By Tom Cooper

This article first appeared in Forbes on January 28.

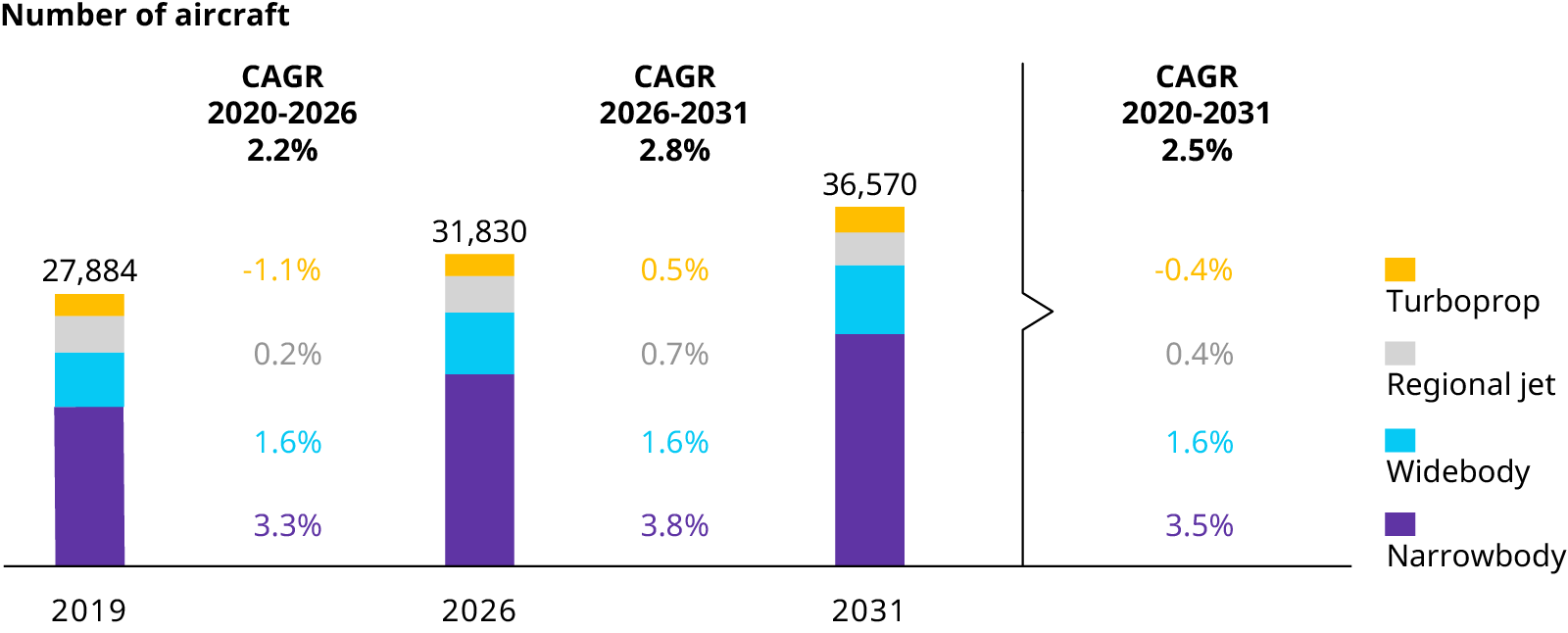

By 2031, the global aviation fleet will include over 36,500 aircraft. While higher than the currently depressed total of 23,700, it still falls 2,500 planes short of the 39,000 it was projected to reach in 2030 — that is, before Covid-19 sent the aviation industry into a tailspin.

While vaccines may help get Covid-19 under control over the next year or two, the aftermath of the disease that so far killed two million people worldwide will continue to curb growth for industries like aviation for the next 10. Airlines, aircraft manufacturing, and maintenance, repair, and overhaul (MRO) providers are now entering a decade of uncertainty, considerable financial pressure, and smaller than expected fleets because of the coronavirus pandemic. It’s a vicious cycle of less travel requiring smaller fleets, which in turn means that fewer aircraft need to be manufactured, and fewer planes repaired.

According to the latest Oliver Wyman Fleet & Global MRO Forecast 2021-2031, released today, preservation of cash will continue to be a top priority for all segments of the industry over the next few years. While most demand will recover before the middle of the decade, there are indications that some portions of travel may not fully get back on track even after that.

Except for airlines in China, where domestic travel returned to pre-pandemic levels by November 2020, global carriers will still burn millions in cash daily for much of the year — but probably not all of it. Some will face the unsettling prospect of restructuring and consolidation. In 2020, the International Air Transport Association estimated that global airlines would lose more than $118 billion that year and close to another $40 billion in 2021. Dozens of airlines sought bankruptcy protection or stopped flying entirely in the first year of Covid.

