We have identified $1 trillion of revenues and costs that might be up for grabs.Chris Allchin and Matt Austen, Partners

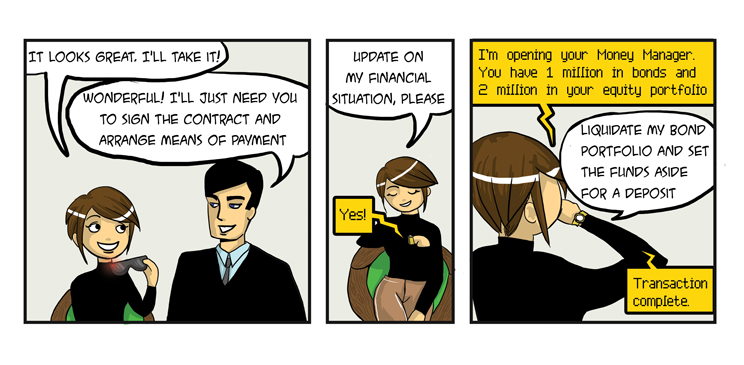

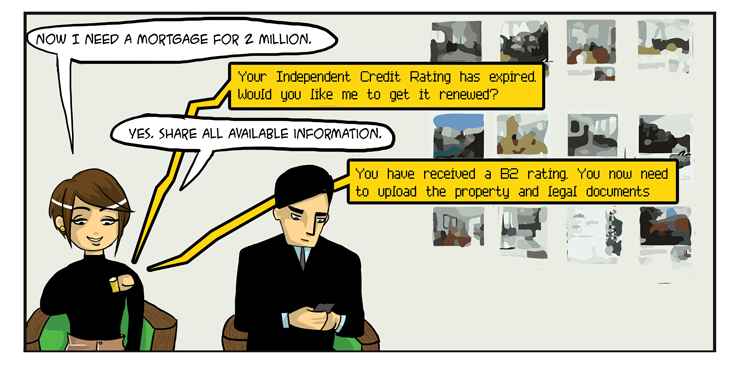

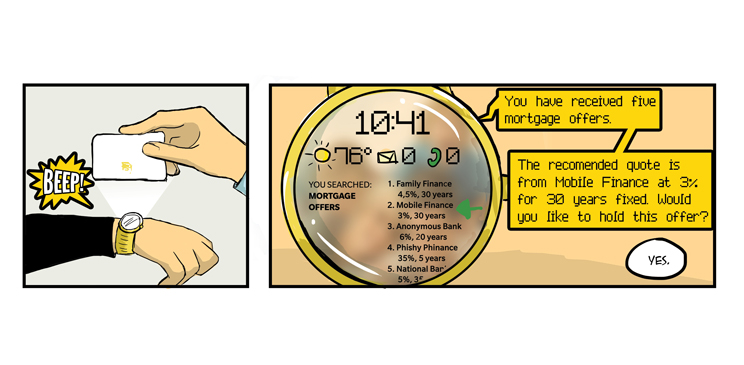

We believe financial services are becoming “modular”, with digital distribution platforms, new product providers, alternative sources of capital and a growth in outsourcing fundamentally reshaping the industry.

Established firms will need to respond to the modular industry structure. Some will try to compete with commerce and technology firms and build sophisticated customer platforms. Others will concentrate on areas of sustainable advantage, making the most of their customer data, analytics and funding models. And they will reinvent their back offices as supply chains.

Banks and insurers have adapted to new technology in the past and we think they will do so again. Nonetheless, financial services will be more modular in ten years’ time and today’s banks and insurers may look very different.

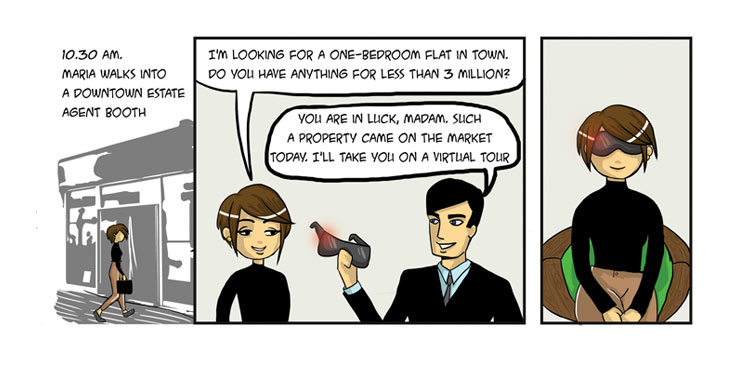

For consumers, modular financial services means more choice, transparency and seamless switching between multiple providers.