NEW TACTICS ARE REQUIRED TO COPE WITH CROSS-BORDER ARBITRAGE RISK

Buyers are increasingly crossing borders in search of lower prices. Consumers are hunting deals online or across neighboring countries for toys, consumer appliances, and electronics. Retailers are generating savings by making their purchasing and selling operations more professional and more international – for example by forming international purchasing alliances or by optimizing sell-in prices systematically across a retailer’s country organizations. In Europe, the resulting arbitrage risk for consumer goods manufacturers amounts to a fifth of total market size, according to an Oliver Wyman study. This endangers the financial performance – and even the survival – of many consumer goods makers. There are various ways to combat these trends, in particular through the smart, holistic management of trade spend. Overspending on trade investment is still common, especially in online channels. But it can be minimized by making more deliberate allocation choices through greater transparency. Many top consumer goods companies operate with a central platform that collates trade spend information from different markets and channels, both for reporting purposes and to inform decisions throughout the organization. To make it clearer what kind of deal trade partners are likely to be content with, the platform usually also comprises data about their margin requirements, based on a reverse-engineering exercise. A trade spend grid can then help to manage allocation across borders and channels, using central guidelines and pay-for-performance objectives for customers. These operations have to become part of an international trade spend organization which usually also aims to harmonize prices across neighboring countries. In addition, manufacturers can differentiate their products and brands for different markets, making it harder for retailers to demand cross-border negotiations. The threat from international arbitrage comes amid massive disruption in the retail sector. Traditional retailers are under mounting pressure from online competition, and their biggest cost is that of goods for resale. So they are internationalizing their sourcing to take advantage of international price differences. While consumers were the first to take advantage of the price differences in durable goods, retailers have now identified the potential too – and they are doing the same in fast-moving consumables such as food and drinks. Consumer goods companies will need to take an increasingly international perspective to avoid being outplayed. That implies developing new capabilities and tools and reviewing the setup of their commercial organizations. So far, the absence of a holistic, internationally coordinated approach to trade spend management has created a significant arbitrage opportunity for retailers and consumers alike.

SOURCING BECOMES PROFESSIONALIZED, INTERNATIONALIZED

Retailers are under pressure from the spread of e-commerce and the rise of discounters. Furthermore, price comparison engines provide consumers with increasing transparency on price levels at different retailers, which has intensified competition.

Exhibit 1: The retail landscape is changing, and so are trade spend requirements

Amazon and the discount retailers have built up sophisticated cross-border buying capabilities. Many retailers are following the example and consolidating purchasing in their own international operations, as well as joining retail alliances and buying groups. A series of cross-border mergers and acquisitions has helped retailers optimize their sourcing in segments including food, beauty and healthcare, and consumer electronics. One reason retailers can profit from international sourcing is the inability of many consumer goods companies to manage pricing internationally due to their lack of a systematic mechanism for pricing across markets. The consequent arbitrage risk, from retailers sourcing products at lower prices in different markets, is an average of 20 percent for branded goods. As an example, for grocery retailers that amounts to a commercial risk exposure of more than 30 Billion euros in European markets alone, according to an Oliver Wyman comparison of cross-border prices in several fast moving consumer goods categories.

Exhibit 2: 20% of branded consumer goods revenues may be at risk from cross-border purchases in grocery retail1

1 Spirits, confectionaries, soft drinks, homecare

2 18% total market size incl. own label

Source: Euromonitor, Oliver Wyman analysis

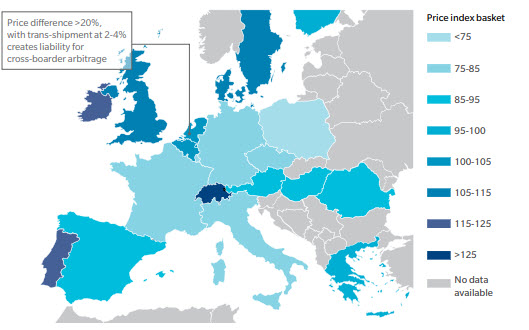

In addition to the arbitrage risk from retailers engaging in cross-border sourcing, there are challenges from consumer price differences. Price comparison portals and deal sites are providing a new level of market transparency, while mega-platforms like Amazon legitimize those prices and accelerate their changes. This threatens the efficacy of promotions and of domestic pricing models. Health-and-beauty care products, for example, are over two-thirds more expensive in some European markets than in others. (See Exhibit 3.) On average, prices of a range of identical consumer products can be 1.5 times higher in some European markets than in others.

