But Medicare prescription drug plans (PDPs) are also a critical piece of a Medicare portfolio and the key to working in the seniors market. How to solve the dilemma? Start by making sure you know why you’re playing and what you hope to accomplish. Then find a way out of Part D’s crippling fixed costs. (Hint: You may need to partner.)

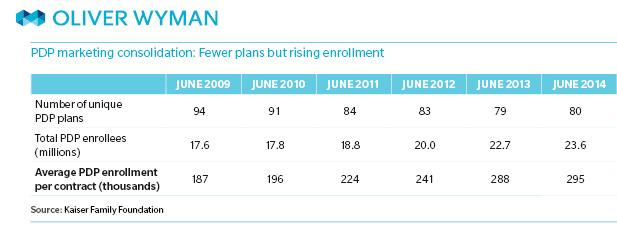

Prescription Drug Plan Consolidation: More enrollees, fewer plans

Between 2009 and 2014, national PDP enrollment grew from approximately 17.4 million to 23.4 million. That represents an annual growth rate of 6.1 percent, roughly double the growth of the Medicare-eligible population. Yet many PDPs are suffering from falling enrollment, and the Kaiser Family Foundation found that three out of four PDPs that existed in 2006 are no longer in the market. Meanwhile, three companies collectively command 55 percent of PDP business.