Is post-trade outsourcing a viable option? Which outsourcing approaches and models are best? Which activities will banks outsource in the future? What are the concerns? What is their perception of outsourcing providers? What can banks save from outsourcing? What are the next steps for the industry to realise the full potential of outsourcing?

To answer these questions, BNP Paribas Securities Services commissioned Oliver Wyman to perform an independent market survey. The poll covered Investment Banking Operations executives (including Head of Operations, COO of Markets, Head of Change, and Head of Strategy) from 32 banks (22 from EMEA, five from APAC and five from Americas).

Here are some of the highlights:

A clear demand for outsourcing post-trade processing

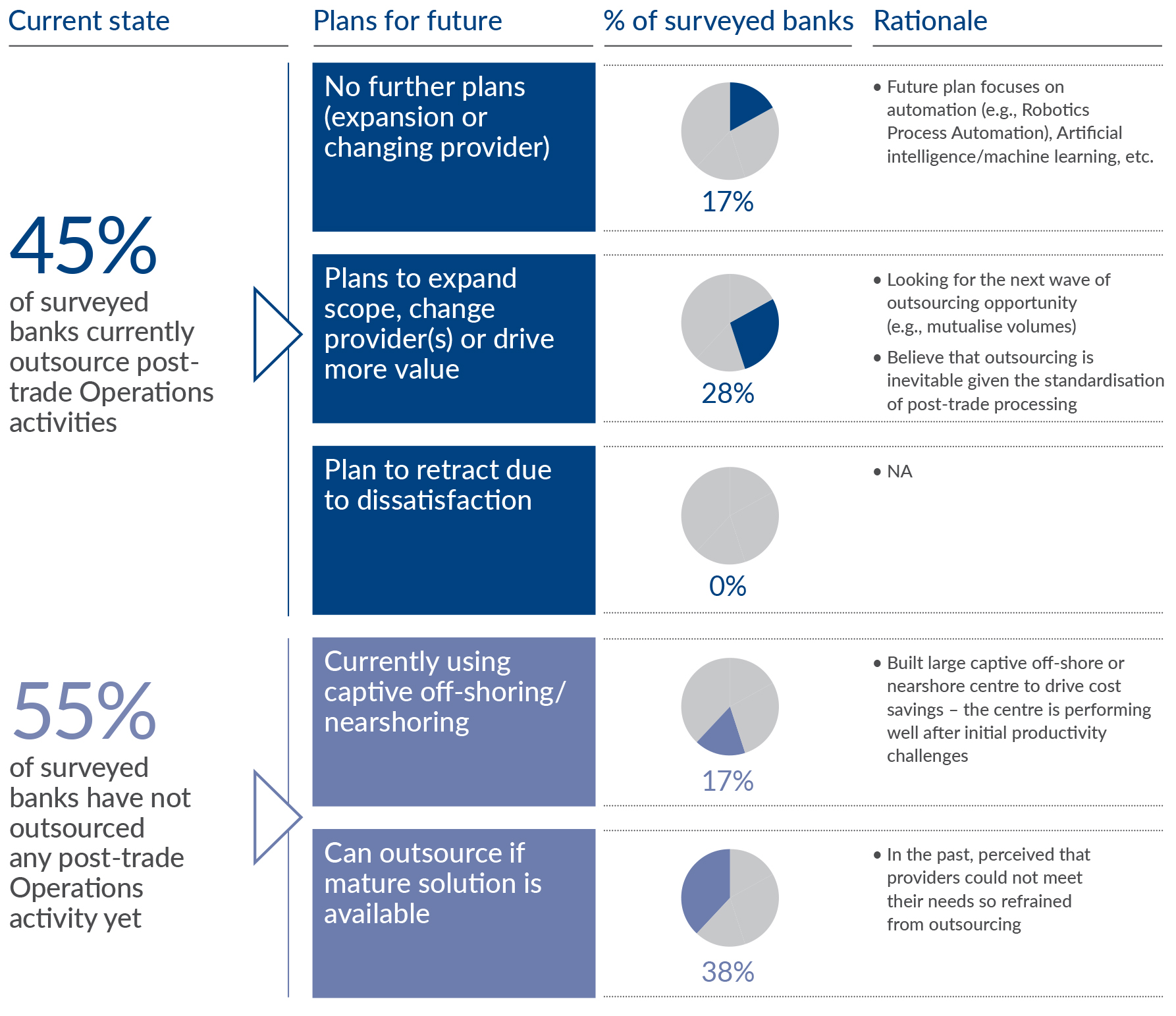

Nearly half of the banks surveyed have already outsourced some post-trade processing activities, and further 38 percent of surveyed banks would consider doing so.