Exhibit 3: Cross country comparison of consumer retail prices for selection of products – H&BC

Source: Retailer websites. Oliver Wyman analysis. Prices before VAT

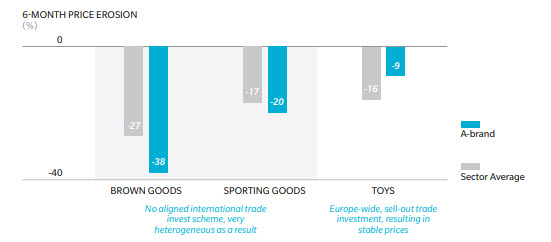

An industry of small- and medium-sized businesses is leveraging these arbitrage opportunities by shipping goods across markets, thus creating price conflicts. In addition, price-matching algorithms, such as those developed by Amazon, are putting pressure on retailers to match prices outside the markets they operate in. If any product becomes available online for a lower price – perhaps due to uncoordinated international pricing by manufacturers – other retailers will quickly have to match this. The price pressure is especially strong in more-expensive products such as consumer electronics and spirits. To compensate for the margin loss, retailers demand additional discounts of various kinds from consumer goods companies. Moreover, brand perceptions are threatened if consumers get used to cheaper prices for certain products. Mass-market brands – or “A-brands” – are prime targets: As retailers like to promote them aggressively to create traffic, cross-border price imbalances trigger price erosions especially quickly. (See Exhibit 4.)

Exhibit 4: A-brands are especially vulnerable to price erosion

Example Germany

Source: Retailer websites, Oliver Wyman Analysis

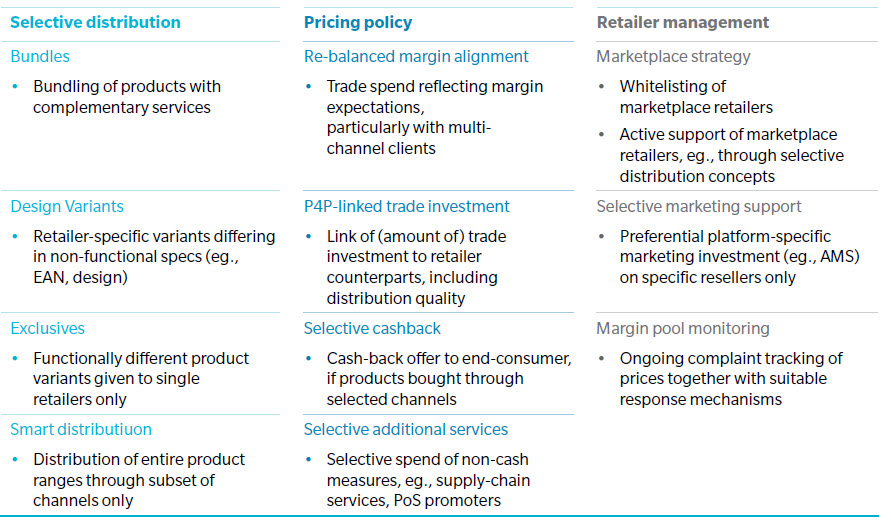

CONSUMER GOODS COMPANIES NEED TO MOVE FAST

Some consumer goods companies have found their way to deal with these challenges. There is no silver bullet, but we have identified a myriad of non-exclusive tactics. These include offering a portfolio of differentiated products for different markets; harmonizing prices and trade conditions throughout Europe; and more closely managing the retailer relationship. These tools depend on a strong and consistent trade invest management scheme, which should include both fundamental capabilities and more-specific measures. (See Exhibit 5.) However such a scheme is implemented, it needs at a bare minimum to be able to justify price differences across markets and channels.

