Companies such as Amazon simply refuse to play the traditional game. The company systematically assesses trade terms throughout Europe and buys at the absolute lowest price across markets. Amazon is not alone – others are doing it too. Retailers are becoming more sophisticated, forming international buying alliances that allow them to cherry-pick across markets and cut prices further. Adding to the CPG headache, consumers are also buying internationally, enabled by the internet and regulatory changes. Our research indicates that the resultant arbitrage risk for CPG companies is up to a fifth of total market size. The threat is substantial and, for some, existential: It is a race for superiority, accelerating all the time.

A RADICALLY DIFFERENT RETAIL LANDSCAPE

The retail landscape is undergoing radical change – and with it, trade-spend requirements. Retailers, under pressure from e-commerce and discounters, are becoming more sophisticated so as to survive the onslaught of e-commerce and discounters. With online sales exploding, even legacy brick-and-mortar retailers are seeing more and more of their sales move online and they are putting greater emphasis on that part of their business. Even smaller retailers are gaining greater visibility into price differentials, thanks to marketplaces.

Retailers in particular are besieged by the spread of e-commerce and rise of discounters. Furthermore, price comparison engines provide consumers with increasing transparency on price levels at different retailers, which has intensified competition.

International retailers like Amazon and the grocery discount retailers have built up sophisticated cross-border buying capabilities. And retailers are now following suit, consolidating purchasing in their own international operations, as well as joining retail alliances and buying groups. Sourcing is becoming more professionalized and internationalized: A series of cross-border mergers and acquisitions has helped retailers optimize their sourcing in key segments including food, beauty and healthcare, and consumer electronics.

CROSS-BORDER ARBITRAGE EXPOSURE

One reason retailers are able to profit from international sourcing is the inability of many CPG companies to manage pricing internationally due to their lack of a systematic mechanism for pricing across markets. Historically, CPG makers have operated their businesses on a market-by-market basis: So, the sales organization in Germany, for example, only focuses on German retailers, while the Netherlands is served by a separate sales team. As a result, different sets of conditions and prices apply to the two countries.

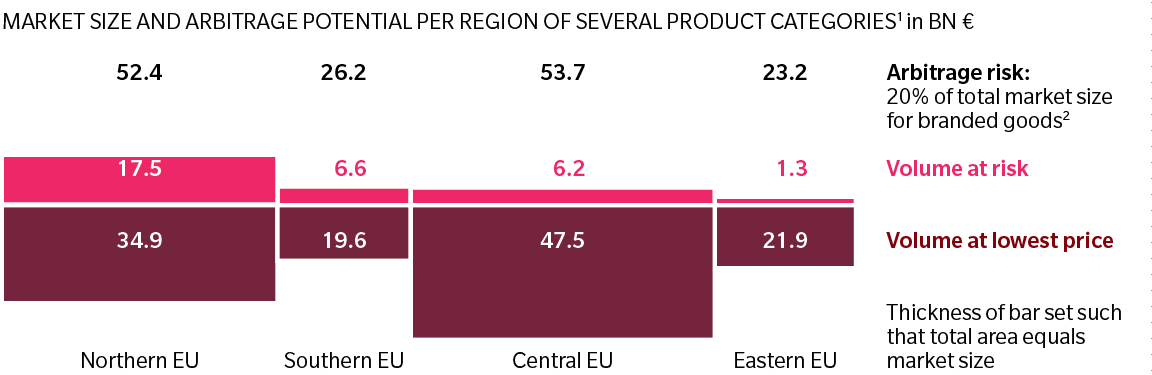

This has given rise to a growing risk exposure for branded goods. The arbitrage risk from retailers sourcing products at lower prices in different markets is 20 percent on average for branded goods (Exhibit 1). For grocery, that amounts to a commercial risk exposure FOR SUPPLIERS of more than 30 billion euros in European markets alone, according to an Oliver Wyman analysis of several fast-moving consumer goods categories.

Exhibit 1: 20% of branded consumer revenues may be at risk from cross-border grocery retail purchases

Source: Euromonitor, Oliver Wyman analysis

THE CHALLENGE OF THE SOPHISTICATED CONSUMER

In addition to cross-border sourcing arbitrage risk, there are challenges posed by the differences in consumer prices. Price comparison portals and deal sites provide a new level of market transparency, while mega-platforms like Amazon legitimize those prices and accelerate their changes. This threatens the effectiveness of promotions and domestic pricing models. On average, prices of a range of identical consumer products can be 1.5 times higher in some European markets than in others. Beauty and healthcare products, for example, are over two-thirds more expensive in some European markets than in others (Exhibit 2).