Exhibit: Assessment of post-trade Operations outsourcing

Moreover, 69 percent of the banks that have already outsourced are satisfied with the outcomes achieved. Most of these banks also believe that there is room to derive additional value from outsourcing.

Where does the value lie in outsourcing?

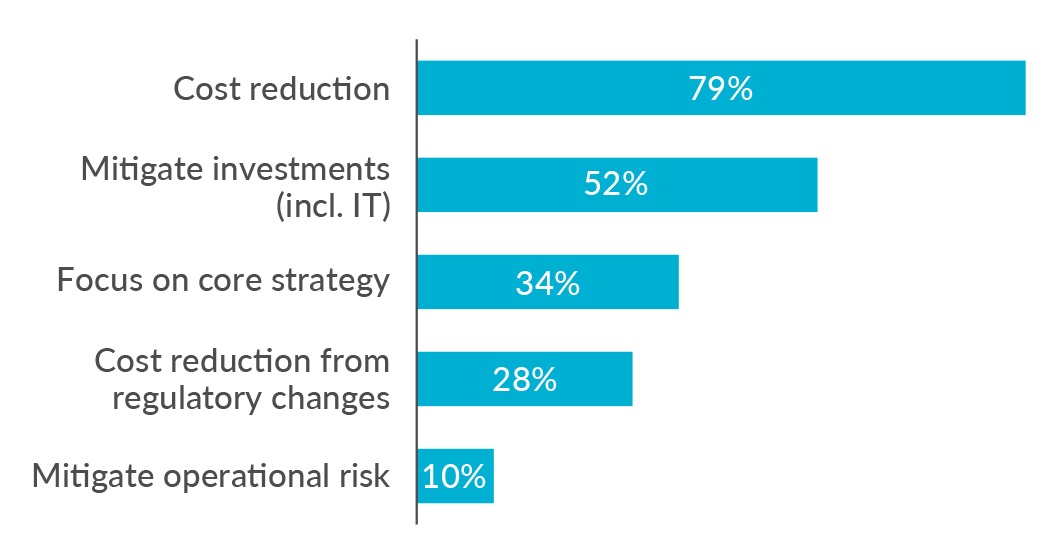

The survey found that the key drivers for outsourcing, and the reasons why some banks have not outsourced. Not surprisingly, the key driver for outsourcing continues to be cost savings (which includes both run cost and change cost, together with IT and regulatory change).

Exhibit: Key drivers for outsourcing(Survey participants could select several options)

The small proportion of banks that are not planning to outsource cite the following reasons: insufficient scale for low-volume players, loss of control over both regulatory changes and essential day-to-day operations, and lack of internal readiness due to complex IT landscapes.

