To avoid the worst impacts of climate change, global temperature rise must be limited to no more than 1.5°C, requiring global carbon emissions to decline to net-zero by the middle of the century. Accordingly, the EU has set a new target to reach net-zero emissions by 2050. Most of the low-carbon investment needed to achieve this goal must come from the private sector, so the extent to which European companies’ low-carbon investment plans are compatible with this objective is a critical question.

From new green infrastructure projects to electric vehicle fleets and renewable power, companies see new business opportunities in developing low carbon products and services that amount to over €1.2 trillionSteven Tebbe, Managing Director, CDP Europe

This report, jointly published by CDP and Oliver Wyman, aims to answer that question by examining European companies’ 2019 disclosures to CDP. For a set of 882 companies comprising over 70 percent of European market capitalization, the report analyses patterns in low-carbon investment by sector, the economics of emissions reduction initiatives and the critical question of whether corporate investment patterns are consistent with the net-zero goal.

Five key findings:

01. In 2019, 882 European companies responsible for over 2.3 GtCO2e of emissions reported €124 billion of new low-carbon investments to CDP.

New low-carbon investment in 2019

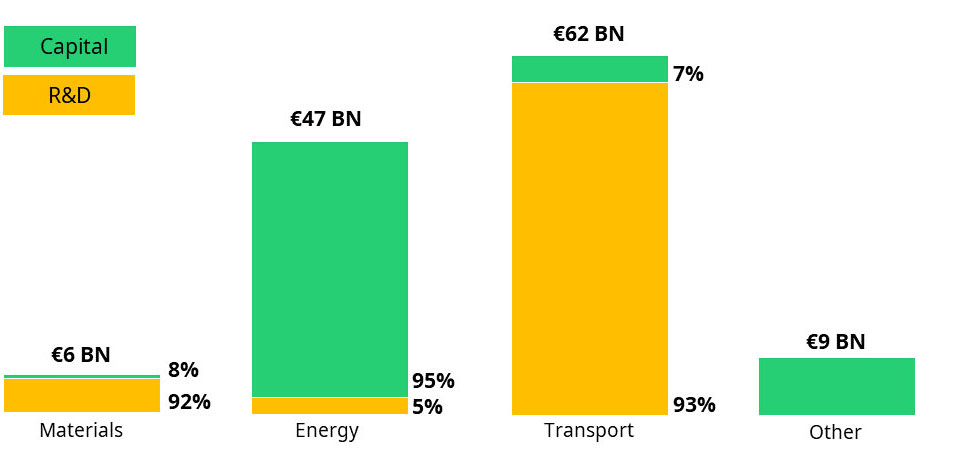

Low-carbon investment was driven by companies in the high-emitting materials, energy and transport sectors, accounting for 5, 38 and 50 percent respectively.

Capital investments comprised €59 billion, driven by electric utility investments of €45 billion in renewables, infrastructure and enabling technologies, such as demand-side response programs and digitalization. Research and development (R&D) investments amounted to €65 billion, of which €43 billion was reported by transport original equipment manufacturers (OEMs), primarily for investments in electrification and autonomous vehicle technologies.

Overall, transport sector R&D accounted for 46 percent of all low-carbon investment reported to CDP in 2019. Transformation of the power system and the electrification of road transport therefore dominated low-carbon investment, comprising over 70 percent of total investment between them.

