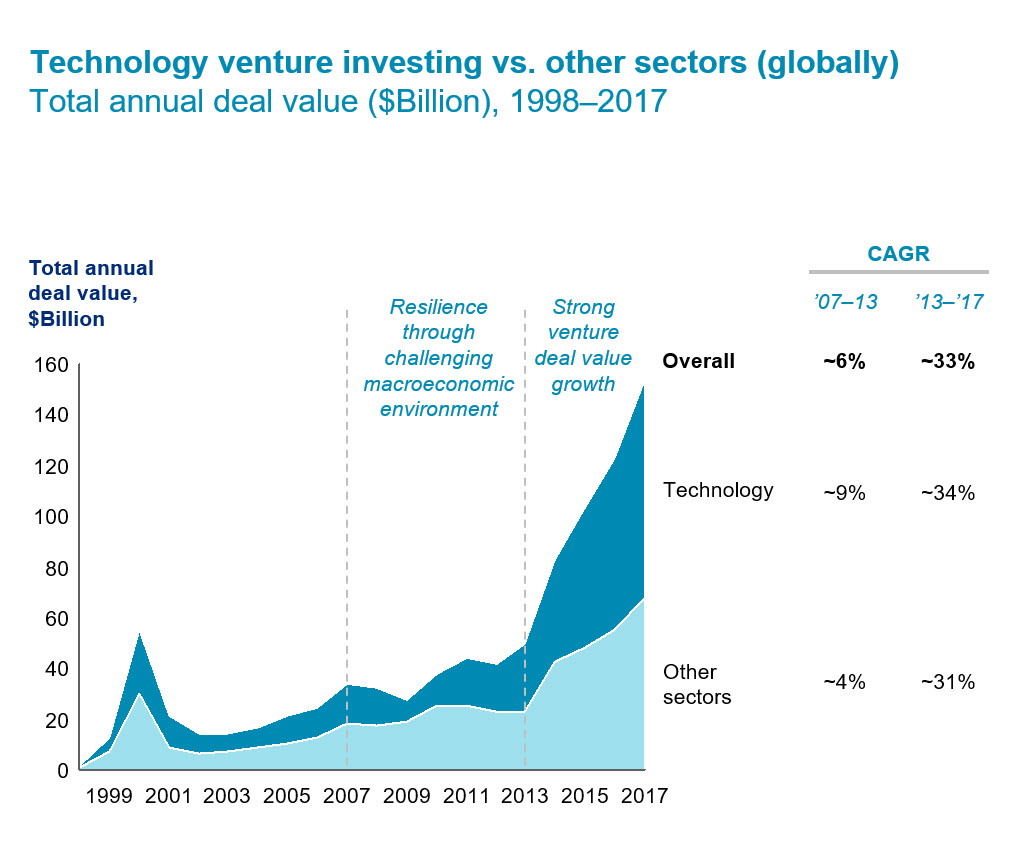

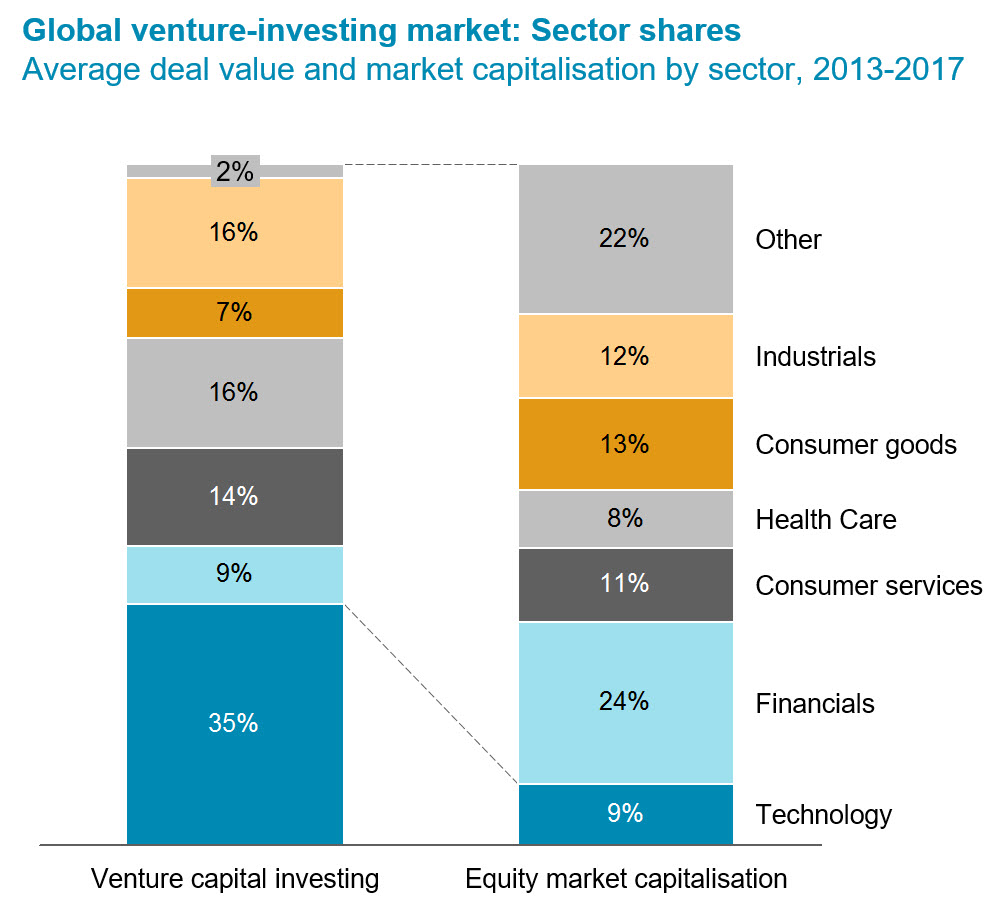

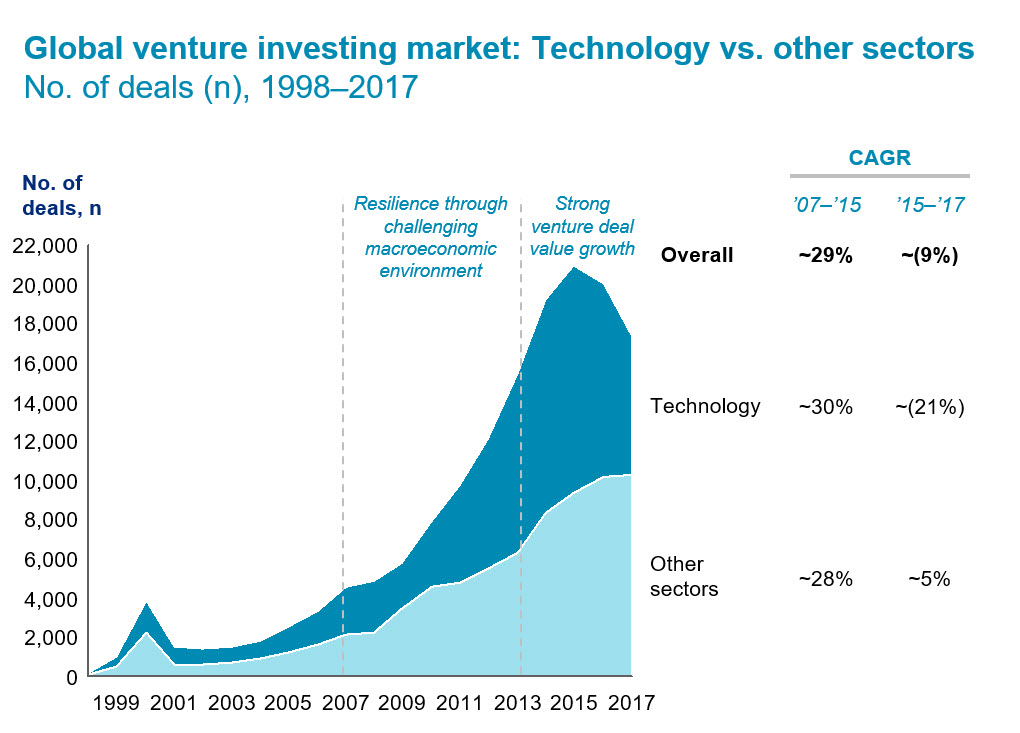

The technology sector is the deepest and amongst the fastest growing segments of the venture investing market. The technology venture investing market has grown very rapidly, with total annual deal value in 2017 more than three times the size it was prior to the dot-com bubble crisis. While deal value growth has been robust, the market has recently experienced a decline in volume of deals.

