This increased their revenues. But their costs increased at the same rate. Although absolute profits grew, the productivity of financial sector firms has not improved since 2001. And, as we now know, risk grew too.

Since the crisis, ultra-low interest rates and new regulations aimed at limiting risk have reduced the revenue accruing to the increased scale, scope and sophistication of financial firms. However the elevated costs remain. Average returns of large financial firms have fallen from over 20% in the early 2000s to 7% in 2013, the level of utilities companies.

The State of the Financial Services Industry 2015 Report looks at the topic financial firms must now grapple with: managing complexity.

For financial services firms, the central problem of complexity has distinct features. Complexity is unavoidable for successful financial firms because it arises out of the desirable features of their business models. Economies of scale, risk diversification, technological advance and ongoing globalization require financial firms to sustain a large number of diverse customers, to whom they offer many products through a range of channels. So, eliminating complexity completely is not an option for these financial firms.

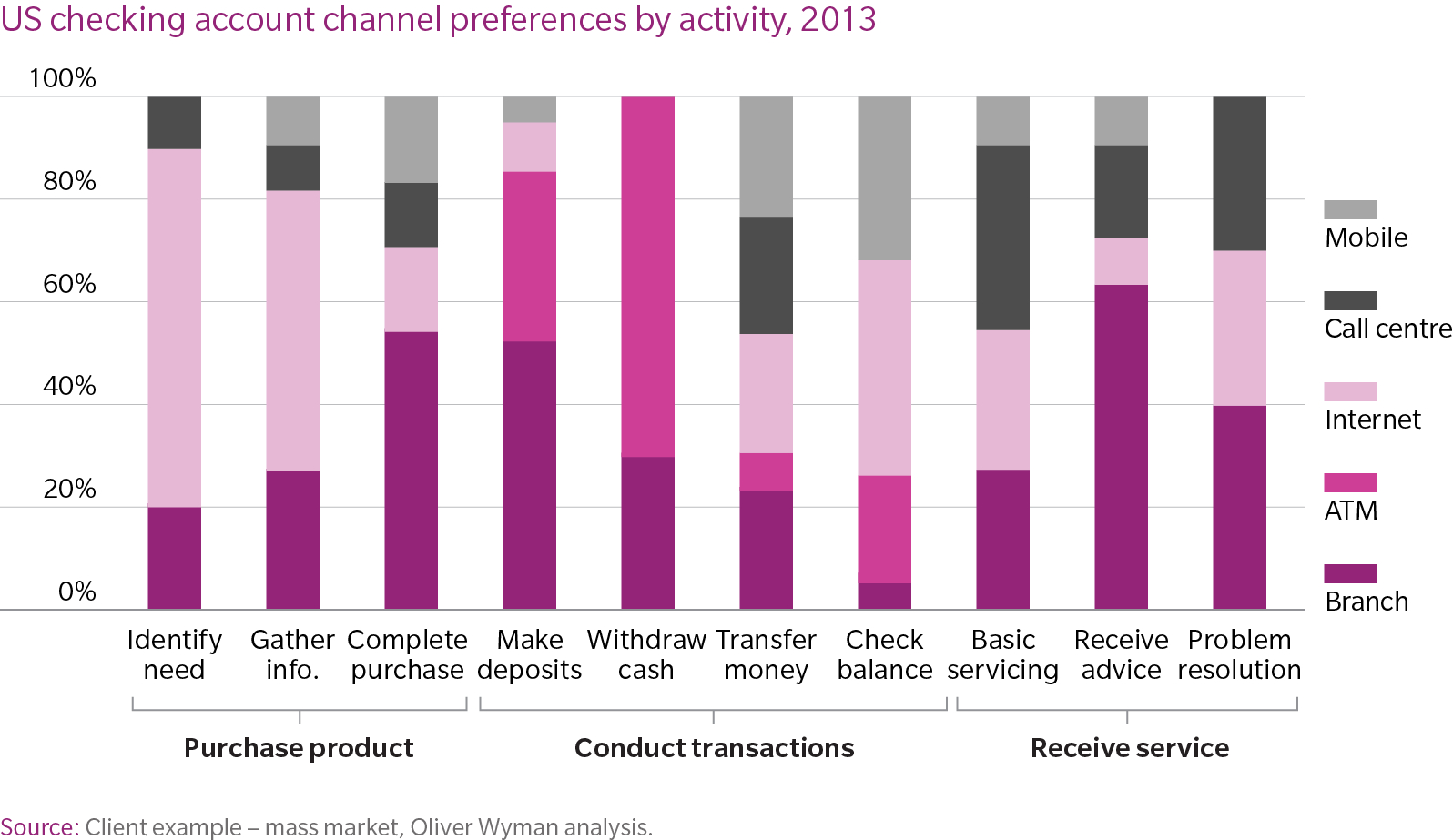

Five important sources of complexity for the industry are explored in the report: regulation, channel proliferation, systems fragmentation, product proliferation and geographic expansion.

In order to reduce the costs of complexity while retaining its benefits, five measures are recommended for financial firms to manage complexity better:

- Use common metrics for the core financial and non-financial metrics that measure complexity, available to all decision makers, to develop self-knowledge of the financial institution and its customers.

- Use advanced statistical analysis and analytical decision-making culture to make tactical decisions involving increasingly complex trade-offs, drawing on the explosive growth of information created by in-house data systems and social media.

- Automate or standardize core processes, taking advantage of rapid advances in technology such as artificial intelligence.

- Delegate decision-making to those closest to the subject matter who therefore have the best information.

- Build a strong corporate culture that supports consistent conduct standards without the need for micro-management.

Key Findings on the Cost of Complexity Include

- Average returns of large financial firms have fallen from over 20% in the early 2000s to 7% in 2013, the level of utilities companies

- Returns of the 8 American and 16 European banks designated GSIBs (global systemically important banks) have declined by 70% since 2006

- Oliver Wyman estimates that between 2 .5% and 3.5% of North American, European and Australian financial institutions’ total costs come from meeting the elaborate new regulatory guidelines, that equates to US$0.7-1.5 BN per annum for the coming 2-3 years for large financial firms

- The average bank in the US and Europe now has five board committees overseeing risk/compliance, whereas before the crisis the average was less than three

- Over the last 15 years, within the top 100 global corporates, there have been more M&A deals on average in the financial industry than in any other, which has exacerbated IT fragmentation

- An expensive growth of middle management has been another cost of increasing complexity. For example the number of banks in the US has fallen by 45% since 1993 while the number of employees grew by 15% over the same period