Many of the national oil companies that dominate today’s oil and gas production – Saudi Aramco, the Iraqi National Oil Company and the Kuwait Oil Company – trace their origins back to partnerships forged with foreign investor-owned oil and gas companies at the turn of the century to develop local resources.

History is repeating itself now. The difference this time is that national oil companies are striking new energy partnerships with investor-owned oil and gas companies and other national oil companies to attain the global size, industrial scope and technical expertise required to manage the energy industry’s rising risks. In recent months, Saudi Arabia’s national oil company, Saudi Aramco, bought a 28 percent stake in a South Korean oil refining and marketing company for $2 billion. State-owned Turkish Petroleum Corp. announced that it will acquire a 10 percent interest in Azerbaijan’s Shah Deniz field and the South Caucasus pipeline from Total SA for $1.5 billion. And Qatar’s national oil company picked up a $1 billion stake in a Brazilian oil field from Royal Dutch Shell.

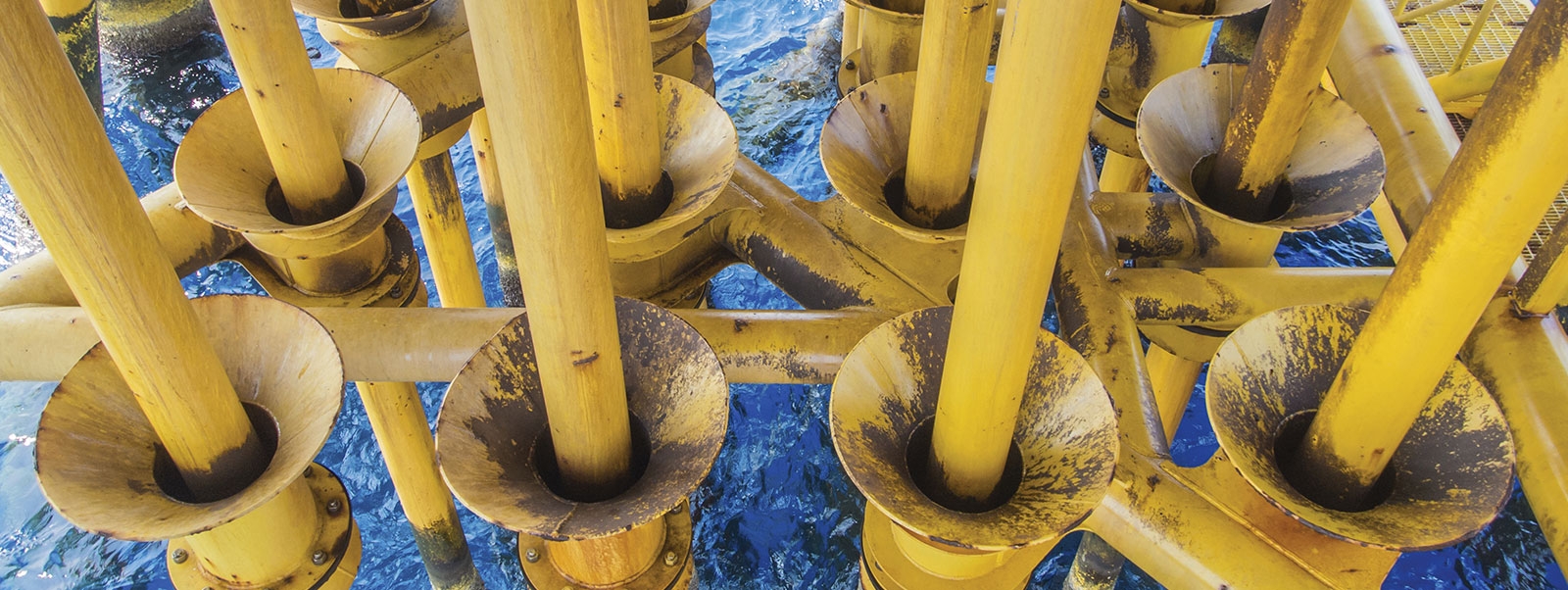

These transnational agreements are being triggered by the fact that drilling for oil and gas is becoming an exponentially higher-cost, hypercompetitive, technology-intensive business. We estimate that by 2015, more than 70 percent of the world’s hydrocarbon supply growth will come from complex resources such as deepwater shelves, tight oil reservoirs, biofuels, Canadian sands and potentially the Arctic. Most oil exploration projects will have budgets of more than $5 billion; currently, only about one-third of exploration projects have budgets in excess of $5 billion. (See Exhibit 1.)