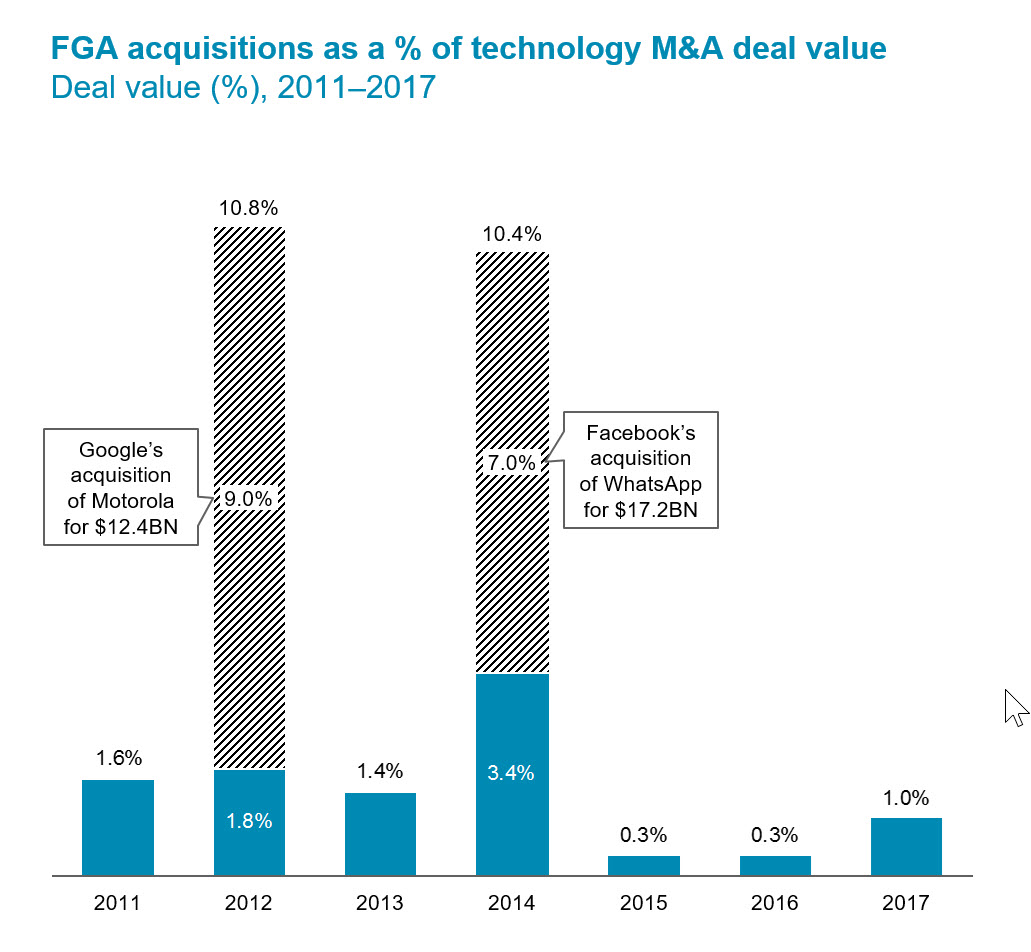

These high-level trends have generated significant debate on the impact large technology players may or may not be having on the technology investing market. Against this backdrop, Facebook commissioned Oliver Wyman to investigate the dynamics of the technology venture investing market and review the potential impact of large technology firms on the health of the market.

Oliver Wyman’s analysis (i) identifies key trends in the technology venture investing market; and (ii) qualifies the relationship between the activities of large technology companies (confined in this exercise to Facebook, Google, and Amazon – FGA) and key trends observed in the technology venture investing space overall focused on four key areas of concern. We opted to take a highly quantitative approach to the review, focusing on what could be learnt from available data as opposed to assessing the varying opinions that exist in the market.

While deal value growth has been robust, the market has recently experienced a decline in volume of deals

DATA POINTS