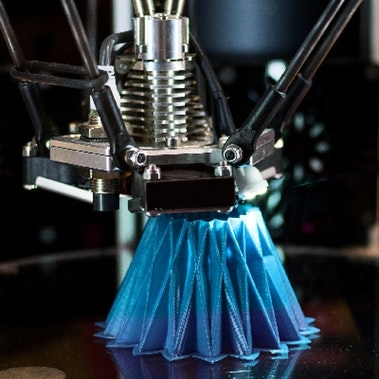

For decades, additive manufacturing (AM) was essentially used in rapid prototyping and tooling applications, with mere successes in end products. The AM industry, however, has been evolving at an unprecedented pace recently. Three catalysts have driven its swift evolution: a sustainable cross-sectorial demand, the increasing maturity of technologies, and the consolidation of a competitive ecosystem. What is at stake for business leaders is competitiveness. Models based on large economies of scale and inflexible heavy capital supply chains are being threatened. As AM matures, it will not only offer new and more performant products, but also superior agility, new means of diversification, and potentially lower overall costs than conventional processes. The so-called 3D printing revolution is happening now.

No doubt there remain significant technological challenges to overcome before AM converges towards a state of the art. Yet, in today’s fast transforming digital context, stakeholders of all sectors must understand how their business models and organizations need to evolve in order to scale and reap the true benefits of AM.

A SUSTAINABLE CROSS SECTORIAL DEMAND

According to expert reports, revenues of AM material, printers, and services have grown rapidly, undergoing more than 28 percent CAGR since 2010. At this pace, this market is predicted to reach US$25 billion by 2022. Proofs of concept are being launched by ever-increasing numbers of companies, the most advanced of which will pursue scaling their production of metal-printed parts. Business cases crop up on a daily basis, with R&D costs and lead-times constantly being factored down. The transportation industry is leading the way, with designs of light-integrated products, functionality breakthroughs, and customized interiors being few differentiating factors. For most industrial companies, the reduction of inventories through spare parts on demand, combined with decentralized production labs, is predicted to disrupt costly supply chains and associated aftermarket strategies. On the consumer products side, leaders will follow the path traced by the medical, dental, and jewellery sectors – in particular, by leveraging mass customization. Customer behavior is evolving towards a higher demand for individualized items, shorter purchasing cycles, or even on-the-spot production. Adidas, for instance, in collaboration with Carbon 3D, a major technology provider, is planning the use of AM to print millions of small batch-customized sneakers by 2019, targeting unbeatable times-to-market of less than a day.

By 2022, the market for AM material, printers, and services is predicted to reach US$25 BN.

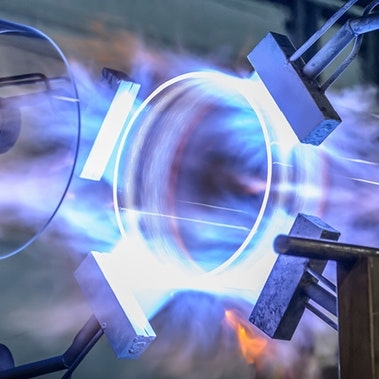

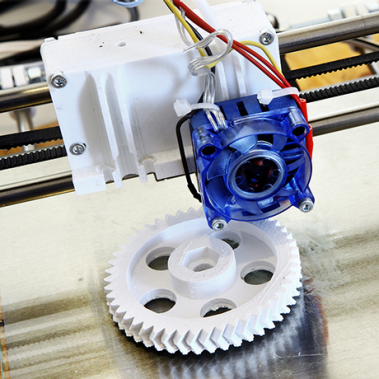

THE INCREASING MATURITY OF TECHNOLOGIES

As noted above, there remain many technological barriers ahead of industrialization, of which the weak repeatability of processes for metal printing, the labor intensity of pre- and postprocessing, low printing speeds, and the quality of surface finishes. However, technology providers are not only complementing each other to offset these, but also responding to high demand. With their respective Jet Fusion and H1 Binder Jet printers, HP and GE for instance, intend to enable 10-times faster and cheaper printing options. Data-driven solutions are also emerging to monitor the quality of the melt pool in real time. By acting on micro molecules, AM offers great perspectives on materials, developing progressively graded multi-material solutions, as well as electronics-embedded technologies. Manufacturers are working towards agile and digitalized printing modules, thereby bringing new capabilities to further diversify product lines, test new markets at lower costs, or react faster to competition. The impact could be significant in terms of market share redistribution. If the cost advantage of AM versus conventional processes is not put in question on small series, all these advances combined could eventually render AM competitive on large series production, considering lower fixed costs, and design breakthroughs together.

THE CONSOLIDATION OF A COMPETITIVE ECOSYSTEM

Lessons from the development of laser technologies show that the AM industry must adopt a global strategy, in order to properly manage the billions currently invested, risks, and mutualization of knowhow. To this respect, numerous publicprivate partnerships have arisen across the globe, while alliances between printer manufacturers and key industrials are announced every day. The market is today dominated by a handful of vertically integrated actors – Stratasys, 3D Systems, and Envisiontech together own 60 percent market share – that have locked the use of their materials with their printers, hence generating high prices and market opacity for traditional material suppliers. However, recent market entries of conglomerates like GE, HP, and Siemens are bringing greater competition to the market. As it further consolidates and enters a virtuous circle, the ecosystem will respond to the remaining challenges. The standardization of materials and processes, the reduction of costs to certify printed parts, or matching material supply and demand are all prerequisites to larger market adoption.

WHAT IT MEANS FOR BUSINESS LEADERS

To achieve the full potential of this revolution, business leaders will have to address five key challenges: (See Exhibit 1.)

Identify value spaces of AM and associated business models. Understanding forthcoming disruptions will promote the right investments under an Industry 4.0 strategy.

Define the associated operating models. Such a transformation carries inherent uncertainties regarding the distribution of added value along the supply chain or risk-sharing and IP ownership. Decentralized and mutualized production means, across industries, will reshape supply chains, including the emergence of large insourcing moves, back from low cost countries. Thus, Make or Buy, footprint strategies and acquisition of capabilities will need to be carefully assessed.

Develop a technological roadmap, selecting appropriate partnerships with printer manufacturers, while factoring in current technological limitations.

Evolve operational processes. New engineering approaches will benefit from cheaper iterative testing, adopting more agile designs, through a ‘test and learn’ mode. Eventually, all manufacturing processes will have to fully integrate into end to end digital chains, including cybersecurity options to secure the distribution of IP.

Embrace a new mindset. Organizations will need to adjust to these new processes. Beyond hiring new skill sets, a profound cultural change is required. Moving away from design to manufacturing dogmas into design to customer value will profoundly expand capital opportunities.

Exhibit 1: Five key challenges need to be addressed to align the adoption of additive manufacturing with the long‑term strategy

Source: Oliver Wyman analysis

The AM industry is undergoing rapid change and evolution, driven by crosssectorial demand, a maturing technology, and consolidation of the competitive ecosystem. Models based on economies of scale and inflexible capital supply chains are being threatened. As AM matures, it will not only offer new and better products, but also superior agility, new means of diversification, and potentially lower overall costs than conventional processes. The so-called 3D printing revolution is happening now. The endgame for manufacturing leaders is competitiveness – and survival.