By: Scott McDonald and Rob Bailey

A version of this article previously appeared on the NACD blog, BoardTalk. This article appeared in BRINK News on September 29, 2020.

While it is often discussed in boardrooms as a major risk, climate change is also a business opportunity. The low-carbon transition creates opportunities for efficiency, innovation and growth that extend beyond high-carbon industries like energy and transport to all sectors. Companies can save energy and materials costs, serve new customer needs, enhance their reputations and better attract and retain talent — all as a consequence of working to reduce their emissions and those of their customers and suppliers.

Through their governance role, boards can help to ensure that climate opportunities are captured by reviewing corporate strategy and focusing on long-term value. This is truer than ever before as companies navigate the fallout from COVID-19 and plan for recovery: Executive teams are occupied with the “here and now” of operational and financial management, and boards will need to keep the pressure on management teams to engage with the strategic questions of what comes next. As we show below, those that apply a “green” lens to recovery planning could uncover trillions of dollars in low-carbon opportunities.

Cost Management

Green operations are lean operations, and companies with sufficient capital expenditure flexibility to make smart green investments can reduce their costs at a time when every dollar counts.

Research undertaken by Oliver Wyman and CDP, a nonprofit that runs the leading global climate-related disclosure system, found that European corporations are realizing significant operating cost savings from comparably modest spending on emissions reductions. Investments last year in low-carbon projects such as renewables and energy efficiency were expected to net companies $45 billion over the investments’ lifetimes — a savings of $20 for every metric ton of carbon dioxide equivalent avoided. The same is happening in the United States, where a 2017 analysis found that Fortune 500 companies were saving $24 per metric ton. Last year, U.S. corporations signed power purchase agreements with renewables developers that will bring 13.6 GW of clean energy into operation. This is equivalent to almost two-thirds of the generation capacity added in the United States last year (20.7 GW) — renewables, fossil fuels and nuclear energy included.

Greener operations can also reduce capital costs. The rapid growth in green lending — where use of proceeds is tied to specific low-carbon projects — and sustainability-linked lending — where borrowing costs are linked to sustainability performance, but with flexibility as to how proceeds are used — provides new opportunities to access cheaper finance. For example, Prologis, Avangrid, CMS Energy and Xylem have all agreed to new credit arrangements with interest rates linked to sustainability performance, and U.S. banks are targeting this new market for growth.

Capitalizing on Changes in Behavior

The pandemic has imposed changes in working arrangements and lifestyles that may create opportunities to increase green efficiency savings. For example, a shift to remote working may provide opportunities to reduce travel and cut office use and energy costs. However, more fundamental shifts in attitudes may also be underway.

Research firm IPSOS Mori found that more than half of Americans (59%) think that climate change is as serious a problem as COVID-19 and want to see it prioritized in recovery planning — a finding replicated across the world. Companies that capitalize on these attitudes may be able to enhance brand loyalty and increase market share among concerned consumers. Research by New York University’s Stern Center for Sustainable Business has found that sustainable brands have increased their share of the U.S. market during the pandemic, demonstrating this trend.

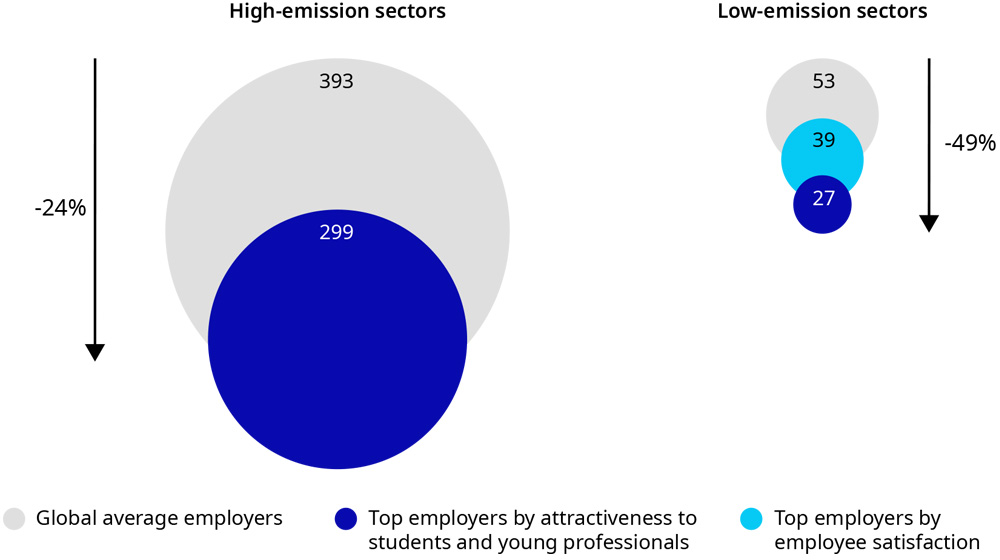

These dynamics are also relevant to workforces. Strong corporate environmental performance is associated with increased staff satisfaction and attractiveness to talent, with the most popular companies producing significantly lower emissions per dollar of revenues than their peers.

Average Employer Emissions Intensity for Popular Companies Compared to Peers

Metric tons of carbon dioxide equivalent per USD million revenue, 2019

Source: Marsh & McLennan, based on data from MSCI, Fortune and Universum

Put another way, companies with leading environmental credentials will be at an advantage when recovery takes off and the competition for talent heats up. The benefits will continue to increase well after the pandemic has waned, as the labor force becomes increasingly dominated by millennial and Gen Z cohorts who place a higher premium on employers’ climate credentials.

New Revenue Opportunities

The low-carbon transition is creating demand for new sustainable goods and services worth trillions of dollars across all sectors. The transportation sector has seen rapid growth in zero-emission vehicles and the explosion of new mobility services. By 2030, electric vehicles may account for 28% of global passenger vehicle sales; this year, Tesla became the most valuable car maker in the world, despite generating less than one-tenth of the revenues of the second-most-valuable company. In the United States, the green economy is already worth $1.3 trillion, and it is growing at over 20% a year. Fifty percent of recent growth in consumer packaged goods has come from sustainable product lines, while sales of plant-based foods — which generally have a significantly lower carbon footprint than animal-based alternatives — have grown at five times the market rate, to reach $5 billion. New financial products and services are emerging in response — Oliver Wyman estimates that revenues from sustainable finance could amount to $100 – $150 billion a year.

Even before the coronavirus hit, the multitrillion-dollar scale of the low-carbon business opportunity was abundantly clear. In 2018, 225 of the world’s largest companies reported over $2 trillion of climate-related opportunities from low-carbon goods and services, displaying the potential to gain new forms of competitive advantage from shifting consumer preferences. Last year, European companies alone identified $1.4 trillion of opportunities — more than six times the cost to realize them. With the United States having the largest green economy in the world, low-carbon opportunities for American companies should be larger still.

The Green Horizon

COVID-19 has not erased these opportunities. The immediate challenges of dealing with the crisis may distract from decarbonization efforts in the short term, and the pace of transition may be slowed if government stimulus plans favor high-carbon activities over low-carbon ones — by providing royalties relief for oil and gas companies rather than providing incentives for efficiency technology upgrades or electric vehicles, for example. But the final destination — a zero-emission economy — is inevitable. This is for the simple reason that climate change will stop only once net global emissions have reached zero. The transition has a long way to go and a lot more value to create.

With many management teams focused on tactical matters of survival in the wake of the coronavirus pandemic, directors have a critical role to play in making sure that strategies keep sight of the trillions of dollars to be gained from low-carbon opportunities on the other side of the crisis. The prize is only going to get bigger.