What matters most when choosing a provider

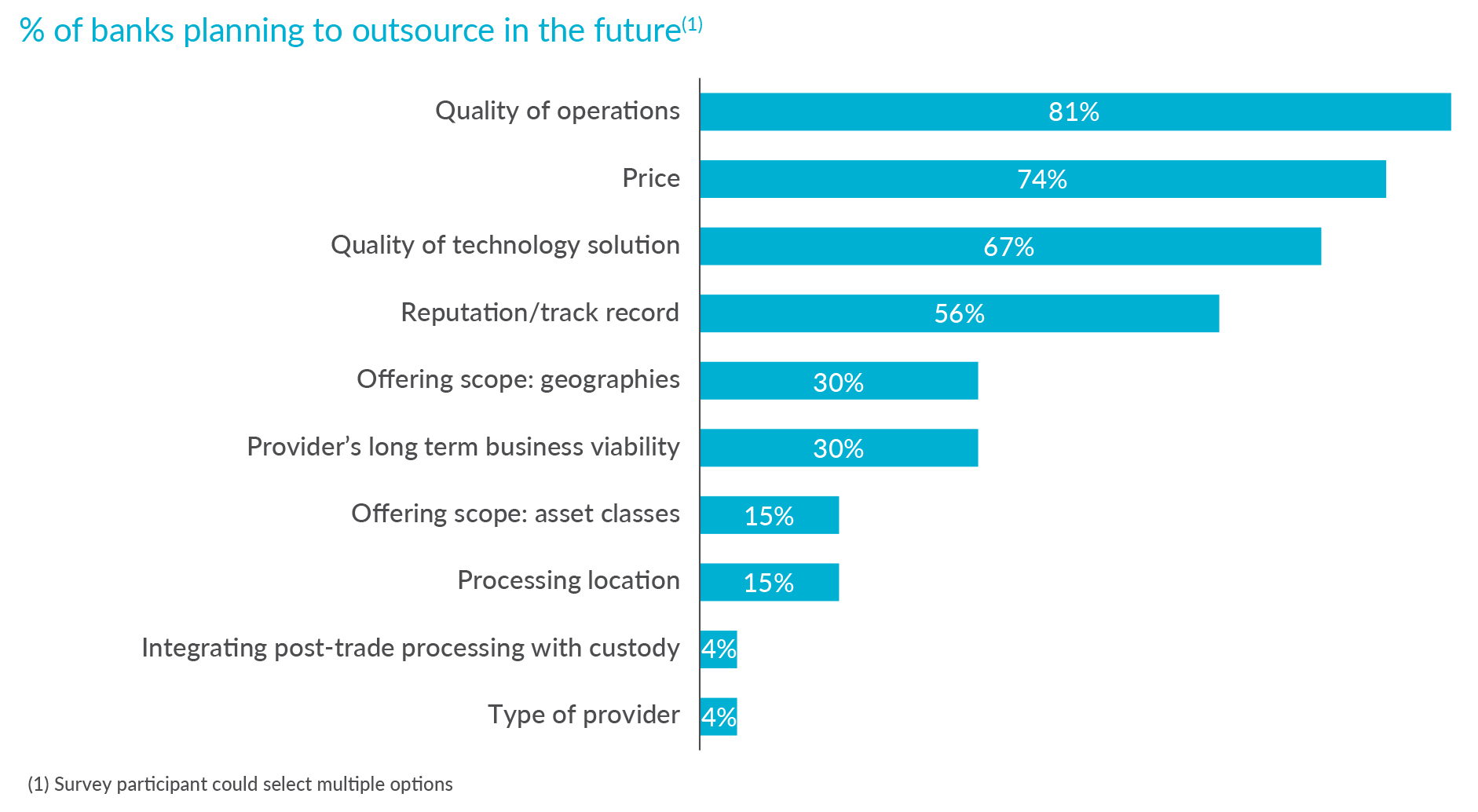

While the survey found no clear preference on a specific type of provider, banks do have a clear idea about what key factors to look for when choosing an outsourcing provider. Most important is the quality of operations processes and services provided.

Second is price, which ensures the viability of the business case. Next is the quality of the technology solution, which is central, given the importance of technology in driving efficiency and automation. Here, banks are not only looking for a solution that can provide a high degree of standardisation, but are also looking for technology solutions with smart automation (such as AI/machine learning) that can provide the next level of efficiency.

Finally, the reputation and track record of the provider is important, given the past experience where banks have not realised the expected benefits.

Exhibit: Key factors for choosing a provider

(% of banks planning to outsource in the future)

The next few years in outsourcing

The outsourcing of post-trade activities is one of the strategies being considered by investment banks. While it evokes mixed feelings among banks that have already outsourced or have tried outsourcing, the demand still remains from most banks, and the provider market continues to rapidly evolve. The next few years may see deepening collaboration and partnership across the market participants.

More information

For more information and to view the results, download the full report now.