Customers’ expectations are simultaneously rising as oil prices stall. Asia alone will need to import 40 percent more oil – about 30 million more barrels per day – by 2030 to keep up with rapidly growing demand. That’s one reason why, over the past two years, the region’s national oil companies have announced nearly $40 billion in new investments in foreign countries, according to our estimates. At the same time, customers are demanding environmentally sound energy, but they don’t want to pay more for it. The result: Oil firms’ profits are being squeezed as never before.

GLOBAL FOOTPRINTSTo thrive in this unforgiving environment, national oil companies must hedge their bets by developing all-encompassing global footprints in businesses ranging from offshore oil and gas exploration projects to gasoline stations. This target is achievable. China National Petroleum Corp. is active in 27 countries and has production-sharing agreements with Shell to explore, develop and produce oil and gas both in China and in West Africa.

But as the industry reshapes itself, national oil companies will be forced to proceed even further in two directions: They will have to spread their requisite tens of billions of dollars in research and development costs over a much wider range of assets, while partnering with investor-owned oil companies to reach the level of efficiency and returns on research that are needed to deliver on multibillion dollar projects globally. Today, publicly traded oil firms issue many more patents, according to our estimates, despite the fact that national oil companies invest roughly the same percentage of their revenues in research and development. (See Exhibit 2.)

Many traditionally slow-moving national oil companies will have to overhaul their organizations. For the leaders, the goal will be to metamorphose into global enterprises that can nimbly respond to local challenges and manage more diversified businesses. To achieve those aspirations, they must first create robust governance structures that can manage the accompanying risks appropriately. In order to realize greater value across all of their assets, operations will need to be more globally integrated.

At the same time, national oil companies will have to apply greater discipline to each of their individual projects’ risk management. National operational and safety management systems will have to become global, while risk management systems will need to cross the silos that presently exist in many organizations. Only then will national oil companies pursuing multiple initiatives grasp how much risk they are assuming overall.

By establishing local subsidiaries and centralized divisions for functions such as procurement, logistics and quality management, CNPC has made great strides toward remaking itself into a flexible, global oil giant. But no national oil company in the world considers itself sufficiently agile to meet the industry’s mounting global hurdles ahead.

To reach their lofty ambitions, many national oil companies may have to weigh having less government involvement. Today, investors own 25 percent or more of only three of the

world’s 10 largest national oil companies, as measured in terms of production volume: Gazprom, Rosneft and Petroleo Basiliero. Managing the myriad new strategic, operational and organizational risks that will accompany ownership shifts will be difficult. If mismanaged, the result could be internal culture clashes or bigger problems should employees resist foreign pressure from foreign investors to perform.

EXTERNAL RISKSNational oil companies also will be forced to confront external risks outside their control. Entry barriers imposed by foreign governments, stricter health and safety requirements, potential flight of new investor capital and protests by countries’ citizens against new foreign investors could all be concerns.

The first step toward getting ahead of these risks and the industry’s fast-changing rules of competition is for national oil companies to develop and deliver a compelling corporate goal and financial case for their stakeholders. Before assembling complex investment portfolios, they must define their strengths and weaknesses in terms of both business mix and geography to provide a clear rationale for reinvention.

TALENT GAPNational energy industry champions must then assess and define new leadership capabilities and a change management strategy. They will need to regularly reassess and redefine their cultures and competencies for a much broader group of constituents. These new stakeholders will range from new in-house communities to new investors, regulators, suppliers and management teams. To gain an understanding of entirely new sets of customers, many firms will be forced to establish new marketing and trading operations worldwide.

In addition, long-term global workforce plans will be required to ensure that national oil companies have access to the highly skilled personnel necessary to carry out their objectives. A landmark study conducted by our sister company Mercer shows that the majority of oil and gas companies expect to experience a talent gap in petroleum and plant engineers in the next five years. (See “The Oil and Gas Talent Gap” on page 81.) If national oil companies fail to recognize and address this war for talent, they may be forced to delay major exploration and production initiatives simply because they do not have enough of the right workers.

The stakes involved in pulling off each of these transitions are high. But going it alone will only become more expensive. That’s why a new network of “international” national oil companies is taking hold that will likely rewrite the rules for the energy industry over the next generation. Those companies that embrace the challenge of forging a new form of national oil company may finally close an energy gap that has persisted century after century. But this can only happen if they move to address the risks involved in attempting a major transformation in a rapidly evolving environment – now.

by FRANCOIS AUSTIN & VOLKER WEBER