This piece was first published on June 3, 2020.

After several weeks of store lock-downs, and only very gradual store re-openings, the impact of COVID-19 on consumer goods businesses is becoming increasingly clear.

Apart from the immediate downturn in revenues, the crisis has driven structural changes to the way consumer goods markets will function going forward, with major implications for company Profit and Losses (P&Ls). Consumers have step changed adoption rates in the online channel — the result here has been a massive and adverse structural mix effect, impacting in the short- and longterm not only a manufacturer’s top line, but also gross profit rates. Oliver Wyman analysis points to a major shift in consumer demand towards relatively lower-priced products in online consumption. If this shift persists, consumer goods companies could well suffer an enduring loss of two to three percentage points in relative gross profit. These trends represent major threats to profitability, and even long-term viability. This article provides ten imperatives for consumer goods companies looking to manage the ongoing COVID-19 upheaval successfully.

The spread of the COVID-19 virus has generated unprecedented disruptions to daily life and economic activity. In a matter of weeks, the impact of these disruptions is emerging in sharp relief.

Retailers have not only suffered from immediate revenue losses, which are likely to be sustained, but also (massive) overstock. For the fashion industry, aging Spring collections no longer in demand lie piled on the shelves of thousands of stores. Due to these severe revenue losses, retailers will have no hope of achieving annual sales targets for 2020, and hence not receive substantial amounts of trade incentives from their suppliers.

Consumer preferences have changed with lightning speed over the past weeks, triggering a stream of knock-on effects for consumer goods companies. These changes are multidimensional, ranging from channel shifts in consumer buying behavior to lower consumer spend levels. They also have affected the specific product segments and features which consumers are now looking for. Consumer data across a range of countries tells a common story — consumer spending has moved strongly towards the online and mobile channels by between five and ten percentage points. In consumer electronics, for example, online penetration in Europe jumped from 18 percent pre-virus to a steady 30 percent and holding.

Consumer goods manufacturers have suffered not only from immediate revenue losses, as well as changes in consumer behavior — they also are reeling from what looks to be sustainable disruption in their P&L structure and economics. Long-term experience tells us that consumers purchasing online tend to be more price-sensitive, and less inclined to buy high-end products. If the channel shift proves to be structural, not only premium brands but essentially every branded player is can expect to experience adverse effects on structure and mix in their product architecture. If indeed retailers choose to shift volumes long-term away from the high-end products which are — in most cases — the true margin drivers for the industry, the economic consequences for consumer goods companies could be profoundly negative.

Despite the grim nature of the current situation, history has shown that companies can survive a crisis, and emerge stronger. We believe the companies which respond faster to the ongoing tectonic market shifts, who manage the crisis better, and who change their models effectively will win. But how? In the following, we provide our take on how best to navigate current stormy waters.

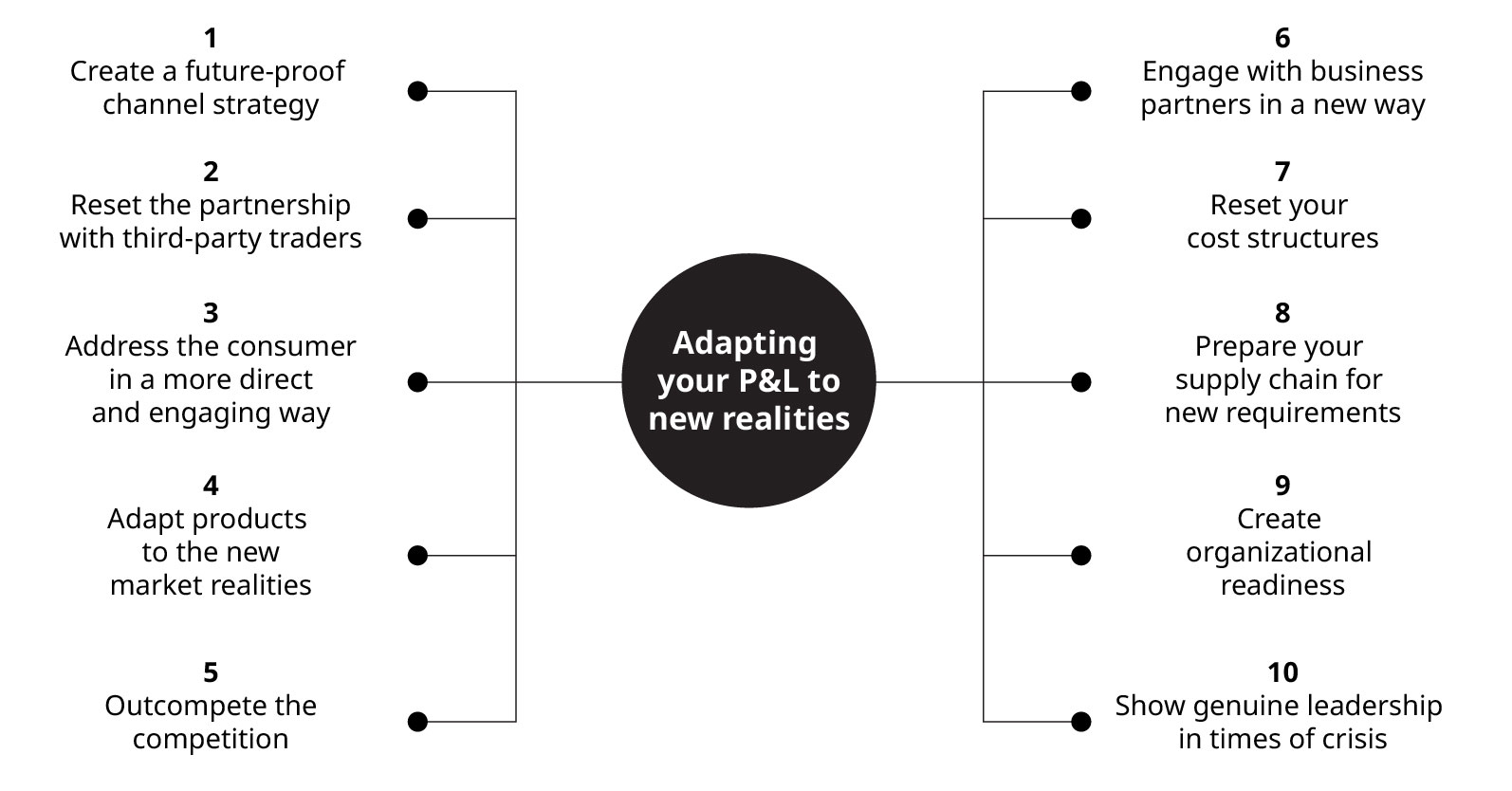

Ten Imperatives For Adapting Your P&L To New Realities