KEY TAKEAWAYS

- Employees do not see an increase in relevance, value, convenience, or simplicity tied to higher healthcare costs – in their experience, they’re simply paying more and getting less.

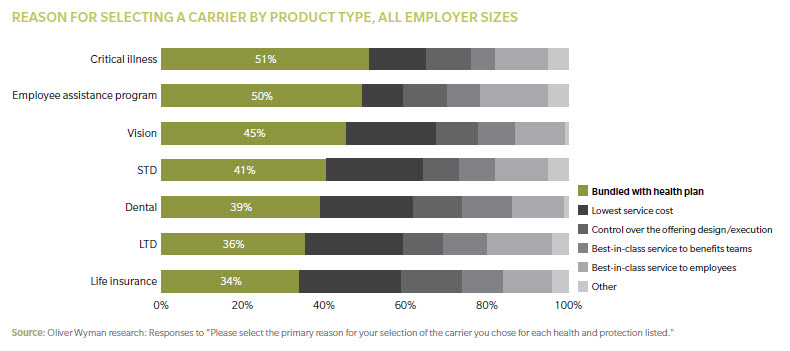

- A key influencer of carrier choice for ancillary benefits is whether that benefit is bundled with the health plan.

- The holy grail for employer sponsored and voluntary benefits is delivery via an integrated value proposition of relevant bundled products that meets life-stage needs, is easy for the employee to enroll in and for the employer to administer, and creates ongoing employee engagement.

Employees are not happy with their health benefits, and for good reason. Over the past decade, premiums have spiked by 80 percent. And for the past five years, average medical costs jumped anywhere from 5 to 15 percent annually, depending on employer size.

Recently, employees have seen their benefits shrink, deductibles skyrocket, and care options contract via consumer-directed health plans (CDHPs), which are now offered by 90 percent of employers. Those costs, and the employee burden, will continue to rise.

GETTING LESS COSTS MORE

Employees do not see an increase in relevance, value, convenience, or simplicity tied to higher healthcare costs – in their experience, they’re simply paying more and getting less.

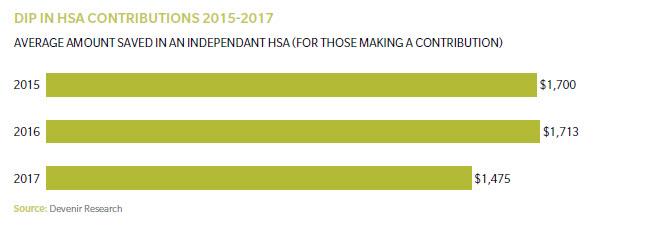

And the majority of employees can’t afford to fund Health Savings Accounts (HSAs) (paired with qualified CDHPs, which many people choose because they’re a low-premium option), in spite of its “triple tax advantage” (for those who even understand this) and have failed to reap any long-term savings benefit. HSA balances are in decline. Thirty-one percent of employees are unable to pay more than $500 out of pocket for a sudden medical bill.

This is not just an issue for employee sponsored care. A recent survey of insured adults (spanning employer coverage, the Affordable Care Act (ACA), Medicare, and Medicaid) found that 22 percent of respondents opted not to receive necessary medical care because of costs, while 77 percent said cost worries had led them to avoid care.

WHY DOES THE SYSTEM CONTINUE TO FAIL?

The current wave of “transparency innovations” provides consumers with more information about how different costs are associated with different care options, making available the exact amount owed. Many transparency efforts, however, do not generally give information about value and quality, creating consumer confusion and frustration.

According to new research by the National Institute for Health Care Management Foundation, consumers offered cheaper, more conveniently located MRI options generally ignored this information and went instead to wherever their physician had referred them. On average, patients turned down six cheaper conveniently located options in favor of the physician-recommended doctor.

Even sites that supposedly showcase consumer feedback tend to fall short. A recent study5 from ConsumerMedical stated while consumers were more frequently using sites like Yelp and Healthgrades to find “high quality” specialists, only 2 percent of physicians listed within the top 10 were also rated highly regarding performance and quality metrics.

STATUS QUO PROTECTORS

There has been little innovation from a product, network, and distribution perspective to drive change, especially for employer-sponsored insurance. The entrenched broker establishment is protective of the status quo, and the initial wave of consultant-led private exchanges didn’t deliver, largely because the “product” on the shelf was unsatisfactory – it was more “do no harm” than any real innovation. Health carriers’ attempts to innovate and differentiate (including Accountable Care Organizations, value-based arrangements, medical management programs, and consumer engagement incentives) have either met resistance from the fee-for-service protectors, are mired in complexity or opaque financials, or have not yet created a tangible value proposition for employers and their employees to drive change in how healthcare is purchased, structured, and delivered.