02. More investment in transformational breakthrough technologies is needed – particularly in the materials sector.

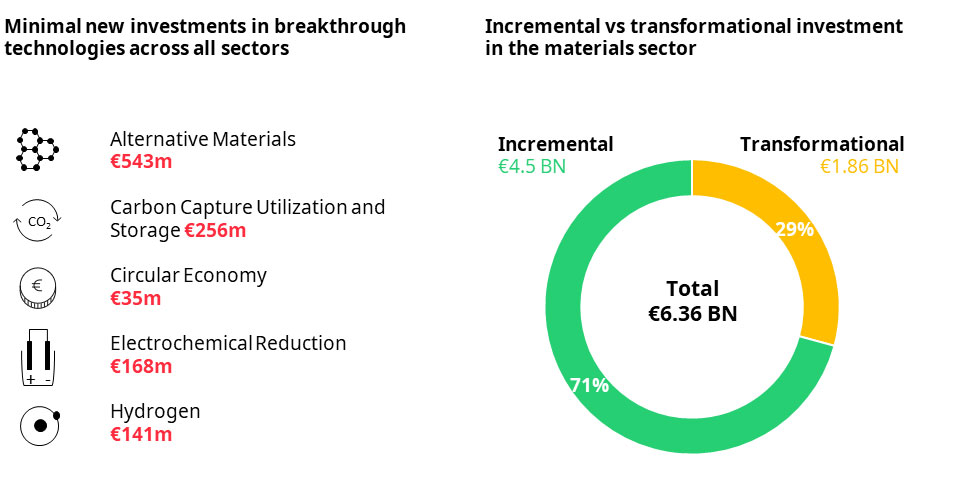

Transformation in the materials sector is further off

The materials sector accounted for only 5 percent of low-carbon investment despite being responsible for 35 percent of reported scope 1 and 2 emissions. Companies in the cement, chemicals, metals & mining and steel industries need to develop breakthrough technologies if they are to decarbonize in line with the EU’s ambitions, but new investments in technologies such as carbon capture, utilization and storage (CCUS) and hydrogen were small. For example, CCUS attracted 0.2 percent of total low-carbon investment in 2019 across all sectors, and hydrogen only 0.1 percent.

Minimal new investments were also reported for advanced biofuels and synthetic fuels, alternative materials and circular economy processes.

03. Low-carbon capital investment must double to place the European corporate sector on track for net-zero emissions by 2050.

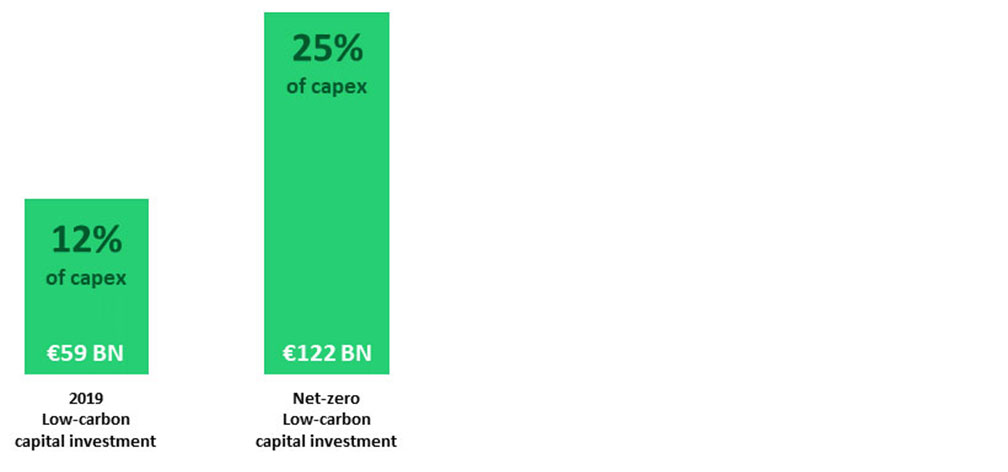

Low-carbon capital investment share required to reach net-zero emissions

The European Commission has proposed new emissions targets of 50-55 percent below 1990 levels by 2030 and ‘climate neutrality’ by 2050. This report uses CDP data on low-carbon capital investments and associated emissions reductions to estimate the annual capital investment required for companies to be on this pathway. It finds that total low-carbon capital investment among the reporting companies would need to more than double, from €59 billion in 2019 to around €122 billion a year.

While this is a significant increase, in the context of overall capital expenditure, low-carbon investment would still remain a modest share: growing from 12 percent to 25 percent of capex.

04. The business case for low-carbon investment is clear: companies expect to avoid 2.4 GtCO2e while contributing over €40 billion to their bottom line.

