This was first published on April 14, 2020.

Recent coverage of the insurance industry’s response to COVID-19 has mostly focused on carriers. As insurers scramble to suspend policy cancellations and offer rebates (personal lines), extend or clarify business interruption coverage (commercial lines), and waive cost sharing (health and employee benefits), little attention has been paid to brokers’ response to the crisis.

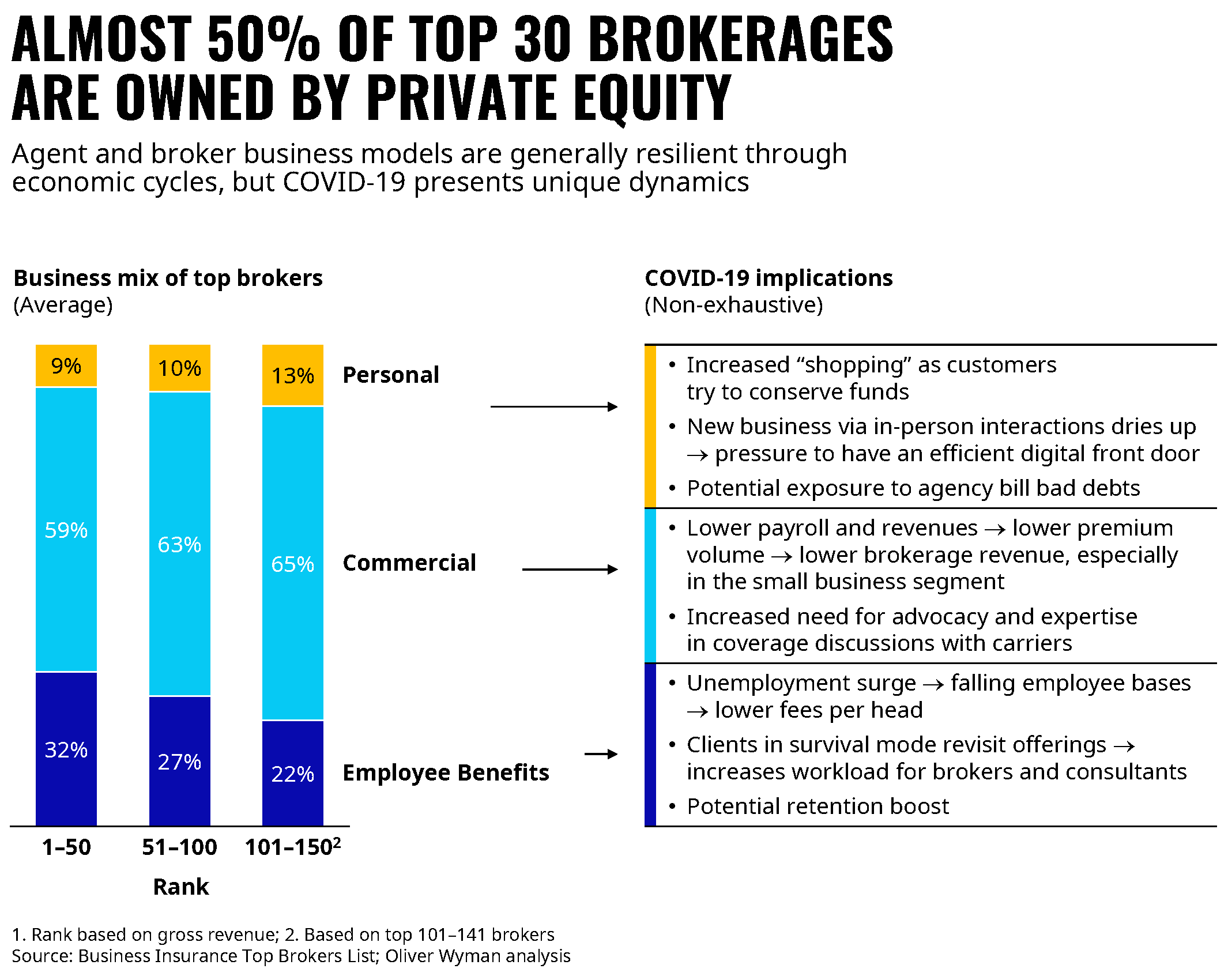

Approximately 50 percent of the top 30 insurance brokers are backed by private equity, and investors are trying to assess the impact of the crisis on their portfolios. Stock prices of the largest, publicly-traded brokers have dropped by 30 percent since February in anticipation of future strain on business volume, commissions, and operations. While most independent agents and brokers’ revenues are skewed towards commercial lines, accounting for about 60 percent of business, many also have exposure to personal lines, making up about 10-15 percent of business, and employee benefits, estimated at 25-30 percent of business.

The below outlines some of our observations across segments.

Personal lines

We expect limited immediate profit and loss (P&L) impact for brokers, but the crisis is expected to further accelerate the shift to digital and direct distribution.

Our observations:

- A sharp decline in auto and home claims volumes during the crisis may drive a positive impact on short term contingency agreements and thus, revenue for brokers.

- At the same time, carriers are suspending premium payments or handing back premiums, which may impact commissions.

- We are also expecting an uptick in shopping behavior as consumers are looking to manage the cost of insurance.

- More traffic will look to digital channels as social distancing remains in place (and will ‘stick’ afterward).

Solutions:

- Expand call center capacity, if not provided by carriers, to deal with inbound requests.

- Review digital capabilities and consider partnering with insurtechs to source leads and process applications.

- Pro-actively contact carriers to discuss potential changes to commissions, as carriers shape their response to the crisis.

Commercial lines

There is pressure on economics but opportunity to prove value as trusted advisor.

Our observations:

- Small businesses are hit hard in the current crisis, eroding premium and commission volume, combined with potential for business interruption claims to impact contingency arrangements tied to loss ratio.

- Corporates are also looking to brokers to help them navigate coverage discussions with carriers.

- The urgency of the crisis puts significant strain on brokers’ systems and staff.

Solutions:

- Brokers should focus on customer support – this is the time to prove the value of the relationship model.

- Support should include simple tools, guidelines, and resources companies can turn to, such as readily available answers to policy coverage FAQs.

- At the same time, brokers need to look after producers and support staff. Many field offices are not well integrated, and providing internal guidelines and incentives are crucial to guarantee the best possible client outcomes.

Employee benefits

Anticipating a drop in employee numbers and risk of an increase in plan costs.

Our observations:

- A spike in unemployment reduces employee base, and we expect a number of smaller organizations to go out of business.

- Brokers are also reporting increased inquiries on plan design to reduce plan costs, both for the insured and self-insured.

- Beyond benefits, more consultative approaches to addressing broader personnel issues will be critical to supporting client needs.

Solutions:

- Per commercial lines recommendations

- However, given that healthcare accounts for 50 percent or more of employee benefits (EB) volume, brokers need to ramp up communication around cost for COVID-19 related treatment, testing, and other expenditures.

- Separately, many plans require that employees have medical exams done as part of the underwriting. Brokers should consider options to move to non-medical product options and tech-enabled testing while social distancing measures are in place.

About the authors

Matt Leonard is a Partner and Chicago Metro Leader at Oliver Wyman and a member of the firm’s Insurance and Corporate Finance & Advisory Practices.

Ben Dietl is a Principal at Oliver Wyman and a member of the firm’s Corporate Finance & Advisory Practice.