MAKING IT EASIER TO DO THE RIGHT THING

Some influential industry players are looking to shake up the status quo. For example, take Atul Gawande, new head of the JP Morgan-Amazon-Berkshire Hathaway nonprofit. Atul’s goal is to help professionals “make it simpler to do the right thing” in delivering care to patients. According to a PBS interview he conducted last summer, some people he grew up with in Ohio spend half their incomes on taxes and healthcare premiums. They’re going bankrupt because of healthcare costs. ”When workers have deductibles that are multiples larger than their bank accounts, they stop treating their chronic conditions,” said Atul. “And it has enormous harm for the future.”

Many industry pioneers are taking action to generate the kinds of higher quality consumer experiences and outcomes Atul (and countless others) envision, while also lowering total cost of care. Some are tackling the network and FFS system head-on, attacking “the belly of the beast” as Ashok Subramanian, founder of TPA startup Centivo, states. Centivo is building targeted, value-based networks from scratch on a market-by-market basis. They are focused on selecting primary care physicians (PCPs) who embrace value-based care – and are aligned with Centivo’s employer customers’ total cost of care goals – and are incentivizing them accordingly.

And Salt Lake City-based startup, Imagine Health, designs its networks around creating a high-quality care delivery experience. Imagine Health’s markets – around 25 to 20 percent of available market providers, compared to a large carrier’s 92 to 98 percent – prioritize quality, allowing for the negotiation of much greater savings compared to what’s commercially available.

CONSUMERS WILL BUY ON VALUE, AND FROM A SINGLE SOURCE

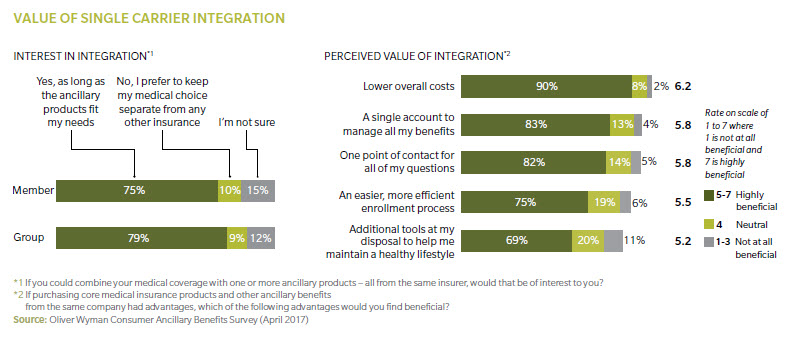

Beyond network and value-based innovations – table stakes for the core health benefit stack – Oliver Wyman research demonstrates consumers will buy bundles of new and core products/services that span health and ancillary (employer-sponsored or voluntary) if they can see the value. Employees would even expand their wallet (increase or redirect out-of-pocket spend) for the right total risk.

Our research shows employers, irrespective of group size, prefer single-carrier integration if ancillary benefits fit their needs and they can accomplish administrative ease and lower overall costs. protection package relevant and valuable to them, at their specific life stage.

Furthermore, our research shows the single greatest influencer of carrier choice for ancillary benefits is whether that benefit is bundled with the health plan.

This is a great opportunity for health plans to deliver an integrated value proposition that addresses not just the network and cost issue, but also the holistic total risk protection needs of the employee (linked-financial wellness is the next frontier). Yet many plans have either shed ancillary products (such as Aetna’s recent sale to The Hartford) or deprioritized them to focus on the core product set.

Health plans cannot stand pat, as “pure play” group benefits carriers are making moves via expansion of product set (gap coverage, stop loss, wellness, and other voluntary

“subscriptions”) or are deepening their digital and distribution footprint to enable greater customer control. Exhibit 5 highlights the growth of digital health investments.

WINNING TOMORROW’S CUSTOMER BATTLE...

... TO DELIVER A DIFFERENTIATED AND BETTER BENEFIT STACK COMES DOWN TO FIVE CRITICAL COMPONENTS:

- The underlying network has to be designed by highest impact target segments, be value-based, and have predictable co-pays and lower out-of-pocket costs, without being viewed as “narrow, constricting, and cost shifting.”

- The bundle has to be relevant to one’s life stage, holistic (covering total risk protection), engaging (services to change behavior), and demonstrate value so the employee/consumer will invest in the bundle and possibly expand share of wallet.

- Digital platforms to enable packaged products have to be curated in meaningful bundles and developed with behavioral economics in mind, but also have to be supported effectively by tools and personal touch to drive longitudinal engagement (such as “clicks” and call/telehealth support).

- It has to be convenient and simple for employers to administer and employees to utilize throughout the year.

- Brokers see bundles and platforms as a differentiator to be rewarded with, one that helps productivity and enables them to sell a greater variety of offerings.

The holy grail for employer sponsored and voluntary benefits is delivery via an integrated value proposition of relevant products that meets life-stage needs, is easy for the employee to enroll in and for the employer to administer, and creates ongoing employee engagement.

About the Author

Howard Lapsley is a partner in Oliver Wyman's Health & Life Sciences practice.