Exhibit 5: Holistic international trade spend approach

THE FUNDAMENTALS OF TRADE INVESTMENT MANAGEMENT

1. End-to-end transparency: Transparency is a key enabler of successful trade spend management. But many manufacturers with international operations have no comprehensive overview of 3-net prices – the prices of goods after recurring discounts – paid for their products in different markets. The main problem: Trade terms differ from market to market, as do conditions for offering these terms. In France, for example, promotional discounts are capped by law – so other discounts are used to compensate. In Spain, unconditional permanent price reductions tend to be far higher than in other southern European markets. A first step for manufacturers is to get a standardized, comprehensive view across different markets of which retailers are being given what level of discount.

2. A harmonized trade invest grid with pay-for-performance: A harmonized trade spend grid is a basic requirement. Trade spend management is a complex process with multiple objectives – and it is usually iterative, so constantly needs updating. The grid should be harmonized so that trade conditions in different markets are represented in a common language, making comparisons easier. Best-in-class consumer goods companies operate with a central platform that collates trade spend across different markets and channels. This transparency improves decision making at all levels, as well as serving for reporting purposes. A large part of current trade spend consists of unconditional discounts: Prices are reduced for a particular retailer – for example, because of its size – irrespective of how that retailer then proceeds to sell the goods. But it is smarter to offer discounts with a counterpart – that is, making them conditional upon, say, presenting the products in a certain way or meeting volume targets. So, when central and local teams allocate funds for different customers, they can also define pay-for-performance objectives, which should fit the manufacturer’s wider strategic objectives. Mechanisms will be needed to enforce pay-for-performance agreements in a coherent, consistent manner. The manufacturer might, for example, dispatch staff to check that retailers are meeting the conditions. The proportion of discounts offered with and without counterparts will vary greatly between markets. In some cases, the counterparts may be ineffective and not lead to better collaboration – if, for instance, a sales target is too easy to achieve; or if a retailer has to display at least three products of a brand, when it is already displaying five.

3. Active steering and governance: To ensure active management of trade spend in individual markets, a suitable governance structure will need to be put in place. Local organizations will have to keep track of performance and feed information back to a centrally maintained data platform. Central guidelines should be set for the allocation of trade spend in different channels and markets – both physical and online, and including the internationally operating retailers. The allocation will depend on several factors. One is corporate strategy – where the manufacturer wants to grow. Others are a brand’s contribution and market performance – that is, where a product’s main growth is happening. A trade fund allocation tool can be a great asset in determining optimal trade allocation.

4. Creating an international trade spend organization: Grocers are increasingly participating in international buying alliances. Others, such as Lidl and Amazon, are operating a similar system in their own organization. Alliances with more than five members have historically focused on negotiating discounts based on their large combined volumes of the range of a manufacturer’s products. Recently, however, smaller alliances of two to four retailers – EURELEC and Envergure, for example – have started to negotiate the prices of individual products. Consumer goods companies, too, need a more coordinated approach. This should have a central team that collects and analyzes trade spend data in order to produce insights on different markets and channels. The central trade team will help to standardize trade-spend structures, definitions, and processes. It will also be responsible for allocating funds to different markets and channels based on their strategic objectives. And it will provide parameters – such as maximum prices – for local teams when they are negotiating with local customers. The central team will get increasing responsibility for managing international clients and buying groups, while local teams negotiate with local retailers.

Exhibit 6: Consumer goods companies can pull many levers to improve price consistency

RETAILERS ARE MOVING FAST AND MANUFACTURERS NEED TO AS WELL

Product manufacturers need to build new capabilities to deal with the increasing internationalization and sophistication of retailers’ operations. There is no single formula, but the starting point is to create transparency in trade spend as a way of understanding where a manufacturer is vulnerable and where opportunities lie. Then, there are numerous tools that can help combat the threat, and it’s up to each manufacturer to figure out the ones which will work and to combine them effectively. In some cases, they will have to make trade-offs. If, for example, a manufacturer harmonizes prices across the EU, its products will end up being relatively pricey in some countries. It will then have to figure out the optimum balance between margin stability and volumes. Whatever manufacturers decide, they will need to act fast. If they don’t, retailers will outsmart them, and large areas of their business will be at risk.