An army of small- and medium-sized businesses has sprung up, leveraging these arbitrage opportunities by shipping goods across markets, thus creating price conflicts. In addition, price-matching algorithms, such as Amazon’s, have pressured retailers to match prices outside the markets they operate in. If any product becomes available online for a lower price – sometimes as a result of uncoordinated international pricing by manufacturers – other retailers quickly have to match this.

Exhibit 2: Cross-country comparison of consumer retail prices for select beauty and healthcare products healthcare

Source: Retailer websites, Oliver Wyman analysis, Prices before VAT

TARGETING THE A-BRANDS

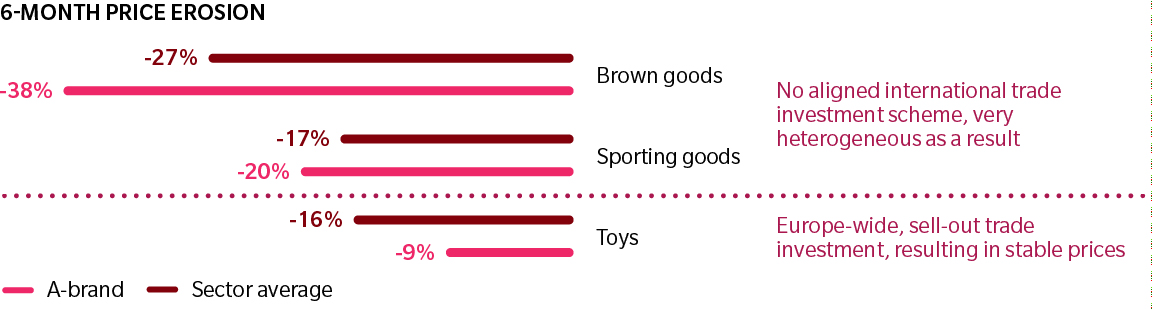

The price pressure is particularly intense in the more expensive product categories, such as consumer electronics and spirits. To compensate for the margin loss, retailers demand additional discounts of various kinds from consumer goods companies. Discounting comes with its own set of challenges, as brand perceptions are threatened if consumers get used to cheaper prices for certain products. Mass-market brands – or “A-brands” – are prime targets: As retailers like to promote them aggressively to create traffic, cross-border price imbalances trigger price erosions especially quickly (Exhibit 3).

Exhibit 3: A-brands are especially vulnerable to price erosion, Example Germany

Source: Retailer websites, Oliver Wyman analysis

TRADE-SPEND MANAGEMENT: A SIX-STEP PROGRAM

CPG companies need to get their act together and understand how they are making their money and where they are making it. But doing that calls for fundamental transparency allowing them to see and know what their products sell for in one market versus another – something they are currently in the dark about. Many CPG companies lack transparency around how much an article sells for in one market versus another: A six-pack of beer may sell for 25 percent less in the UK than in France, posing a considerable arbitrage risk to the CPG maker. While some consumer goods companies are wrestling with and dealing with these challenges, there is no silver bullet. But our work has seen the emergence of a powerful tactical framework and toolkit to help companies regain the initiative: Effective measures include offering a portfolio of differentiated products for different markets; harmonizing prices and trade conditions throughout Europe; and more closely managing the retailer relationship. All of these initiatives depend on a strong and consistent trade invest management scheme, which must include both fundamental capabilities and specific measures (Exhibit 4).

Exhibit 4: Holistic international approach to improved trade spend

.jpg)

Source: Oliver Wyman

SIX FUNDAMENTALS FOR MANAGING TRADE INVESTMENT

1. END-TO-END TRANSPARENCY

Transparency is a key enabler of successful trade-spend management. But many manufacturers with international operations lack a comprehensive overview of 3net prices – the prices of goods after recurring discounts – paid for their products in different markets. The main problem: Trade terms differ from market to market, as do conditions for offering these terms. In France, for example, promotional discounts are capped by law, so other discounts are used to compensate. In Spain, unconditional permanent price reductions tend to be far higher than in other southern European markets.

Step One: Achieve a standardized, comprehensive view of the discounts that retailers are being given across all markets.

2. A HARMONIZED TRADE-INVESTMENT GRID

WITH PAY-FOR-PERFORMANCE:

Trade-spend management is a complex process with multiple objectives – and it is usually iterative, so constantly needs updating. A harmonized trade-spend grid is a basic requirement. The grid should be harmonized so that trade conditions in different markets are represented in a common language, making comparisons easier.

Best-in-class consumer goods companies operate with a central platform that collates trade spend across different markets and channels. This transparency improves decision-making at all levels, and helps with reporting. A large part of current trade-spend consists of unconditional discounts: Prices are reduced for a particular retailer – for example, because of its size – irrespective of how that retailer then proceeds to sell the goods.