Aircraft Backlog To Work Through

In 2020, Covid-related pressure on airline cash flow and reduced demand for air travel led global carriers to put thousands of aircraft into storage, retire twice as many as normal, convert some into cargo planes, and cancel or defer some deliveries of new planes. Given the inventory backlog, more aircraft will be delivered to airlines over the next several years than will be produced by aerospace manufacturers. While production and deliveries are closely aligned in normal years, the imbalance reflects conflicting pressures on airframe manufacturers to balance the realities of lower market demand with needs of key suppliers to maintain enough production.

Other aerospace revenue also may be in jeopardy. The early retirement of planes may reduce aerospace sales of new parts because of increased competition from the surge in supply of used components and green-time engines harvested from retired aircraft. It will take as much as three years to work through the excess of used serviceable material.

For MRO companies, a smaller fleet translates into less work. Demand is expected to be 33%, or $60 billion, below combined pre-Covid projections for 2020 and 2021. While the market is beginning to recover, the long-term MRO growth trend is now roughly half of pre‑Covid expectations. Cumulatively, MRO demand is expected to be $95 billion lower over the forecast period.

Opportunities For Growth

Despite the reduced expectations for MRO, the compound annual growth of the sector between 2019 and 2031 is projected at three percent. The combination of near-term lower demand and long-term growth prospects has created an attractive environment for private equity investors, and interest in MRO is high.

The popularity of narrowbody aircraft is also on the rise. For years, the narrowbody share of the total fleet has increased as the improving range capability and attractive seat mile efficiency of the class have made the aircraft the choice of low-cost carriers. This trend is expected to continue as more airlines align fleets to the demand realities of Covid-19.

While forecasts for narrowbody production are 40% below 2018 levels for 2021, we expect the aircraft class to recover to within 10% of our original pre-Covid projections for the final years of the forecast period. One bright spot has been sales of A321LR, which remain strong even in the face of the pandemic. The aircraft offers sufficient range to serve routes that were previously flown with Boeing BA +1% 757s or widebody aircraft, as well as providing airlines increased flexibility in their scheduling.

Deliveries of narrowbodies in 2021 will also be bolstered by decisions from the Federal Aviation Administration and European Union Air Safety Agency to recertify the Boeing 737 MAX for commercial service. Other regulators are expected to follow suit. More than 20 737s have already made it into carrier fleets since the recertification, but there are 400 to 450 more MAX aircraft that were built in 2020 and sit in Boeing’s inventory waiting to be delivered or sold. In addition, the number of narrowbodies in the fleet will be expanded by the almost 400 737s that airlines have had in storage since the plane’s grounding in March 2019.

The Impact Of Less Business And International Travel

In contrast, widebody aircraft production has seen a significant decline because of Covid-19’s impact on long-haul travel demand. Over the forecast period, we expect widebody production to be as much as 40% below pre-pandemic expectations unless there’s a faster-than-expected recovery in long-haul routes.

International travel — which accounts for the bulk of long-haul — evaporated in the early days of Covid-19 and continues to be hard-hit, which has had implications for widebodies. Over the last year, nations around the world have been tightly regulating cross-border travel in an effort to keep out or at least contain the pandemic. Border closings and sudden requirements to quarantine for 14 days have discouraged travel between countries, with passengers fearful of being stranded or unable to get home. Under a new executive order from President Joe Biden, travelers entering the United States must provide proof of a recent negative Covid-19 test prior to entry — a requirement that already exists in some other countries.

Contributing to the decline in international long-haul travel has been the fall in business travel, the most profitable category for airlines. This is especially true on long-haul flights, on which executives often opt for premium seating.

Videoconferencing and teleconferencing have become attractive substitutes that allow companies to cut travel budgets, particularly for intracompany trips. Covid-19 has also forced many business conferences and trade shows to go virtual or be canceled entirely, eliminating another reason for executive travel. While most of this travel will eventually return as more people get Covid-19 vaccinations, it is unlikely to recover fully over the midterm.

Regional Jet Delays

Meanwhile, the regional jet class is facing multiyear delays for some of its latest models as new platforms encounter development problems and as clauses in US pilot contracts limit their use. Given that many regional jets will reach typical retirement age or cumulative utilization during the forecast period, we expect many to end up flying beyond historical thresholds to cover some of the demand for smaller commercial aircraft.

It’s no exaggeration to say that modern commercial aviation has never faced such a long list of challenges as Covid-19 has created. It will likely take several years to adjust the fleet to new realities, and even then, the industry will not regain over the next 10 years all that it has lost with the pandemic.

Ian Reagan, Chad Porter, Carlo Franzoni, and Faith Lee — all of Oliver Wyman — contributed invaluable insights and research to this article.