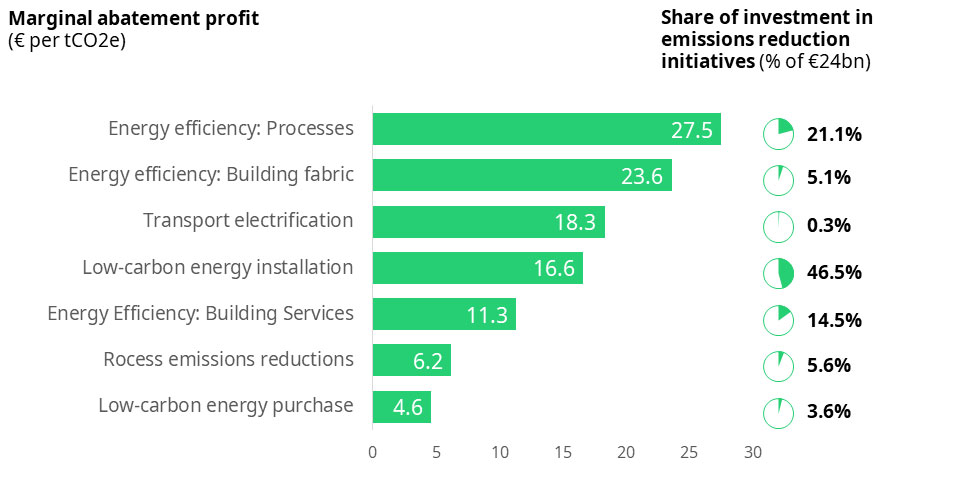

The top emissions reduction initiatives by marginal abatement cost

Emissions reduction initiatives offered attractive economics. Companies anticipated more than 2.4 GtCO2e of cumulative emissions reductions over the lifetime of their initiatives – more than the annual emissions of Germany, the United Kingdom, Italy, Poland and France combined – at an average profit of €17 per tonne of CO2e, reflecting the fact that emissions reduction initiatives typically yield cost savings in excess of the initial investment. In total, this represents a contribution to companies’ bottom line of more than €40 billion over the investments’ lifetimes. The most profitable emissions reduction initiatives were investments in energy efficiency processes, yielding average profits of more than €27 per tonne CO2e, but significant abatement profits were also anticipated from investments in transport electrification and low-carbon energy.

Companies also identified €1.22 trillion of new revenue opportunities from low-carbon goods and services – more than six times the investment needed to realize them.

05. Closing the low-carbon investment gap requires action on multiple fronts.

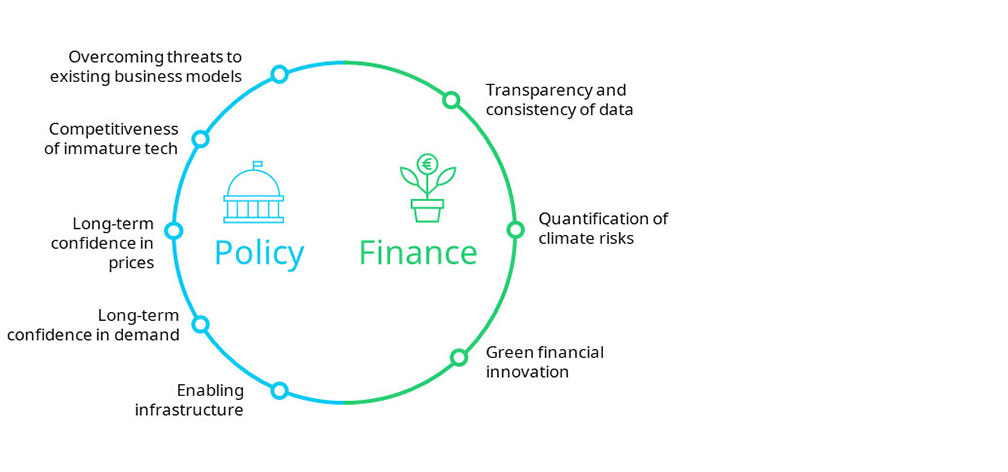

An agenda for policy and financial sector reform

In the public sphere, policies must address the unfavorable economics of immature low-carbon technologies, enable companies to overcome threats to existing revenue models and provide sufficient, long-term certainty for large transformational investments in capital intensive breakthrough technologies. Increased public financing is required to de-risk private investment and support the development of new infrastructure.

Reforms to improve transparency of climate-related data will help underpin efforts to incorporate climate risks into financial regulatory frameworks and develop transition risk modelling among financial institutions, ultimately helping to align capital allocation decisions and loan pricing with prevailing climate policies and regulations.

This is a bold and far-reaching agenda, but all of it falls within the scope of existing initiatives: The European Green Deal, The European Green Deal Investment Plan and The Action Plan on Sustainable Finance. Much will rest on the ambition, reach and effectiveness of the policies implemented under each.

Action on policies and regulation must be matched by action in the private sector, where the decisions to lend and invest will be taken. Among corporates, low-carbon investment decisions will be supported by emissions reduction commitments aligned with the EU's target of net-zero emissions by 2050, and the integration of climate into financial planning, strategic planning and corporate governance frameworks. Among financial institutions, continued innovation in green financial products is needed, in particular to ensure the transition financing needs of ‘brown’ sectors are met.