Ford is reallocating $7 billion from cars to build more sport utility vehicles (SUVs) and trucks. Fiat Chrysler Automobiles is expanding its Jeep SUV brand, and General Motors has closed five plants that produced conventional passenger cars. Low gasoline prices mean cars are out and pickup trucks and SUVs are in – for now.

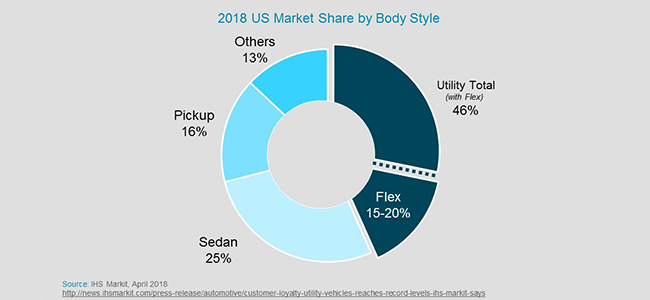

But what would happen if gas prices suddenly increase? Our research suggests that 15 to 20 percent of the light truck market – as many as 3.4 million vehicles – might swing back to cars if prices rise high enough. (See Exhibit 1.) Likewise, how will consumer tastes change, for instance, when more moderately priced options in electric vehicles (EVs) become available in the United States over the next few years? Or when fully autonomous vehicles begin to hit the road in earnest sometime in the next decade? The answers are far from a slam-dunk, so automakers need a plan to deal with the current level of market uncertainty.

Exhibit 1: 2018 US Market Share by Body Style

Preparing for when customers change their minds.

In this transitional environment, US manufacturers require both long-term strategies focused on new technologies like electrification and autonomy and short-term ones to remain flexible and agile to accommodate swings in the market. With so many uncertainties, the only way to avoid stranding investment capital may be to incorporate agility into every phase of production and design as a form of risk management.

1. Agile platform sharing Manufacturers can increase the number of shared platforms across vehicle lines; it is already common to have the same size car and crossover built on the same line. Similarly, they now share powertrains widely across segments, blurring the historical distinctions between cars and light trucks. Another possibility is for automakers to share platforms across regions to limit the need for imports and exports. Given today’s uncertainty concerning global trade and tariffs, such a strategy could reduce the risks caused by policy changes as well.

More companies are leveraging modular design strategies which offer the ability to build wider varieties of vehicle sizes and types on the same platform. Modules can reduce product development times, keep plant investment costs down during new model launches, and make manufacturing processes more consistent and streamlined. Likewise, modular platforms can enable greater global reach across brands and entities within a company.

2. Agile manufacturing strategies With dedicated car or utility-vehicle plants and a few potentially flexible ones, how quickly could a manufacturer change its vehicle mix if the market changed tomorrow? The most flexible mass-market automakers have worked for years to develop the capability to build different products on the same line, moving products from line to line and plant to plant successfully and rapidly. Given the last decade’s market volatility, North American automakers cannot afford to dedicate plants to SUV or pickup production without the flexibility to change products if the market shifts

3. Agile product development As demands for new products become sharper and consumer technologies permeate the vehicle, successful automakers have made their product development processes more agile, especially in terms of time to market. The link between product development and manufacturing could also increase agility during these uncertain times.

Each automaker will respond to risk differently, adopting modular platforms, consolidating product lines, or perhaps delaying action until the last minute. Whichever approach companies take, change is coming, and only those with agility baked into their production, design, and organization are likely to win in this uncertain new environment.