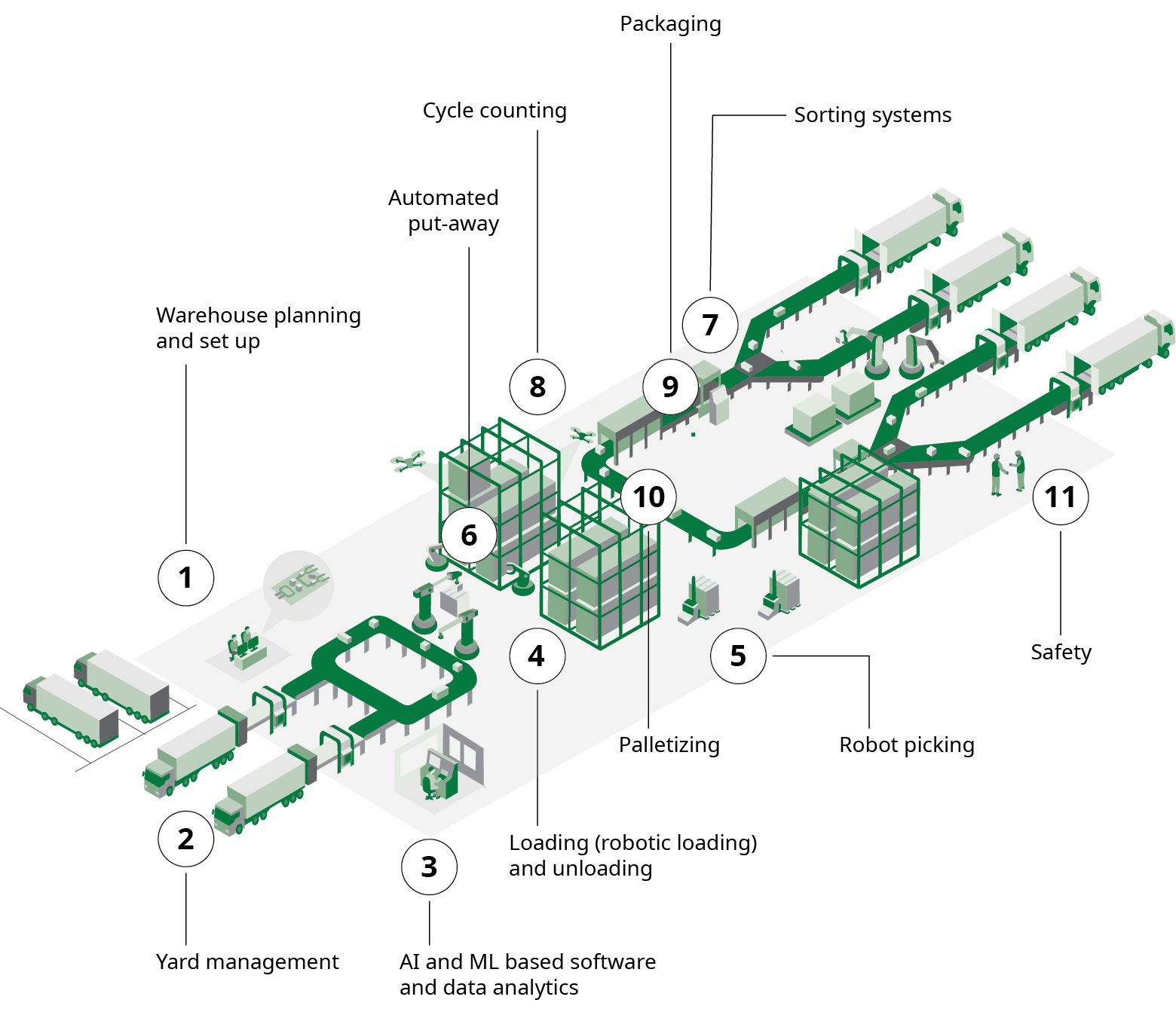

Exhibit 3: Overview of warehouse automation technologies

Source: Oliver Wyman analysis

The following provides an overview of the current state of development in warehouse automation focusing on the three key elements of software, data and connectivity, and hardware (Exhibit 3).

A. Software

- Warehouse set up: a “digital twin” creates a virtual replica of the warehouse. This assists planning and operations in improving processes in the warehouse management system (WMS).

- Yard management system (YMS): enables container location optimization and sequencing. It can be connected to existing enterprise resource planning (ERP) or WMS systems.

B. Data and connectivity

- Next-generation WMS systems: AI / ML capabilities enable faster decision making, responding to real-time developments, in pick and put-away process.

C. Hardware

- Robotic loaders and unloaders: enable efficient and fast loading and unloading of loads that meet service level agreements (SLA) and reduce warehouse injuries. The robotic systems can be fully autonomous or may require operator assistance.

- Mobile and assisted robotic picking: enable quick and efficient retrieval of totes and pallets. They use AI to adjust to different shelving configurations and rack types.

- Automated put-away: facilitated by a range of technologies including conveyors, automated guided vehicles (AGVs), radio frequency identification (RFID), and voice recognition.

- Sorting systems: include automatic sorting and retrieval systems that take parcels from conveyor belts to sort up to 500 locations. Scanner-based systems provide quality checks and identify the loading dock destination.

- Cycle counting: automated, robotic, drone-based, and handheld radio-frequency identification (RFID) scanner-based counting systems all greatly enhance inventory accuracy.

- Packaging: automated packaging systems located at the end of the line, such as box volume reduction, case formers, carton loaders, and case sealers, eliminate manual packaging.

- Palletizing and shrink wrapping: standalone robots are relatively low cost and accelerate palletizing and wrapping to increase throughput and productivity.

- Safety: All the above hardware automation opportunities directly or indirectly enhance the level of worker safety.

Conclusion

The tremendous growth in online shopping, coupled with demands for swift delivery, create opportunities for even more strategic investments to address labor shortages and optimize warehouse operations. Warehousing is one focal point, with investment paralleling the heightened interest in logistics. Notably, private equity injected $50.6 billion into logistics in 2021, marking a 34% rise from 2019. There is ample room for continued investment, especially in warehouse automation.