But it is smarter to offer discounts with provisions – making them conditional upon presenting the products in a certain way or meeting volume targets. So, when central and local teams allocate funds for different customers, they can define pay-for-performance objectives, which should fit the manufacturer’s broader strategic objectives. Mechanisms will be needed to enforce pay-for-performance agreements in a coherent, consistent manner. The CPG maker might, for example, dispatch staff to check that retailers are meeting the conditions. The proportion of discounts offered with and without stipulations will vary greatly between markets. In some cases, those terms may be ineffective and not lead to better collaboration – if, for instance, a sales target is too easy to achieve, or if a retailer has to display at least three products of a brand, when it is already displaying five.

Step Two: Develop a harmonized, unified trade-investment grid that presents and compares trade conditions in different markets in a straightforward way.

3. ACTIVE STEERING AND GOVERNANCE:

A governance structure will be needed to ensure active management of trade spend in individual markets. Local organizations will have to keep track of performance and feed information back to a centrally maintained data platform. Guidelines should be set for the allocation of trade spend in different channels and markets – both physical and online, and including the internationally operating retailers. The allocation will depend on several factors. One is corporate strategy, where the manufacturer wants to grow. Others are a brand’s contribution and market performance, namely where a product’s main growth is happening. A trade fund allocation tool can be a great asset in determining optimal trade allocation.

Step Three: Establish a governance structure for overseeing trade spend in different markets.

INTERNATIONAL TRADE-SPEND MANAGEMENT CAPABILITIES

4. CREATING AN INTERNATIONAL TRADE-SPEND ORGANIZATION

Grocers are increasingly participating in international buying alliances. Others, such as Lidl and Amazon, are operating a similar system in their own organization. Alliances with more than five members have historically focused on negotiating discounts based on their large combined volumes of a manufacturer’s products. Recently, however, even smaller alliances of two to four retailers – EURELEC and Envergure, for example – have started to negotiate product prices.

Consumer goods companies, too, need a more coordinated approach. This should have a central team that collects and analyzes trade-spend data in order to produce insights on different markets and channels. The central trade team will help to standardize trade-spend structures, definitions, and processes. It will also be responsible for allocating funds to different markets and channels based on their strategic objectives. And it will provide parameters – such as maximum prices – for local teams when they are negotiating with local customers. The central team will get increasing responsibility for managing international clients and buying groups, while local teams negotiate with local retailers.

Step Four: Create a centralized trade-spend team to align terms and coordinate cross-country trade investment.

5. A STRATEGY FOR INTERNATIONAL KEY ACCOUNTS AND BUYING GROUPS

Once a central team has been established, it will be in a position to leverage insights across markets and deal with international clients and buying groups. The insights can be used to allocate trade spend based on growth potential and the channels the retailer is active in, and how these contribute to strategic objectives. Prices across markets and channels can be standardized to varying degrees. They can be fully harmonized across markets, or they can be made consistent within pricing corridors so that any price differentials are so small that it will not be worth transshipping products across borders.

Step Five: Develop a growth-driven strategy allocating trade spend for key accounts and buying groups.

6. A TOOLKIT TO MITIGATE INTERNATIONAL PRICE ARBITRAGE

The first step to deal with international price arbitrage is to establish which product areas are at risk. Once the largest threats have been identified, mitigation measures can be selected that best fit the company, brand strength, and positioning. An array of different levers is available in three groups (Exhibit 5). The first group is related to selective distribution, which includes design variants: Several A-brand product manufacturers offer larger pack sizes to Lidl than to other retailers, for example. A second group is pricing policy: In one cashback example in the Netherlands, Heineken offers a free glass of beer in a bar to shoppers who buy a crate of beer in a Dutch supermarket. The third group, retailer management, includes establishing a strategy to deal with Amazon Marketplace and the like: This can be done either through dedicated programs for premium products or by engaging in strategic partnerships with a few selected marketplace sellers.

Step Six: Create a toolkit for improving price consistency by identifying the biggest threats and potential mitigation levers.

Exhibit 5: Consumer goods companies can pull many levers to improve price consistency

Source: Oliver Wyman

RETAILERS ARE MOVING FAST AND MANUFACTURERS NEED TO AS WELL MANUFACTURERS NEED TO AS WELL

Product manufacturers need to build new capabilities to deal with the increasing internationalization and sophistication of retailers’ operations. There is no single formula, but the starting point is to create transparency in trade spend as a way of understanding where a manufacturer is vulnerable and where opportunities lie. There are numerous tools that can help combat the threat: It’s up to each manufacturer to figure out the ones that will work and to use them effectively.

In some cases, they will have to make trade-offs. If, for example, a manufacturer harmonizes prices across the EU, its products will end up being relatively pricey in some countries. It will then have to figure out the optimum balance between margin stability and volumes. Whatever manufacturers decide, they will need to act fast. If they don’t, retailers will outsmart them, and large areas of their business will be at risk.